Analysis and Predictions on Bitcoin’s Price Surge

As the world becomes increasingly digitized, the interest in cryptocurrencies, particularly Bitcoin (BTC), continues to mount. Last month, Bitcoin experienced a significant increase in price, which many attribute to the growing optimism surrounding a potential approval of a spot Bitcoin Exchange-Traded Fund (ETF). The possibility of this approval is perceived as a major catalyst for broader institutional crypto adoption.

Despite the optimistic trend, Bitcoin’s peak has since pulled back considerably after reaching a high past $31,400 earlier this month. At present, the price is fluctuating slightly above $29,000.

Insights into Bitcoin’s Possible Price Action

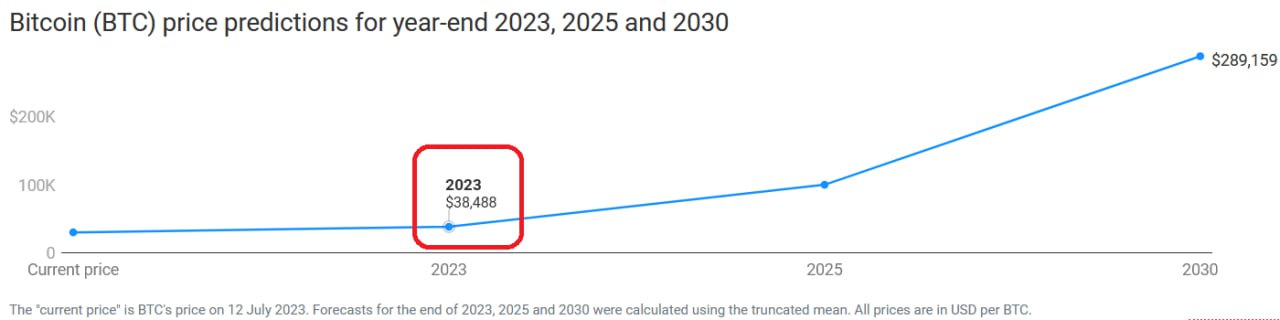

To give a detailed understanding of Bitcoin’s possible price action for the year’s remainder, we have sought the insights of 29 finance experts who provided their end-of-year price estimates for BTC.

Per Finder.com results shared with Finbold, the leading finance experts project that the world’s largest cryptocurrency will appreciate in value over the next months, ending the year at an estimated $38,488. This implies a plausible rise of over 30% compared to the current rate. Simultaneously, they posit that the potential peak for Bitcoin in 2023 could be about $42,000.

Long-term Predictions

These finance experts further projected that Bitcoin’s price could soar to approximately $100,000 by the end of 2025. Their foresight doesn’t stop there. By the end of 2030, Bitcoin is expected to exceed $280,000 markedly.

Expert Takes on BTC Price

The forecast for the 2023 end-of-the-year Bitcoin price was established after intensive analysis of estimates from various prominent finance professionals. These projections varied in bullishness, underscoring the varying perspectives on the potential performance of the cryptocurrency.

“We are finally through the darkness of crypto winter. With numerous top financial institutions submitting an application for a Bitcoin spot ETF, the pressure is on the SEC to approve. If that happens, tens of billions of dollars will chase Bitcoin this year.”

– Joe Raczynski, Technologist and Futurist

Raczynski believes that BTC could end the year higher than the panel average at $40,000, profiting from the escalating institutional interest.

“Bitcoin is on the brink of entering the halving narrative, backed by potential flows from U.S. spot ETFs, if approved. The possible scenarios will largely depend on the SEC spot ETF approval, several high-profile exchange lawsuits, and the identification of any more unethical actors in the space.”

– Alex Nagorskii, DigitalX

Nagorskii pegs the best-case scenario for Bitcoin at $35,000 by the end of 2023 and ultimately soaring to $65,000 by the end of 2025.

