Renowned Macroeconomic Expert Predicts Second Wave of Bank Failures

Top macroeconomic specialist, George Gammon, has voiced his concern regarding the likelihood of an impending second wave of bank failures. With a wide reach of almost 480,000 subscribers on his YouTube channel, in a recent update, Gammon pointed to specific indicators that suggest more problematic times for the banking industry.

Key Indicators Pointing to Future Bank Failures

Gammon highlights noticeable trends in two primary areas:

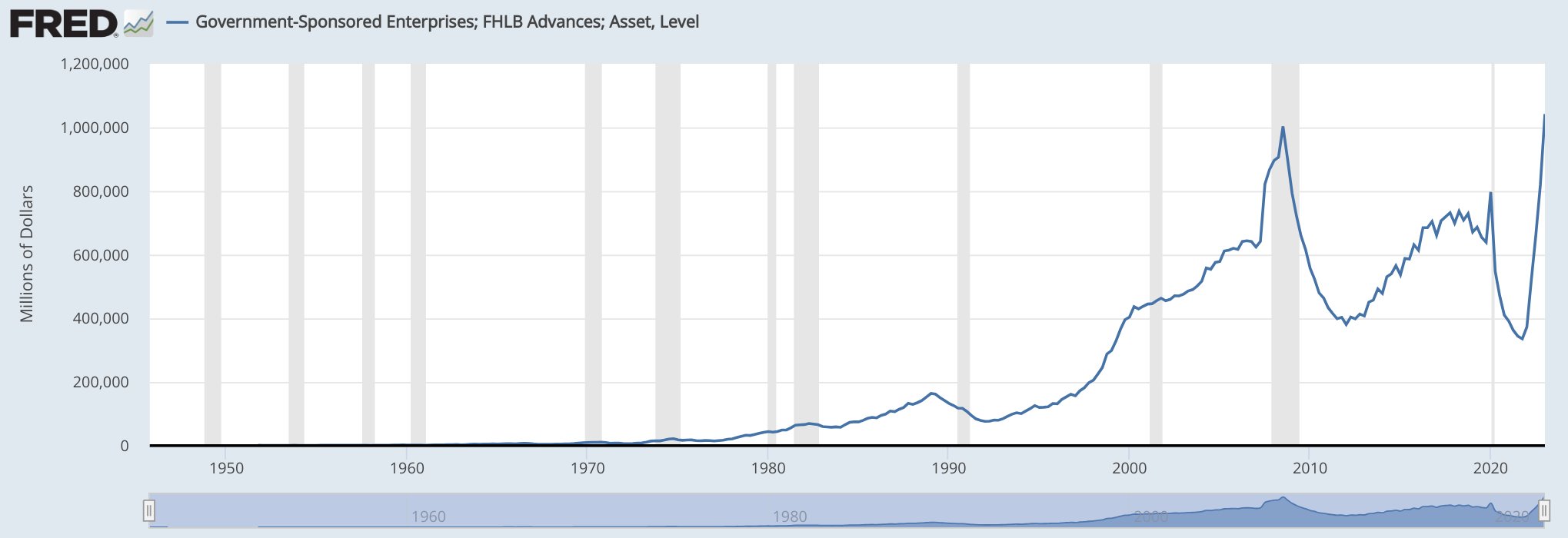

- A dangerously steep increase in bank borrowing from America’s Federal Home Loan Bank (FHLB) system

