The crypto market has witnessed countless evolutions since Bitcoin’s inception in 2009. A recent development in this field is the “Ethereumization” of Bitcoin. This term has been coined to describe the adaptations within the Bitcoin network, seemingly making it more Ethereum-like.

This transformative process has positive and negative aspects, raising concerns among top crypto community leaders.

The Ethereumization: A New Dawn

The introduction of BRC-20 has largely driven the Ethereumization of Bitcoin. This is a protocol that bears a striking similarity to Ethereum’s ERC-20.

The BRC-20 protocol, powered by the Ordinals system, has enabled the Bitcoin network to mint non-fungible tokens (NFTs) by assigning unique identifiers to each satoshi – Bitcoin’s smallest unit. This development has expanded Bitcoin’s capabilities, infusing new possibilities into its network.

Interestingly, BRC-20 allows the creation of meme coins due to its diverse potential. While this might appear as a disadvantage at first glance, it plays into the hands of the digital age. Meme coins have repeatedly demonstrated their capacity to engage audiences and create viral trends.

Indeed, speculators are rapidly issuing and minting tokens using the BRC-20 standard. There is a palpable hype around these tokens, with CoinMarketCap reporting that 8,500 tokens have been issued on Bitcoin in just a few weeks since the BRC-20 standard was first introduced.

However, the Ethereumization of Bitcoin does not imply that it is losing its unique identity. NFTs minted on the Bitcoin network are more decentralized than those on Ethereum.

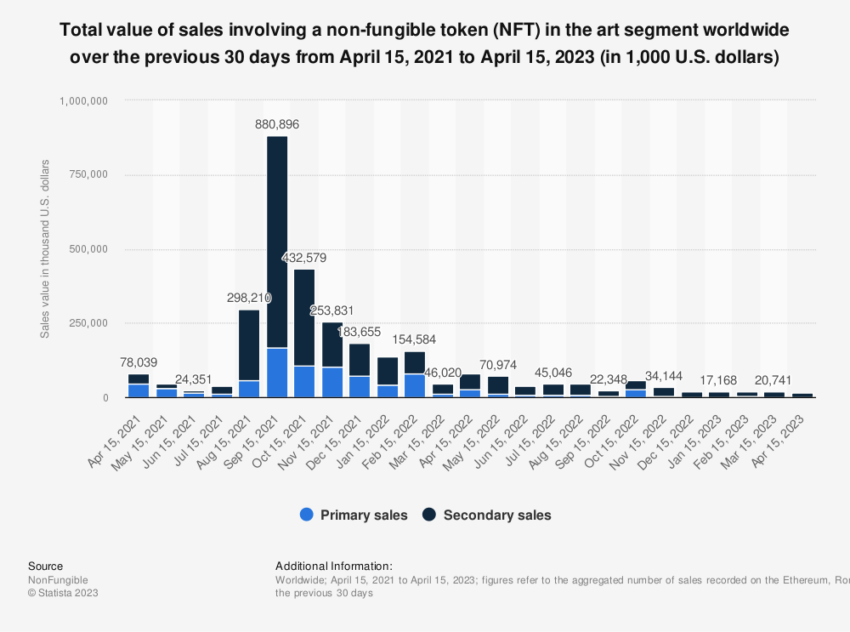

NFT Sales Worldwide. Source: Statista

While Ethereum stores only metadata of NFTs on-chain, Bitcoin NFTs are completely stored on the chain, making them closer to the essence of non-fungible tokens. This advantage may pose a significant challenge to Ethereum’s NFT market, which has recently been experiencing a decline.

The BRC-20 Effect: Transaction Fees Skyrocket

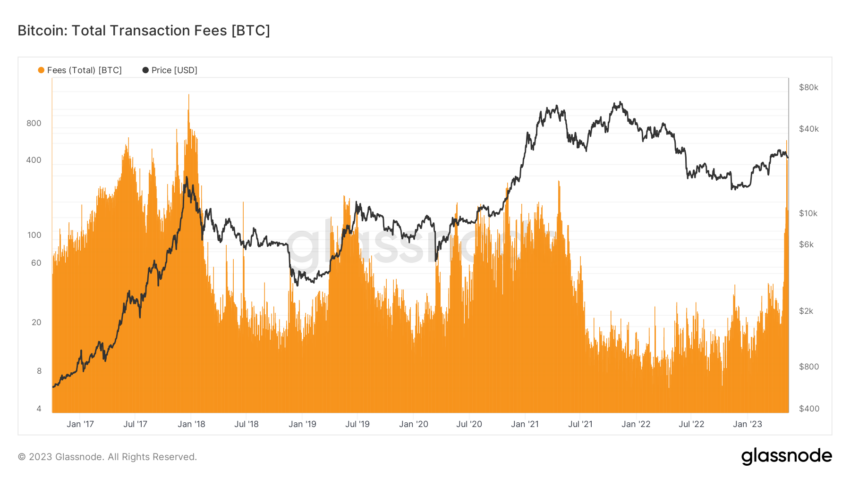

The BRC-20 phenomenon has sparked significant activity on the Bitcoin network, pushing transaction fees to their highest levels since 2018.

