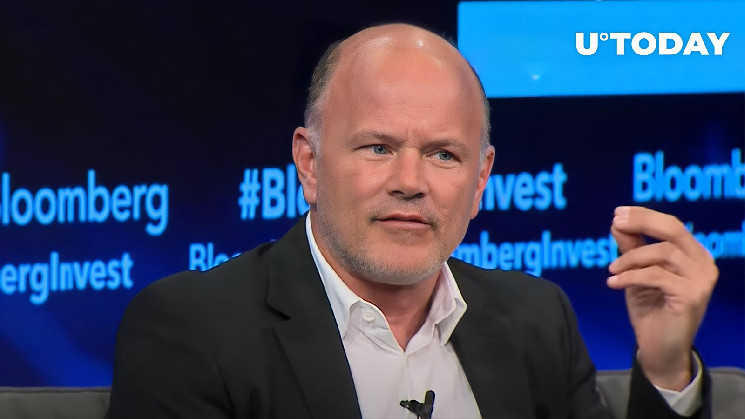

Mike Novogratz, a prominent figure in the cryptocurrency world, recently made a bold statement about Bitcoin. According to Novogratz, Bitcoin is a report card on monetary policy and financial stability. This statement was made on Twitter, where Novogratz emphasized that BTC was built for the current economic climate.

Novogratz’s statements are backed up by a research piece published by Galaxy, a widely respected crypto research firm. The report shows that Bitcoin data is increasingly bullish. The research examines performance, on-chain, and supply-side data, which shows the key reason for continued optimism for Bitcoin bulls.

On a risk-adjusted basis, Novogratz stated that Bitcoin is the best-performing asset of the year, outpacing growth stocks, banks, and major stock benchmarks. Galaxy suggests that on a risk-adjusted basis, Bitcoin is the best performer of the year compared to a range of securities, indices, and commodities. This suggests that Bitcoin is an increasingly attractive investment in the current economic climate.

The research indicates that the flagship cryptocurrency’s correlation with gold is rising, while its correlation with stocks is decreasing. This indicates that it behaves more like a safe-haven asset during times of crisis. This is a significant development for Bitcoin, as it suggests that it is increasingly seen as a hedge against global economic uncertainty.

Despite a 60% rally in Bitcoin’s spot price this year, futures funding and basis have remained stable. Concerns over an oversupply due to the pending Mt. Gox bankruptcy distributions appear to be overblown, with exchange and miner supplies down and miner selling stabilized. This suggests that the Bitcoin market is healthy and stable, which is a positive sign for investors.

Positive on-chain metrics suggest increasing accumulation, wider ownership, and longer holding periods for Bitcoin, according to Galaxy. The upcoming halving, which has historically led to long-term bullish runs, might point toward another major bull run for the world’s largest cryptocurrency. This is an exciting development for Bitcoin investors, as it suggests that Bitcoin may be entering a period of sustained growth and prosperity.

Overall, the research from Galaxy and the statements from Novogratz suggest that Bitcoin is an increasingly attractive investment in the current economic climate. As the world becomes more uncertain and global economic instability increases, Bitcoin is increasingly seen as a safe-haven asset. Its correlation with gold and decreasing correlation with stocks suggest that it is becoming increasingly valuable in times of crisis. The upcoming halving and positive on-chain metrics suggest that Bitcoin may be entering a period of sustained growth and prosperity. As such, investors may want to consider adding Bitcoin to their investment portfolios as a hedge against global economic uncertainty.