Funding Update on Major Crypto Venture Capital Firms

In recent news, over $350 million has been raised by crypto venture capital (VC) firms Polychain Capital and Coinfund. The respective firms reported raises of $200 million for a new investment fund and $152 million for a seed fund.

Polychain Capital: $200 Million Raised So Far

A July 18 Forbes report revealed that Polychain Capital managed to raise a sum of $200 million in the “first close” of its fourth investment fund. This information originates from sources who are familiar with the situation at hand.

Features of the “First Close” of Polychain’s Fourth Investment Fund:

- The firm has now sealed contracts with investors following the close.

- It is now in a position to start allocating funding to burgeoning startups and projects.

- Despite the remarkable raise, Polychain plans to raise a total of $400 million for its new venture fund.

- Three members of Polychain’s research team have been let go due to a shift in the firm’s investment priority.

As it stands, Polychain manages three funds with approximately $2.6 billion in assets under management, as per Pitchbook data.

Coinfund: $152 Million Seed Fund

Despite a decrease in VC funding for crypto projects for over a consecutive year, VC firm Coinfund managed to raise $152 million for its fourth seed fund, as reported by Bloomberg on July 18.

In the Words of Coinfund’s CEO

July is CoinFund’s 8th anniversary, celebrating the journey of @jbrukh @flexthought and team from kitchen table to cap table. We’re thrilled to bolster this milestone with the announcement that CoinFund has closed its $158M Seed IV Fund to back the leaders of the new internet

pic.twitter.com/6kwBFuIHiy— CoinFund (@coinfund_io) July 18, 2023

CEO Jake Brukhman of Coinfund revealed that the company initially aimed to raise $125 million. However, due to a revitalized interest in the industry, an additional $27 million was raised.

Decline in VC Funding For Crypto and Web3 Startups

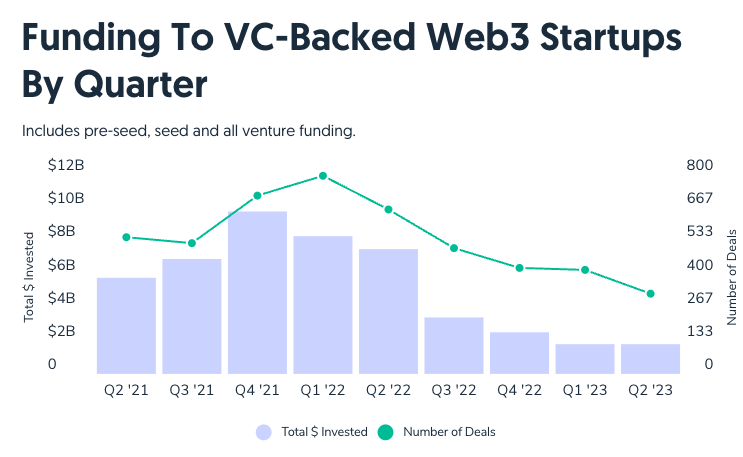

According to data from the business analytics firm, Crunchbase, there has been a 76% decrease in the total volume of venture funding for crypto and Web3 startups, compared to this time last year.

The total amount of venture funding and the number of deals for crypto startups over the last two years, according to Crunchbase.

Investors’ Caution Towards the Crypto Sector

Investors have reportedly become more cautious regarding the crypto sector after the downfall of several high-profile crypto projects such as Do Kwon’s Terra Money ecosystem and Sam Bankman-Fried’s FTX over the past couple of years.

- This has induced a shift towards more traditional market sectors.

- VC investors seem to have developed wariness of new investments in general, with the only significant exception being the artificial intelligence domain.

Rising Interest in Artificial Intelligence (AI)

As we ushered in the new year on January 1, 2023, the AI industry saw a boon with over $12 billion dollars ploughed into venture funding due to investors’ eagerness to tap into this new sector.