The cryptocurrency market, always known for its volatility, showed an unpredictable twist as its value decreased by 0.82% in a single day. It descended to a total worth of $1.2 trillion. This occurrence came to the forefront as the digital currency giant, Bitcoin (BTC), exhibited precarious conditions, falling beneath the significant $30k benchmark on Tuesday.

Rollercoaster Ride for Crypto Market

The last 24 hours have been nothing short of a whirlwind for cryptocurrency traders primarily dealing with leveraged digital assets. They witnessed a humongous liquidation amounting to $106.88 million, presenting a consequential effect on both long and short positions. During the, particularly tumultuous day on July 18, the crypto asset 1inch (1INCH) emerged as the most severely impacted. It suffered a brutal loss of almost 16% against the U.S. dollar.

In addition to 1inch (1INCH), several other digital assets also experienced precipitous descents. Terra classic (LUNC), for instance, was hit hard, as it plunged by over 6%. Solana (SOL) did not have a fair day either, as it also wiped out roughly around 6% of its value. Despite the prevalent bearish trend in the market, some coins managed to resist the tempest. Bitdao (BIT), relatively, had a positive day with a two percent incline, and Chainlink (LINK) even achieved a 4.65% gain against the U.S. dollar.

Leaders and Losers of Tuesday

The arena of cryptocurrency saw multiple other assets striving to make their mark on Tuesday. The top performers in this fluctuating market were sui (SUI), apecoin (APE), and xdc network (XDC). Analyzing liquidations in the preceding hour, Bitcoin (BTC), Ripple (XRP), Bitcoin Cash (BCH), and Ethereum (ETH) were at the lead of the chart in terms of liquidated positions.

The Optimistic Bitfinex Alpha Report

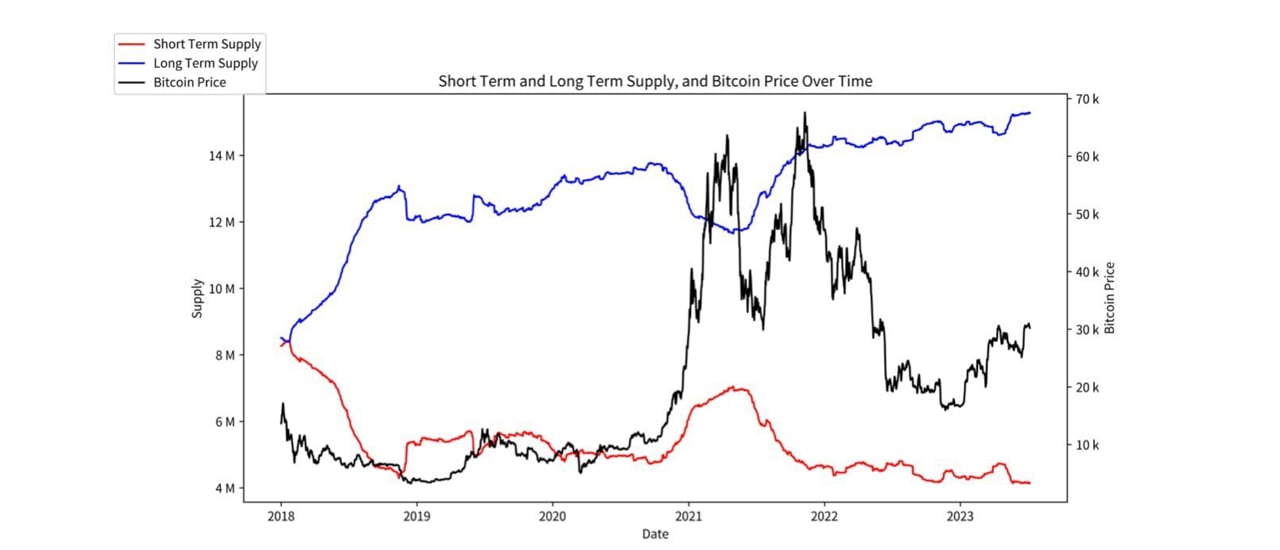

Interestingly, even though the crypto markets experienced a wide-ranging decline, the Bitfinex Alpha Report released this week takes a different stance. According to the report, Bitcoin investors are currently “behaving more bullishly.”

Bitfinex Alpha Report.

The report shines a spotlight on the on-chain movements of Bitcoin. It suggests a noticeable shift of supply from long-term holders (LTHs) to short-term holders (STHs). This kind of cycling is generally an indicator of a bullish market.

Elaborating further on the trend, the report states, “This shift hints at new market entrants seeking quick profits and long-term holders cashing in on favourable prices. As this trend plateaus, it signals an early bull market stage where supply change occurs between these two cohorts.”