Ethereum Liquid Staking Providers Self-impose 22% Market Cap Rule

Following concerns about the decentralization of the Ethereum network, at least five liquid staking providers have either imposed or are currently seeking to impose a self-limit rule. The rule stipulates that they promise not to own more than 22% of the Ethereum staking market. It’s seen as an initiative aimed at preserving the decentralized nature of the Ethereum network.

Ethereum Staking Providers Committed to the Self-Limit Rule

Among those committed to this initiative or considering it include:

- Rocket Pool

- StakeWise

- Stader Labs

- Diva Staking

- Puffer Finance

These providers were recognized by Ethereum core developer, Superphiz, who acknowledged their commitment (or potential commitment) to the imposed self-limit.

These providers are committed (or are in the process of committing) to self-limit to <22% of Ethereum validators. This is how our chain will be successful: Coordination above greed. Cooperation instead of winner-take-all.@Rocket_Pool @stakewise_io @staderlabs @divastaking

— superphiz.eth ️ (@superphiz) August 30, 2023

Objective of the Self-Limit Rule

The introduction of a self-limit rule for Ethereum staking providers was proposed to counteract concerns about increasing centralization of Ethereum staking. The 22% limit is calculated based upon the need for at least 66% of validators to agree on the state of Ethereum. Reaching this threshold would require collusion of at least four major parties.

Understanding the Finality Concept

The finality is the stage in a blockchain where a transaction cannot be altered or changed, thus ensuring immutability. This makes the proposal from Superphiz a conscious effort towards enhancing the robustness and reliability of the Ethereum network.

Handling the Concerns Over Centralization

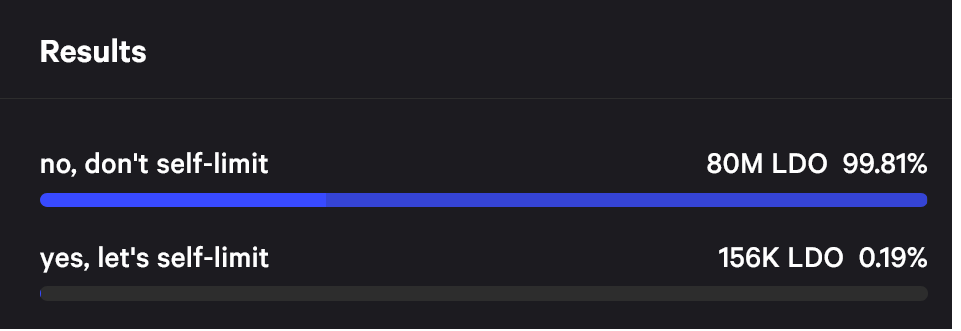

This initiative was initially proposed in May 2022, when Superphiz challenged the staking community to consider if they would prefer the overall health of the Ethereum network over individual profits. Lido Finance, a large Ethereum liquid staking provider, declined to self-limit, with a 99.81% majority expressing their intentions to control the majority validators on the beacon chain.

Votes cast by Lido (LDO) token holders about the self-limiting proposal. Source: Snapshot

Observations in the Staking Market

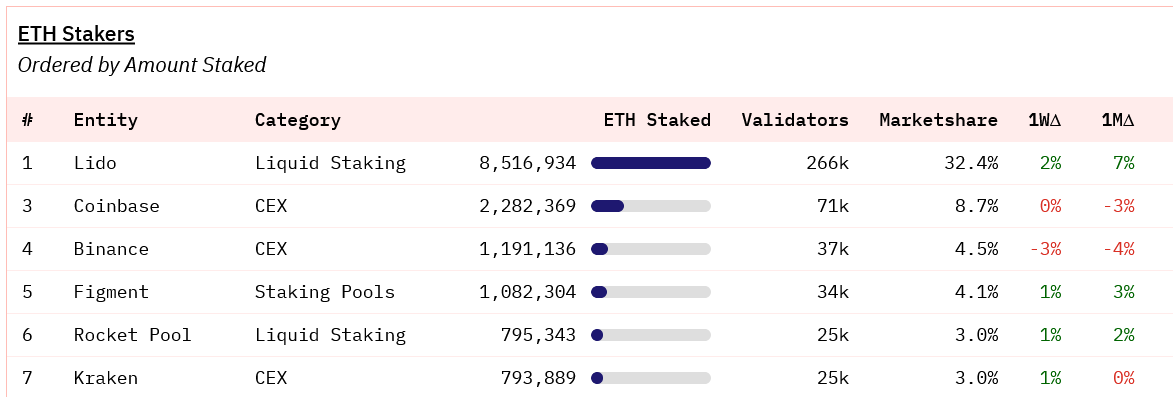

Lido controls 32.4% of all staked Ether and Coinbase follows at 8.7% stake in the market, according to data from Dune Analytics.

Ethereum stakers by staking amount and market share, indicating only Lido exceeds the 22% threshold. Source: Dune Analytics

Reactions from the Ethereum Community

Opinions about this self-limit proposal are contradictive within the Ethereum community. Some members highlighted that it has nothing to do with Ethereum alignment. This alignment is understood as a principle promoting credible neutrality and permissionless innovation on Ethereum.

A noted industry pundit, “Mippo,” opined that the promoters of the proposal, given their positions, would not limit themselves as they were suggesting. At the end of the day, all the parties were economically self-interested and acting rationally, he concluded.

Yeah because they have way less market share than that now… easy to chirp from the cheap seats.

This has nothing to do with “Ethereum alignment.” None of these teams would self limit were they in Lido’s place.

Everyone is doing the economically selfish and rational thing…

— Mippo (@MikeIppolito_) August 31, 2023

Others noted that initiatives targeting user-friendly solutions should not be shamed. However, some members were wary of potential centralization issues and characterized Lido’s dominance as “disgusting and selfish.”