Solana Price Increase Anticipated Following Shopify Support

Given the recent events of Thursday, August 24, Solana (SOL) is slated to receive a forecasted 4% increase in its price. The Canadian multinational e-commerce company Shopify has added support for USDC Via Solana Pay. Advanced analysis of derivatives market data shows that investors have been largely optimistic about SOL’s future performance.

The Shopify Integration and its Potential Impact

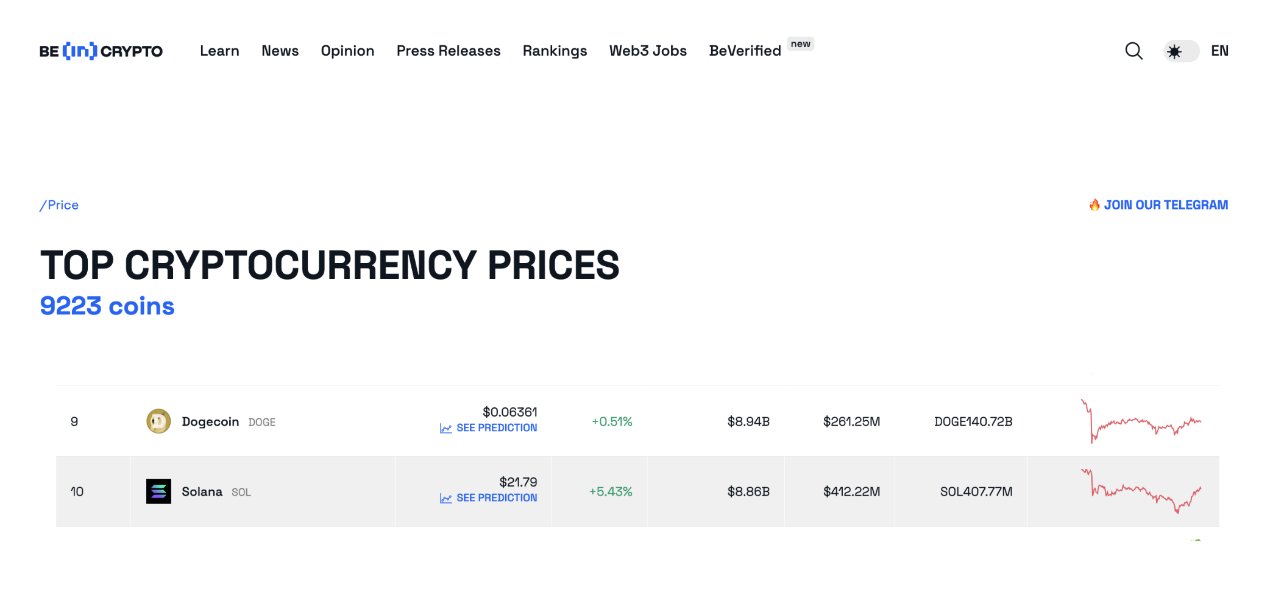

Could Shopify Integration potentially enhance Solana’s value, placing it ahead of Dogecoin’s (DOGE) in the top ten cryptocurrency rankings? Over the past week, Shopify made a defining move by integrating the USDC payment method via Solana Pay on August 23.

| Shopify’s Impressive Figures |

|---|

| 4.2 million registered online stores |

| 2.1 million daily active customers |

Given those statistics, cryptocurrency enthusiasts are hopeful that this critical integration would leverage the SOL price while bolstering the global adoption of cryptocurrency.

Solana Crypto Forecasts: Predict, Prepare, and Profit

How Might the Shopify Payment Integration Affect Solana’s Price?

Within barely twelve hours of the announcement, there was observable crypto trading activity on SOL, triggering a nearly 4% surge in its price. This has steered Solana’s market capitalization towards the $9 billion landmark. The climax is set to position it just behind Dogecoin.

The Calculation of Market Capitalization:

- The total value of a cryptocurrency’s circulating supply is calculated by multiplying its current price by the circulating supply to get the market capitalization.

Moreover, Solana’s anticipated market valuation has increased significantly due to the Shopify integration. As it stands, SOL’s market cap has almost caught up to Dogecoin, hovering around a close $8.9 billion.

The Impact on Short Traders

The Shopify announcement led to an immediate response, with a 3.5% price increase from $21.27 to $22. This price hike caused Solana short traders to scramble, closing their positions.

Definition of Terms

- Short Traders: These are investors who borrow and sell assets, such as stocks or cryptocurrencies. They anticipate a decrease in the asset’s price and intend to buy back the assets at a lower price later. The difference in price is their profit.

- Short Liquidation: This event is triggered when the asset’s price rises rapidly, leading to losses that exceed the value of the short trader’s collateral or ‘margin’.

If a Short Squeeze sets in, Solana’s price valuation will likely pervade Dogecoin’s market cap in the succeeding weeks.

The Solana Ecosystem

Simultaneously, cryptocurrency investors have started investing fresh funds into the Solana Futures Markets to gain potential upsides from this Shopify collaboration.

Open Interest: refers to the total value of active derivative contracts for an asset. An increase in Open interest is a bullish sign, indicating potentially significant capital inflows.

If the uptrend in Open Interest is consistent, there could be a consequent increase in Solana’s price. Thus, the Shopify Integration could continue to push up Solana’s value in the spot markets over the next few days.