The Impact of Pandemic-Induced Stimulus Measures on the United States Economy

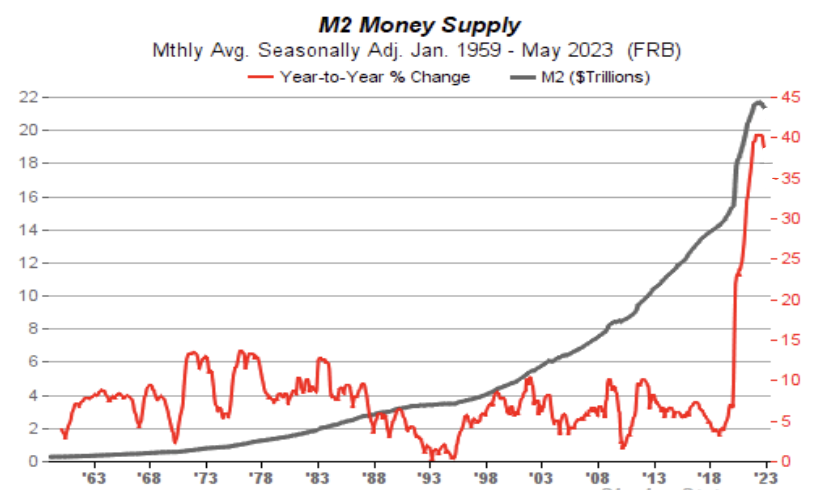

In response to the economic effects caused by the global COVID-19 pandemic, the U.S Government took radical measures, leading to the central bank printing nearly 80% of all existing dollars since 2020. The enormous increase in money supply has had severe impacts on the national economy.

Dramatic Increase in Circulating Dollars

According to a report published by The Kobeissi Letter, a macroeconomic commentary outlet, on August 27, the volume of dollars in circulation spectacularly rocketed by 375% in a mere three-year span.

The Madness of Money Supply

As we entered 2020 and the world locked down due to the havoc wreaked by COVID-19, there existed $4 trillion in circulation. As per reports from The Kobeissi Letter, there is currently an astounding near-$19 trillion in M1 circulation.

The drastic printing of money was implemented as a means to deliver stimulus packages and financial aid to virtually everyone adversely affected by the country’s lockdown.

A concerning revelation is that the U.S pays an exorbitant price for the trillions of dollars that were generated almost instantaneously. The surprising point is the Federal Reserve’s apparent confusion at inflation reaching a 40-year high.

US M2 money supply. Source: X/@KobeissiLetter

Understanding Money Supply Categories

- M2: This is the Federal Reserve’s estimate of the total money supply. It encompasses all the cash individuals possess, and all the money deposited in checking accounts, as well as savings accounts and other transient saving vehicles.

- M1: This category only includes cash and savings in notes and coins.

This out-of-control money supply lead to significant devaluation of the currency through soaring prices and inflation. Hence, the current dollar doesn’t have the same purchasing power as a dollar from five years ago.

If you’re interested in learning more about the looming banking crisis in the United States, take a look at our comprehensive explainer here: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Additionally, U.S. inflation began to climb again in July to a rate of 3.2% following a year of monthly decreases. In a statement last week, the Federal Reserve chairman Jerome Powell confirmed that the central bank would continue to elevate interest rates “if appropriate”, as the inflation rate remains alarmingly “too high.”

Meanwhile, the average U.S. household has a reported $7,300 in credit card debt, despite only having $5,300 in savings.

“Inflation has made basic necessities unaffordable and proven that ‘free money’ clearly isn’t free.” – The Kobeissi Letter

Global Dominance of the USD in Transaction

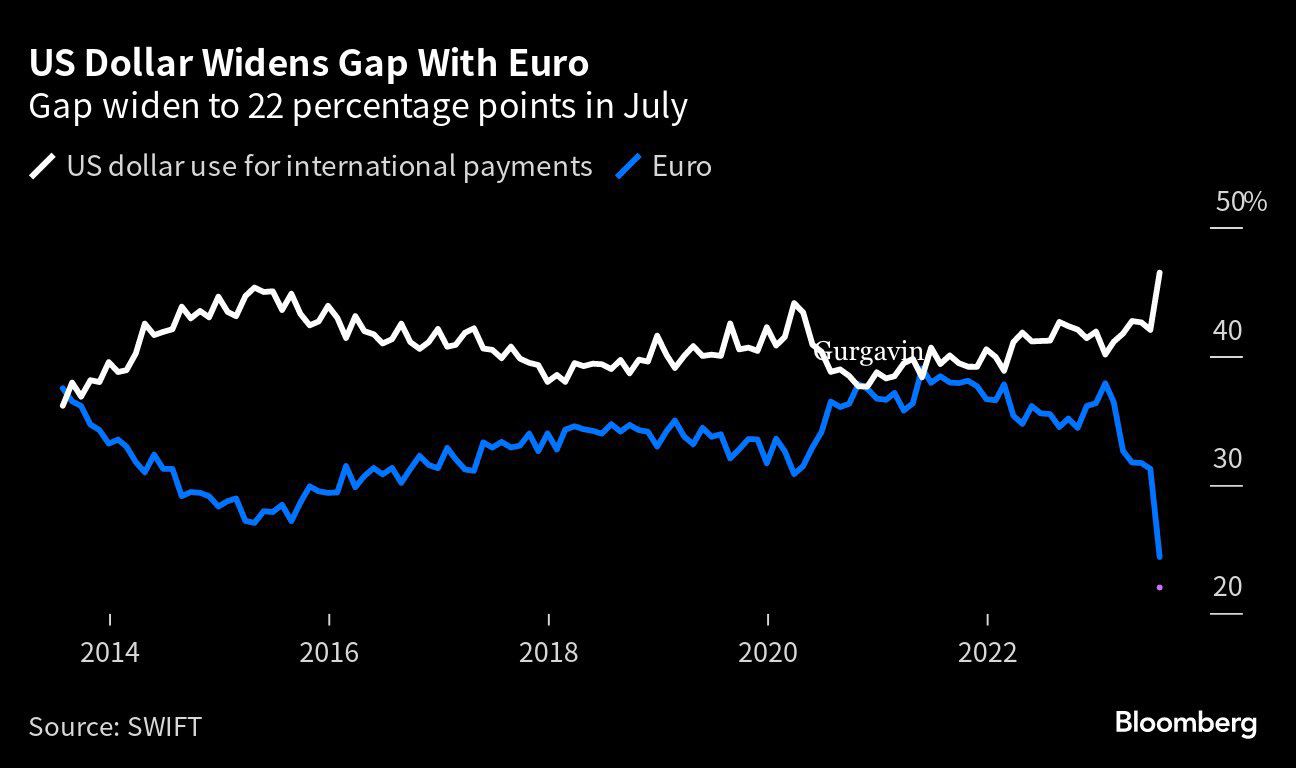

Not all is grim for the U.S. Dollar. As per data acquired from Bloomberg, the USD’s role in the global transaction landscape remains paramount, reaching a recent peak of 46%.

USD in global transactions. Source: X/@gurgavin

Nonetheless, the strategy of de-dollarization is in play, and an increasing number of nations are working towards trading in their individual currency.

Recently, Brazil’s president advocated for the BRICS nations (Brazil, Russia, India, China, and South Africa) to create a common currency for trade and investment. He believes a BRICS currency “increases our payment options and reduces our vulnerabilities.”