As per the aforementioned panel, 59% are bullish on BTC and suggest it’s a good time to enter the market. Conversely, 33% advise holding, and 7% recommend selling the cryptocurrency.

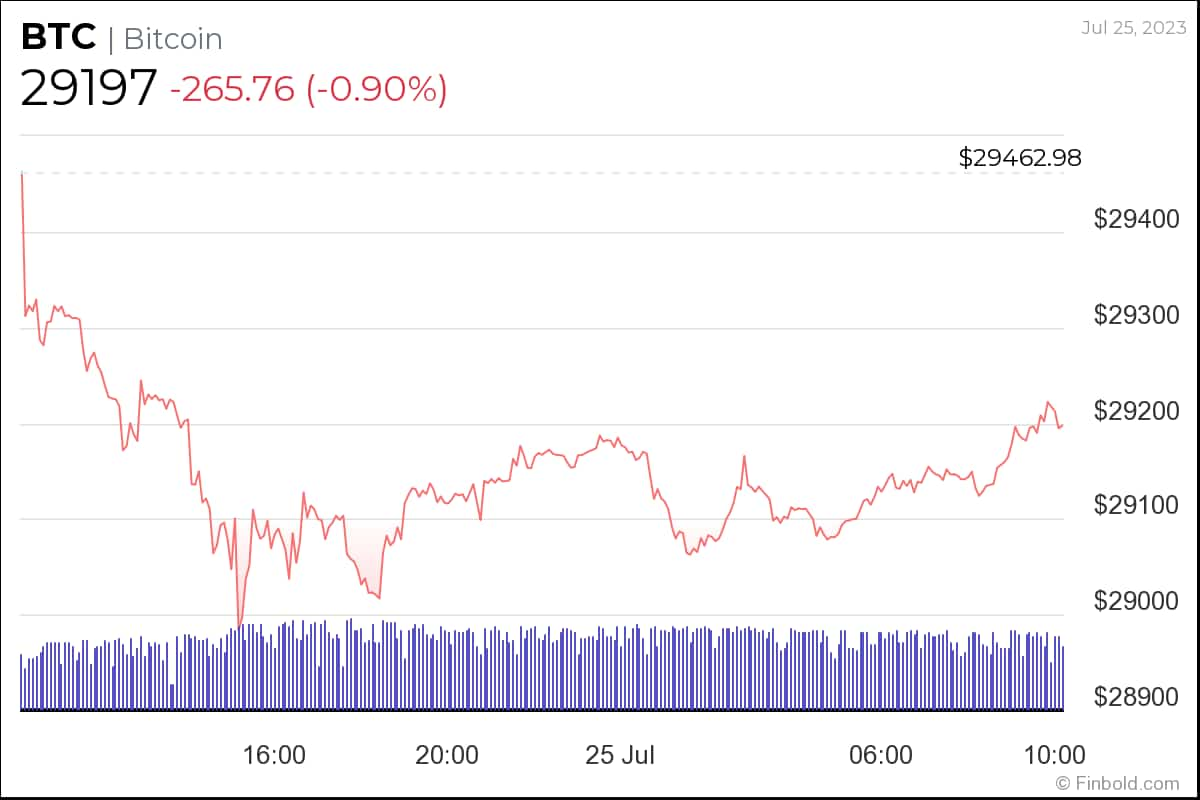

Current Bitcoin Price Analysis

At the time of this publication, Bitcoin was trading at $29,197, down by 0.9% on the day.

Weekly and Monthly Outlook

- The popular crypto asset experienced a loss of around 2.7% during the past week.

- On a monthly basis, it has nearly shed off 5%.

Year-to-date Performance

While the weekly and monthly checks are indicating a pullback, Bitcoin’s year-to-date gains remain robust. It has climbed over 75%, reflecting a strong recovery from the lows experienced in 2022.

Disclaimer: This content should not be interpreted as investment advice. Investing is speculative, and your capital is always at risk.