Ethereum Holder Swaps 694 ETH For 1,010 Maker

On September 4, a crypto whale performed a daring move by challenging the trade path embarked upon by Ethereum co-founder, Vitalik Buterin. This address, referred to as “0x3737,” exchanged 694 ETH, which is equivalent to approximately $1.13 million, for 1,010 MKR tokens. The MKR tokens were valued at $1,122 per token during the trade. The intriguing part of this trade is that it occurred just a few days after one of Ethereum’s co-founders, Vitalik Buterin, sold his MKR stash in exchange for ETH.

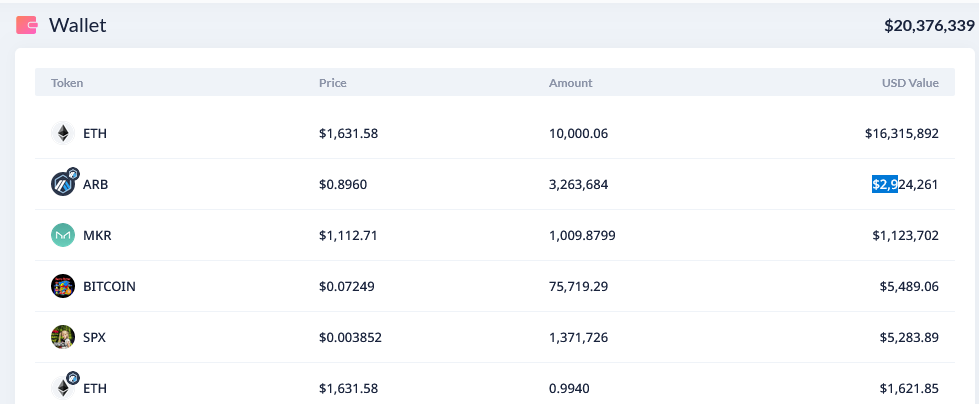

1. ETH Holder’s Asset Details:

The Ethereum holder is said to have accumulated more than $20.37 million in assets as of the date of the trade. Although the Ethereum holder traded against Vitalik, there’s an apparent bullish stance on MKR. Looking deeper into the address’s portfolio, it’s clear the Ethereum holder’s largest holding is ETH.

About The Holdings:

- ETH: The address holds 10,000 ETH. At the prevailing market prices, the ETH holding is estimated to be worth $16.3 million, representing over 75% of the total portfolio.

- Arbitrum (ARB): The next major holding of the Ethereum holder is ARB, valued at $2.9 million.

- MKR: Finally, the whale also has holdings in MKR, worth approximately $1.1 million.

2. The Significance of MKR

MKR is the issued token by MakerDAO, the Decentralized Autonomous Organization (DAO) that regulates the minting of DAI, a stablecoin on the Ethereum platform. In the last few months, MKR has seen quite a surge.

MKR plays a critical role in the stabilization of DAO — it is used as a last resort. The holders of this token participate in governance through voting on proposals aimed at stabilizing the algorithmic stablecoin.

In June, MKR saw its value more than double, rising by 125% to reach its peak price of around $1,300 in early August. At present, it’s trading just above $1,100, recording a 13% increase from its August lows.

3. Maker’s “Endgame” Roadmap

The recent surge in the token’s value can be attributed to various factors, but the most prominent is the unveiling of MakerDAO’s “Endgame” roadmap. Some of the prominent steps in the roadmap include releasing their blockchain, rebranding, and launching two new tokens.

MakerDAO’s Significance in DeFi:

As one of the pioneers in the decentralized finance (DeFi) sector, MakerDAO’s moves garner significant attention. The protocol currently boasts a Total Value Locked (TVL) of more than $5 billion, making it the world’s most substantial decentralized money market, according to data from DeFiLlama.

Maker’s Stablecoin (DAI):

The DAO’s stablecoin, DAI, currently has a steady yield, and is the largest stablecoin within Ethereum. As of now, DAI has a market cap of $5.3 billion, granting it the 12th position in the stablecoin market. Following USDT and USDC, DAI is third on the list of largest stablecoins.

4. Vitalik’s Recent Sale of MKR

Despite the excellent performance of MKR in comparison to the broader cryptocurrency market, Vitalik Buterin recently liquidated his MKR holdings worth $580,000. This action was a response to the announcement by MakerDAO’s co-founder, Rune Christensen, regarding potential plans to launch a new blockchain that bridges to Ethereum. Branded as “NewChain” and based on Solana’s code, this new blockchain is part of MakerDAO’s “Endgame” roadmap.