Dan Gambardello’s Perspective on Cardano’s Potential: Drawing Parallels to Amazon’s Early Years

Recently, Dan Gambardello, the founder of Crypto Capital Venture, expressed his views on Cardano ($ADA), likening it to the early years of internet giant Amazon. In his intriguing comparison, he delved into the potential of ADA and its similarities with Amazon that could forecast its long-term value.

Acknowledging ADA’s Market Conditions

First and foremost, Gambardello recognized the harsh market conditions faced by ADA holders. Over two years, the ADA market experienced a substantial downside. Importantly, his comparison between ADA and Amazon wasn’t solely focused on their technological advancements or specific achievements, but their core principles and latent potential for long-term value.

Amazon’s Stock Plunge from $5.25 to 30 cents

One major point that Gambardello highlighted was the dip in Amazon’s stock from its all-time high of $5.25 to 30 cents. This downward spiral happened from 1999 to 2001. Interactive chart showing Amazon’s stock plunge:

Source: Google Finance

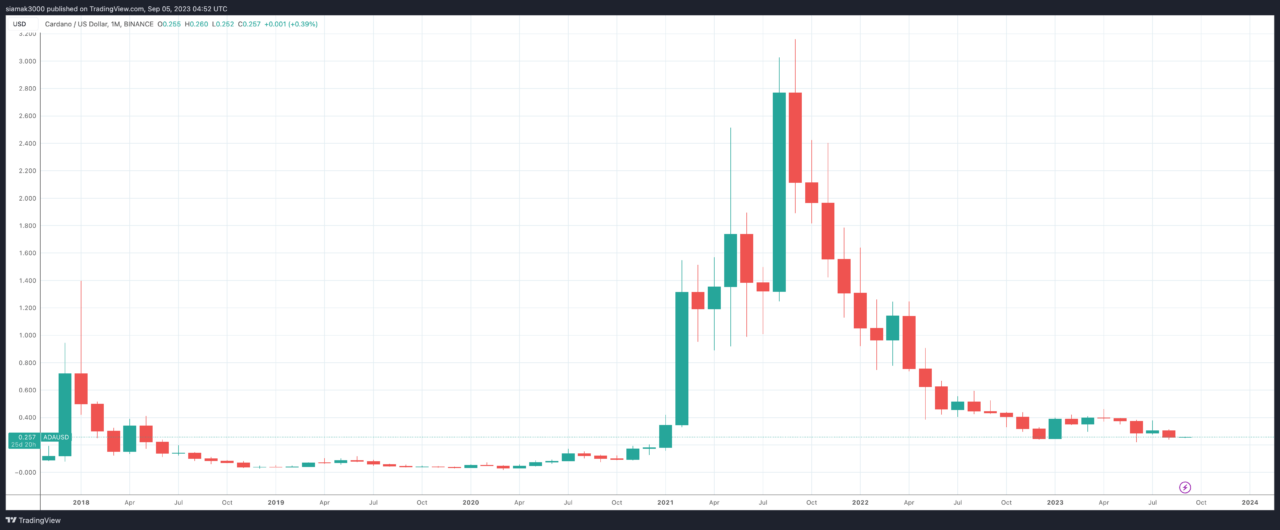

ADA’s Similar Market Behavior

In a similar vein, Cardano’s ADA followed a corresponding trajectory. Its last bull market peaked at slightly above $3 in early September 2021, and since then, it has plummeted to nearly 25 cents at present. Chart illustrating ADA’s market behavior:

Source: TradingView

Cardano’s Potential for Future Growth

Drawing from these parallels, Gambardello suggested the idea that buying ADA in 2023 could generate returns comparable to buying Amazon stock in 2001, particularly considering Cardano’s potential as a global financial operating system.

He noted Cardano’s market cap stands roughly at $8.9 billion now, compared to Amazon’s market cap of $2.2 billion post-crash. This indicates that Cardano retains a higher valuation than Amazon did at a comparable stage, even after a 90% crash.

Gambardello’s Comparison to Amazon’s Downturn:

- Gambardello referred to a letter by Jeff Bezos, Amazon’s CEO, to shareholders during their downturn. Bezos highlighted that despite their stock price collapse, Amazon’s position was stronger than ever.

- In a similar context, he drew parallels for Cardano, stating that despite the hardships, Cardano’s position is getting stronger, signified by its developments like staking, smart contracts, and scalability.

Using Benjamin Graham’s Investing Philosophy

He invoked investor Benjamin Graham’s wisdom that the stock market, in the short term, behaves like a voting machine, but in the long term, it’s a weighing machine. According to Gambardello, ADA, with its strong fundamentals, could withstand the test of time, just like Amazon.

Cardano’s Early Stages of Customer Adoption

Gambardello pointed out that Cardano is currently in the initial phase of customer adoption, with numerous firms leveraging its blockchain for their operations. This resembles Amazon’s relentless concentration on customer experience, which catalyzed its long-lasting success.

Cardano’s Emphasis on Security and Decentralization

Further, Gambardello spotlighted Cardano’s prime focus on security and decentralization, making it an attractive option compared to blockchains like Solana, which he thinks are lacking in these aspects.

Recent Developments Supporting Cardano’s Potential:

- As of 2023, start-ups have begun adopting Cardano. Gambardello highlighted the efforts of World Mobile to connect the unconnected and bank the unbanked, signifying a concrete real-world application for Cardano.

- He is confident that this is just the beginning for Cardano, and there’s a lot more potential left to be explored.

Dan Gambardello’s Optimistic Outlook

To summarize, Dan Gambardello perceives enormous untapped value in Cardano, drawing compelling similarities with Amazon’s formative years. He asserts that Cardano is well-positioned for the long haul, quite like Amazon, and could provide significant returns to insightful investors who can realize its latent potential.

Featured Image by Traxer via Unsplash