China’s Commerce Ministry spokesperson, Shu Jueting, has stated that China is willing to discuss issues concerning both nations in regards to the import of beef and barley from Australia. This statement came after Australia expressed concerns over China’s import restrictions on these products, which were implemented in May 2020, and their impact on the Australian agricultural industry.

When asked about the lifting of restrictions on the import of Australian coal, Shu Jueting stated that Australia can apply for a coal import license normally. This is a positive development for the Australian mining industry, which has been hit hard by China’s recent restrictions on coal imports, with some Australian coal ships stranded outside Chinese ports for several months.

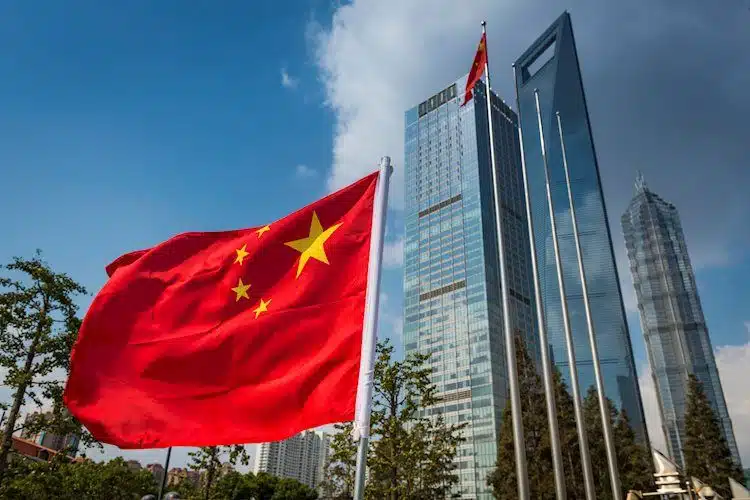

Although this statement provides some hope for the resumption of trade between China and Australia, it is important to note that there is still significant tension between the two nations due to a range of geopolitical and trade issues. This includes the Australian government’s decision to ban Huawei from its 5G network and the ongoing debate around whether the origins of COVID-19 were in a lab in Wuhan, China.

In addition to the above statements, Shu Jueting conveyed that China intends to continue pushing for the relaxation of market access for foreign investments and steadily expanding institutional openness. This is consistent with China’s broader policy of opening its markets to foreign investment, which began over a decade ago with the establishment of the China Investment Corporation, the country’s sovereign wealth fund, in 2007.

While these comments are positive in terms of China’s willingness to engage in dialogue with Australia and expand its openness to foreign investment, there remain challenges for both countries. Local governments and firms in Australia have noted that the biggest challenge for 2023 trade development is the lack of orders due to the pandemic. This is a significant concern for a country that heavily relies on trade, particularly with China.

Meanwhile, China is dealing with its own issues around economic growth and stability, exacerbated by the impact of the pandemic. As the world’s second-largest economy, China’s growth rate has slowed over the past decade, leading to a shift towards a more consumption-driven economy. This has created its own set of challenges, including a slowing real estate market and rising debt levels.

Despite these challenges, the Australian dollar (AUD) has picked up fresh bids in early European trading, rising above 0.6650 and adding 0.64% on the day. This is a positive sign for the Australian economy, which has been heavily affected by the challenges posed by COVID-19 and the ongoing tensions with China.

In conclusion, while Shu Jueting’s recent comments provide hope for improved trade relations between Australia and China, there remain significant challenges for both nations. It will require continued dialogue and cooperation to navigate these challenges and create a more stable trading environment moving forward.