Africa’s Financial Revolution: Central Bank Digital Currencies

Amidst the hustle and bustle of the vibrant African continent, we find a silent financial revolution taking place. In an area often overlooked when it comes to global technological advances, Central Bank Digital Currencies (CBDCs) are not just a modern concept but promise a future of transformation.

CBDCs: Shaping the Monetary Future

In an increasingly digitized world, Africa is shaping a story that might dictate our financial future. CBDCs are at the heart of this narrative. As advanced economies continue to ponder their adoption, many African countries are taking the lead. These nations have recognized the potential of CBDCs to become a game-changer in their economic landscape and are thus swiftly moving forward to make this vision a reality.

The Technological Evolution: From Mobile Payments to CBDCs

The tale of Africa’s technological evolution is unique and inspiring. This evolution became evident when the continent, bypassing the phase of landlines, directly leaped into the mobile age. The transition didn’t only reflect an upgradation in technology but also had a profound impact on the societal structure.

- M-Pesa, a mobile platform, extended financial services to those corners of the continent that were overlooked by the conventional banking system.

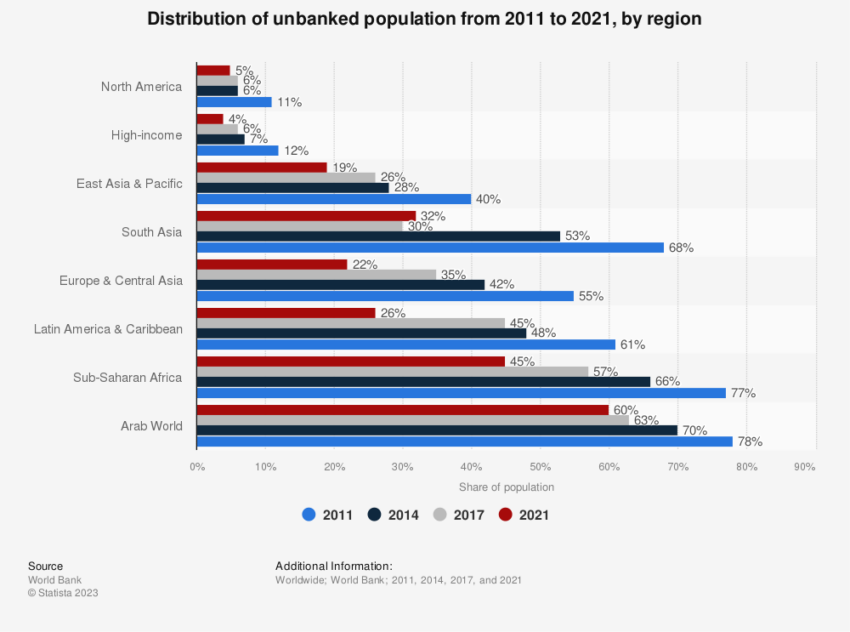

- Nonetheless, traditional banking couldn’t fully cater to Africa’s needs. Despite the average rate of account ownership increasing to above 70%, approximately 350 million adults across Africa, from the lively markets of Lagos to the tranquil seashores of Madagascar, remain unbanked.

“In Sub-Saharan Africa, [the increase in the average rate of account ownership] was primarily due to the adoption of mobile money… Mobile transactions have become a significant enabler of financial inclusion in Sub-Saharan Africa — especially for women — and have facilitated account ownership and usage through mobile payments, saving, and borrowing,” the World Bank reports.

The Unbanked Population Worldwide. Source: Statista

Today, change wafts through the African continent, bringing with it the whisperings of yet another digital transformation, this time powered by CBDCs.

With their promise of stability and digital efficiency, CBDCs are set to welcome the significant unbanked population into a new age of the monetary system. CBDCs offer a balanced blend – providing the benefits of digital currencies under the regulated, secure umbrella of government backing, thereby eradicating the erratic swings of decentralized cryptos.

The Adoption of CBDCs in Africa

- Nigeria’s eNaira: Nigeria’s journey with its digital currency, the eNaira, marks a significant milestone for CBDC adoption in Africa. Launched in 2021 amidst skepticism, the eNaira now boasts of more than 13 million wallets conducting transactions over $47.7 million.

“The eNaira has emerged as the electronic payment channel of choice for financial inclusion and executing social interventions,” asserts Godwin Emefiele, the Central Bank of Nigeria’s governor.

The eNaira has transcended its digital token status and become a tool for welfare, financial inclusion, and policymaking.

- Ghana’s e-Cedi: Venturing westwards brings Ghana’s eCedi experiments into focus. Though still in its early stages, the eCedi reflects Ghana’s aspiration to leverage digital tools for societal good.

- Kenya’s Digital Shilling: Heading back to the east, we find Kenya, famed for its M-Pesa success, contemplating the possibilities of a digital shilling. This not mere conjecture but indicative of the nation’s determination to revamp its financial landscape.

- South Africa’s Digital Rand: Meanwhile, in the south, South Africa contemplates introducing a digital rand. Its aspirations extend beyond merely digitizing the currency. It seeks to overhaul financial structures, address issues with remittances, and potentially change monetary policy mechanisms.

“CBDCs are remarkable. We believe wholesale CBCDs can maximize the self-verifying properties of blockchain, simplifying inter-bank clearing. Additionally, retail CBDCs can contribute to society by including more participants in the formal financial system and reducing scope for tax evasion and financial crime,” Sim Tshabalala, Chief Executive at Standard Bank, a major South African bank, explains.

Obstacles to CBDC Adoption in Africa

However, the roadmap to CBDC integration in Africa isn’t devoid of obstacles. Some of the primary challenges include:

- Infrastructure: The ubiquitous adoption of CBDCs requires steady internet access, a population well-versed in digital tools, and robust cybersecurity safeguards.

- Trust: Convincing a populace that has largely remained outside formal banking’s sphere to entrust a centralized digital entity may pose significant challenges. Suspicion, disinformation, and inherent skepticism about governmental digital initiatives might create roadblocks.

- Disruption to existing systems: CBDCs can cause disruption to existing monetary systems. The central banks’ strategies in response to this — whether they adjust interest rates, influence lending practices, or form partnerships with private entities — are something to keep an eye on.

The African CBDC Experiment

If Africa’s CBDC experiment is successful, it can serve as a blueprint for other emerging economies facing similar issues. If the experiment stumbles, it will yield valuable lessons to shape global approaches to digital currencies for years to come. However, it is more than just about CBDCs. It symbolizes Africa’s relentless reinvention, drawing from its rich past, facing challenges, and moving towards a promising digital future.