Ethereum’s Market Performance and Future Projections

Ethereum’s market value has shown a steady upward trend over recent weeks. This phenomenon has given rise to a wave of optimism among investors as they anticipate the advent of a new bull market. However, crucial resistance levels still remain to be defeated for Ethereum (ETH) to enter into a new long-term bullish trend.

- Technical Analysis

An in-depth technical analysis of Ethereum’s performance will offer more insights into what to expect in the near future. For this article, the analysis is contributed by Edris.

-

The Daily Chart

From the daily chart’s perspective, Ethereum’s price has been on a steady upward trend. This follows a decisive rebound from the 200-day moving average, paired with a significant breakout from the 50-day moving average on the higher side. The 50-day moving average has recently served as a cushion for the price, propelling it upward. The average is currently at around the $1,850 mark.

In the given timeframe, a target price of $2,200 appears to be the most feasible. For the market to get back on a long-term bullish trend, a breakout over the $2,200 level would be crucial.

-

The 4-Hour Chart

When the 4-hour chart is considered, Ethereum’s movement becomes more intriguing. The cryptocurrency has made a successful breakout from the large declining wedge pattern. However, Ethereum has faced rejection multiple times at the $1,920 resistance level. The cryptocurrency continued to be buoyed by the superior boundary of the falling wedge and has consistently trended upwards.

The $1,920 level is presently undergoing a shift towards the higher side. This phenomenon is accompanying the market’s thrust towards the psychological $2,000 level. Moreover, the RSI indicator currently reflects the dominance of bullish momentum, although it is nearing the overbuying zone.

- Sentiment Analysis

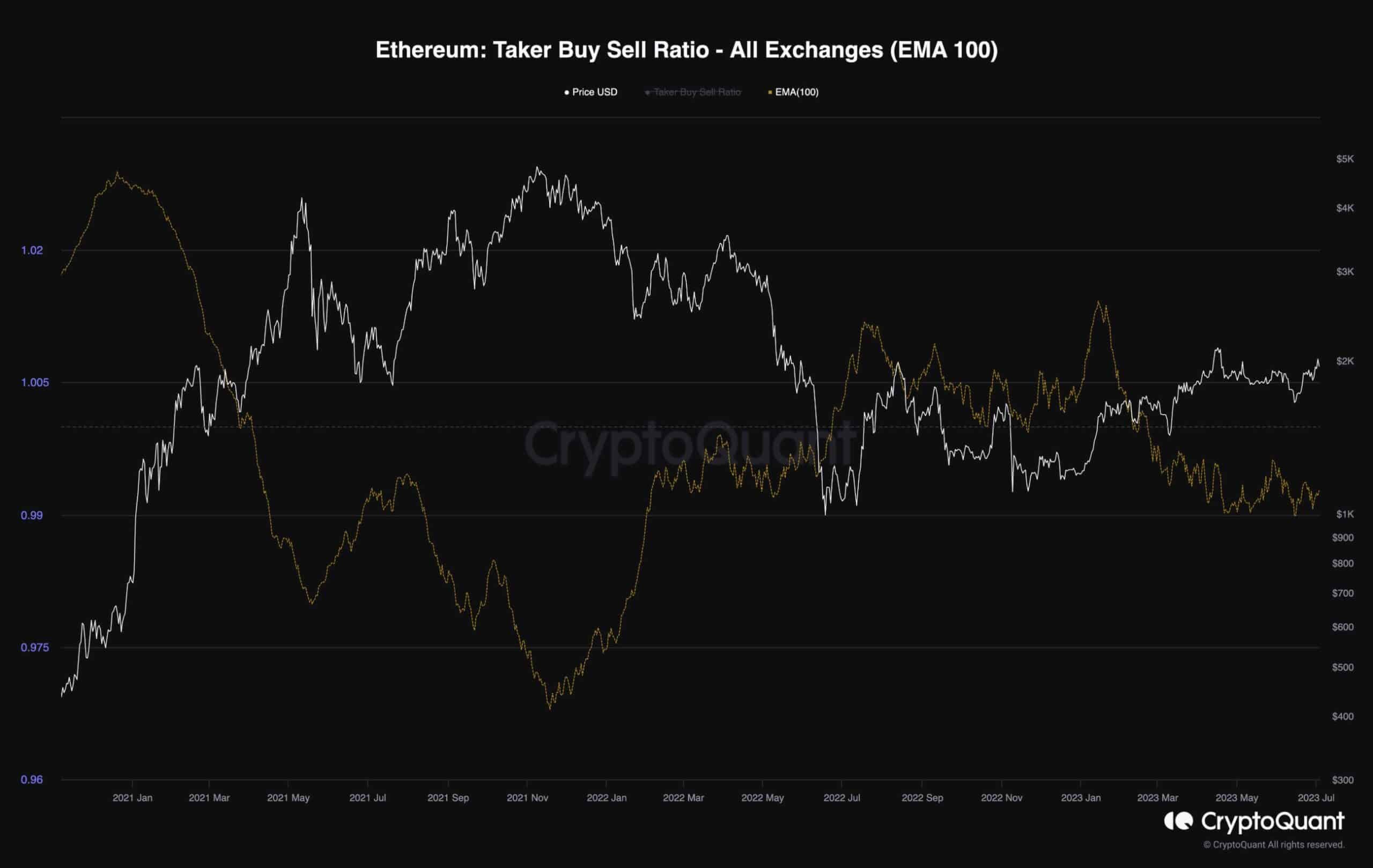

Ethereum Taker Buy Sell Ratio

To gain clarity about the prevalent market sentiment and to gauge whether Ethereum is transitioning into a new bull market or prolonging the current bear market, it is worth studying the sentiment in the perpetual futures market.

The Taker Buy-Sell Ratio metric, tweaked by a 100-day exponential moving average, gives valuable data on the dominance of long or short traders. If this ratio is more than 1, it implies a bullish sentiment. On the contrary, a ratio below 1 signifies a bearish sentiment.

Even though the price of Ethereum has shown a moderate upward trend over the past few months, the Taker Buy-Sell Ratio is still below 1. This indicates a prevailing bearish sentiment in the futures market. Some investors might be short-selling in the market to safeguard their spot portfolios, while others engage in short-selling to generate profit. This implies the notion that the bear market is not over yet.

If the futures traders continue with their current actions and the demand in the spot market diminishes, it might result in selling pressure, potentially causing a bearish reversal in the near future.