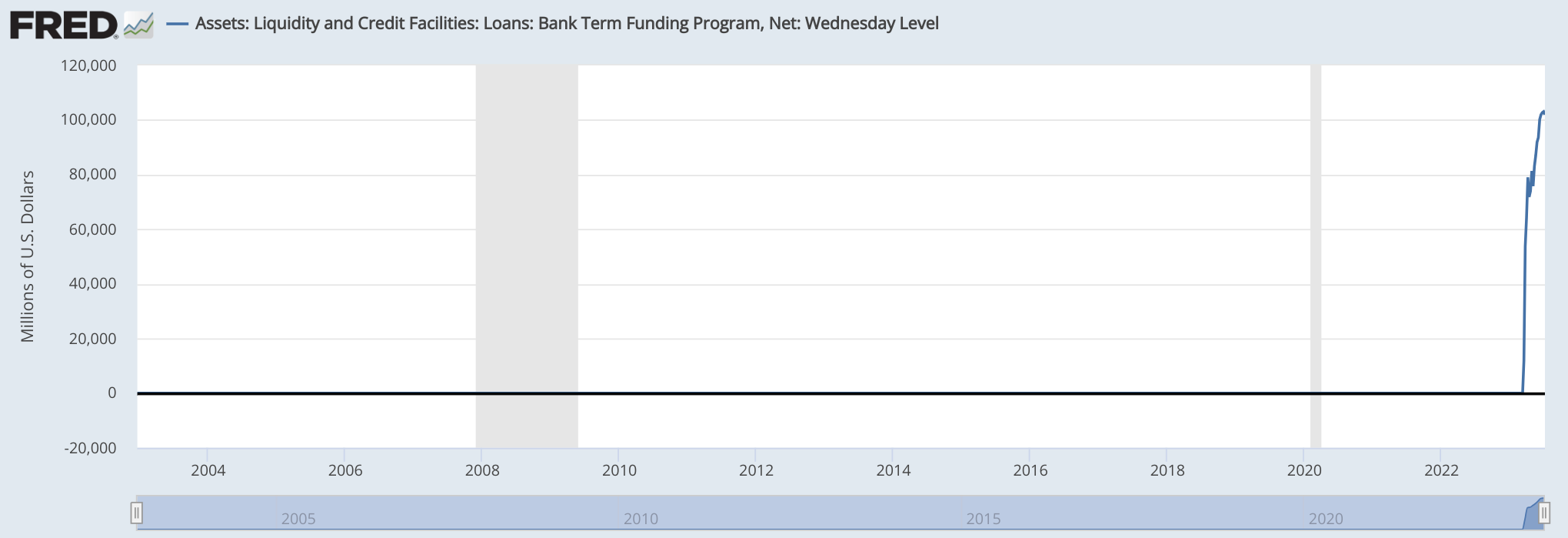

- Accelerated borrowing under the recently established Bank Term Funding Program (BTFP)

The trends in these two areas alone paint a worrying picture of the future of the banking industry.

“When these troubled banks need liquidity, their first option is the marketplace. The repo market, to be specific. But they’re very sophisticated lenders and so, their next best option is often FHLB. However, they are reluctant to adopt this route due to its high cost and often stringent terms. For worse off banks, even the FHLB may not want to do business with them. In such cases, the banks are bound to approach the Federal Reserve as the ultimate lender of last resort, trying to access newly formed facilities such as the BTFP,” explains George.

Troubling Statistics from the Federal Reserve Economic Data (FRED) System

Gammon cites the FRED system that reveals increasing borrowing from both the FHLB and BTFP. These statistics reflect a banking crisis far from resolution.

“The chart of the advances of the FHLB is still extremely high and going even higher. This, in combination with the BTFP being extremely high, indicates to us that the banking crisis is far from over,” George elaborates sharply.

Underlining George’s concern are two graphics, provided by the Federal Reserve Bank of St. Louis, which clearly show these rising trends:

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

The Federal Reserve’s Discount Window: An Emergency Lending Signal

The Federal Reserve’s discount window is an emergency lending program designed to give banks short-term loans. In essence, when banks turn to this program in higher numbers, it’s a major red flag. This spike in usage signals to the market that these banks are failing.

“The next wave of this crisis can be timed by combining the [FHLB and BTFP] charts with the discount window. If you see that number shoot up, you know that over the next few weeks or months, more banks are likely to go bust, possibly bringing us into an environment that’s very similar, or even worse than, the global financial crisis,” Gammon elaborates.