SEC Imposes Heavy Fine on 3M Company for Alleged Bribery Scandal

The American conglomerate, 3M Company, found itself at the center of a scandal that led to a hefty fine of over $6.5 million imposed by the U.S. Securities and Exchange Commission (SEC). The charges revolved around allegations of 3M directing bribery towards Chinese hospital officials through lavish “business trips” abroad.

Background

Renowned for working across a broad spectrum of industries encompassing healthcare, consumer goods and beyond, 3M recently highlighted its Chinese subsidiary’s usage of digital assets to improve their customer experience. Yet, it was not the exploration into digital assets that triggered the SEC’s investigation. Instead, the allegations insinuated a series of violations of the U.S Foreign Corrupt Practices Act (FCPA) perpetrated by 3M.

Allegations

- 3M’s Chinese subsidiary reportedly spent years secretly facilitating overseas trips for administrators of state-owned hospitals and healthcare facilities, as per the SEC’s investigations.

- Rather than being standard business trips involving conferences and hospital visits, these were, according to the SEC, lavish vacations overflowing with recreational activities. These trips were allegedly designed to coax officials into purchasing more 3M medical products.

- Between 2014 and 2017, 3M is assumed to have covered the expenses for at least 24 of such extravagant getaways, which caused them to bear financial costs nearing $1 million. The Chinese officials revelled in the lap of luxury with activities like hot air balloon rides, private vineyard tours, spa treatments and golf outings. Allegedly, the officials even went the length of skipping conference days to relish the trips and activities.

- Behind closed doors, 3M employees were alleged to have conspired with Chinese travel agencies in order to fix two forms of itineraries for each trip. One itinerary was aimed at internal compliance approval, listing legitimate conferences and hospital visits. The other itinerary, shared covertly with the officials, outlined the extravagant leisure activities.

- Beyond that, 3M is also claimed to have directly transferred over $250,000 to a Chinese travel agency between 2016 and 2018. Oversight bodies regard the payment as another attempt at bribery through funding overseas tourism.

Stock Market Impact

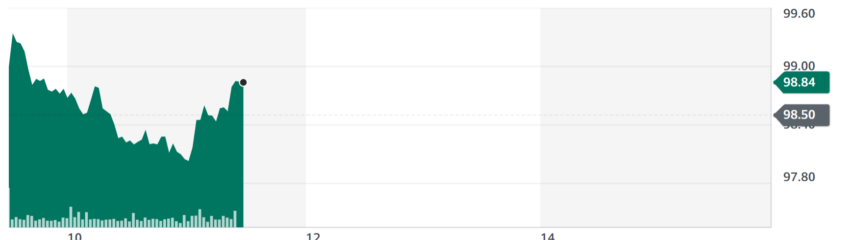

In the wake of these allegations and the resulting fine, 3M’s stock market performance was significantly affected, with the company’s shares experiencing a notable dip on Friday.

After the SEC’s charges were made public on Friday, 3M’s stock (MMM) landed in the red. It opened at approximately $99.00 on Friday, rose temporarily to a peak of $99.34 at 09:33 EDT before plunging to $98.00 at around 11.00 EDT. However, around 11:30 ETD, the stock bounced back, making up for the day’s initial losses.

Beyond the hefty fine, 3M also faces a civil penalty of a formidable $2 million. Despite the temporary hit, the multinational’s shares recovered. Yet, the damaging blow to its corporate reputation and financial standing underlines the significant potential consequences of violating international anti-corruption practices.