The new token standard has instigated intense bidding wars, leading to block rewards exceeding 12.5 BTC. This has resulted in a substantial payday for Bitcoin miners, with transaction fees forming a significant portion of their block rewards.

Interestingly, the BRC-20 token standard has created a “first come, first mint” mentality among users, increasing competition and high transaction fees. This has brought about a scenario reminiscent of the transaction bidding wars that overwhelmed Ethereum in 2021 and 2022.

Bitcoin Transaction Fees in BTC. Source: Glassnode

As the BRC-20 protocol gains traction, ignoring the Bitcoin network’s scaling issues is impossible.

With average transaction fees against the US dollar soaring to a 2-year high of $30.15 on May 8, 2023, up from a steady $2 since July 2021, the problem is clear.

The fee surge has led to the consideration of controversial measures such as censoring BRC-20 tokens and other assets based on the “ordinals” issuance method.

Bitcoin Transaction Fees in USD. Source: BitInfoCharts

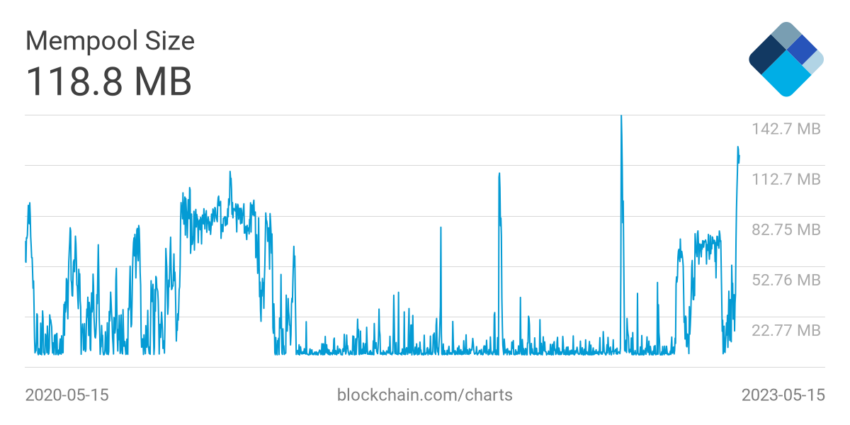

The design of BRC-20 tokens has also contributed to increased blockspace congestion. These tokens, stored in JSON format, consume more blockspace due to their larger size, inundating the mempool – where transactions wait for validation and are ordered based on the attached fee bid.

Data reveals that the Bitcoin mempool is currently experiencing unprecedented congestion. The last major peak in April 2021 saw 200,000 transactions waiting in line, but recently it surged to 450,000 transactions.

Colin Harper, Head of Research and Content at Luxor Technologies, maintains this issue can be mitigated by storing BRC-20 tokens as binary code instead of JSON files. The initiative could potentially reduce bandwidth usage by up to 80%.

Bitcoin Mempool Size. Source: Blockchain.com

While the narrative around BRC-20 issuance has been heated, Michael Saylor, former CEO of MicroStrategy, has declared their emergence “bullish.”

“What happened with Ordinals and NFTs is we crossed this chasm from what was a bearish scenario to a bullish scenario. If I was a miner, I would be ecstatic,” said Saylor.

Still, an underlying issue is at play: Bitcoin is struggling to scale.

Bitcoin’s Ethereum-Like Features: The Good, the Bad, and the Ugly

Bitcoin’s “Ethereumization” through the BRC-20 protocol has pros and cons. For instance:

- On the positive side, it extends Bitcoin’s utility beyond a simple store of value and a medium of exchange. It allows for the creation of complex decentralized applications, smart contracts, and tokens. This could potentially draw a wider audience to the Bitcoin network and increase the overall value and utility of the ecosystem.

- On the downside, the introduction of BRC-20 tokens and the subsequent surge in transaction volume has strained the Bitcoin network. This has led to higher transaction fees and slower transaction times, negatively impacting the user experience. However, these issues are not inherent flaws of the BRC-20 protocol but symptoms of the Bitcoin network’s broader scaling issues.

From a broader perspective, this phenomenon highlights the growing pains associated with expanding the functionality of Bitcoin. While Ethereum has long faced similar scaling challenges, the Ethereum community has made significant strides toward addressing these issues through strategies like sharding and Layer 2 solutions.

For example, the transition of Ethereum to Ethereum 2.0 aims to increase the network’s scalability and efficiency significantly.

For Bitcoin to continue its evolution and adoption, it will likely need to adopt similar solutions. This could involve Layer 2 solutions like the Lightning Network, allowing faster and cheaper transactions by moving them off-chain.

There are also potential improvements within the BRC-20 protocol itself, which could decrease the size of token transactions and alleviate some network congestion.