| Key Facts | |

|---|---|

| Global Stablecoin Market | Traditionally dominated by the US dollar |

| Latin America Stablecoin Market | On the rise, with an increase in local currency-tied stablecoins |

In recent years, the US dollar has largely dominated the global stablecoin market. This is particularly true in Latin America, where digital assets that are backed by the dollar offer an accessible method for individuals to hedge against inflation. However, the region is also starting to see an increase in stablecoins that are tied to local currencies, which could potentially transform the means by which money is transferred across borders.

Stablecoin Usage in Latin America

Take Argentina for example. Tether has aggressively expanded in the country, where inflation has now exceeded 100%. The situation has become so dire that presidential candidate Javier Milei has proposed replacing the Argentine peso with the US dollar.

Point of Interest:

- Tether Expansion: Aggressive expansion in Argentina where inflation exceeds 100%

- Javier Milei Proposition: Replace the Argentine peso with the US dollar

Venezuela is another country where stablecoins are gaining popularity as an alternative to the national currency, which is struggling due to persistent inflation. According to a 2022 report by Chainalysis, 34% of all small retail transactions in the country were comprised of stablecoin trades.

Despite the growing popularity of dollar-pegged stablecoins as a hedge against inflation, people in most countries still predominantly use domestic currencies for their everyday transactions. This is the case both for consumers and businesses.

The Rise of Native Stablecoins

While there is a plethora of tokens geared towards the US dollar, the market for Latin American stablecoins is still in its early stages.

One company making a splash in this space is Num Finance, an Argentinian FinTech startup founded in 2021. Focusing on deploying crypto payment technologies in emerging markets, Num has developed several stablecoins pegged to South American currencies. The company’s stablecoins include the following:

- nARS: Pegged to the Argentinian Peso. Collateralized with a mix of crypto and fiat currencies.

- nPEN: Pegged to the Peruvian Sol.

- nCOP: Pegged to the Colombian Peso.

In addition to Num, other technology companies are interested in developing stablecoins for Latin American currencies. Anclap, a Panama-based FinTech, is exploring this technology, and Celo developers are actively investigating the possibility of deploying a digital Colombian peso on the Celo network.

Issuers Target LatAm Remittance Market

In both technological and financial sectors, the potential to use these technologies for cross-border remittances is gaining attention.

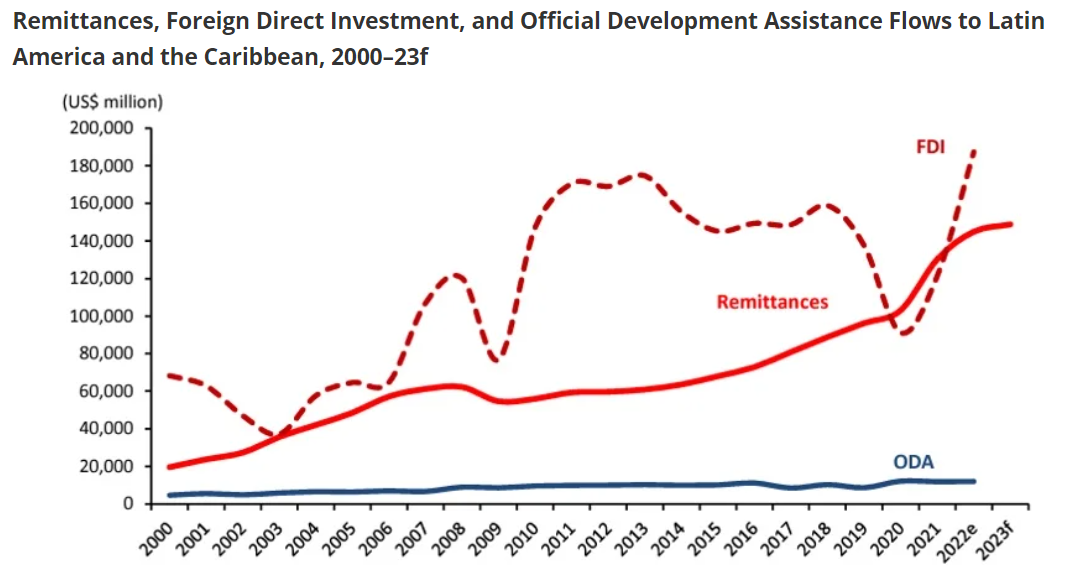

As reported by the World Bank, remittance inflow to Latin America and the Caribbean escalated to $145 billion in 2022. This growth is primarily driven by migrant workers sending their earnings back to their families and is more stable than foreign investment.

The primary obstacle is the stubbornly high cost of international money transfers via traditional payment methods. In the first quarter of 2023, a transfer from the US to Latin America had an average transaction fee of 5.8%. In some cases, the fees are even higher.

Stablecoins could significantly bring down the cost of transferring money both within and to Latin America. Num and Anclap have targeted the cross-border payment market by making this clear. Unlike the traditional remittance model, Num has added both lending and reward mechanisms into its stablecoins to incentivize usage and encourage users to maintain funds in stablecoin form for longer durations.

Agustín Liserra, the CEO of Num, said on the launch of nCOP:

“In Colombia, there exists a unique opportunity to “tokenize” remittances and offer them a yield in nCOP, based on regulated financial products. Currently, Colombia is one of the main recipients of remittances in Latin America, with nearly USD 6.5 billion flowing into the country. Num Finance aims to provide a new possibility for people to send and receive nCOP as remittances and get a yield on it.”