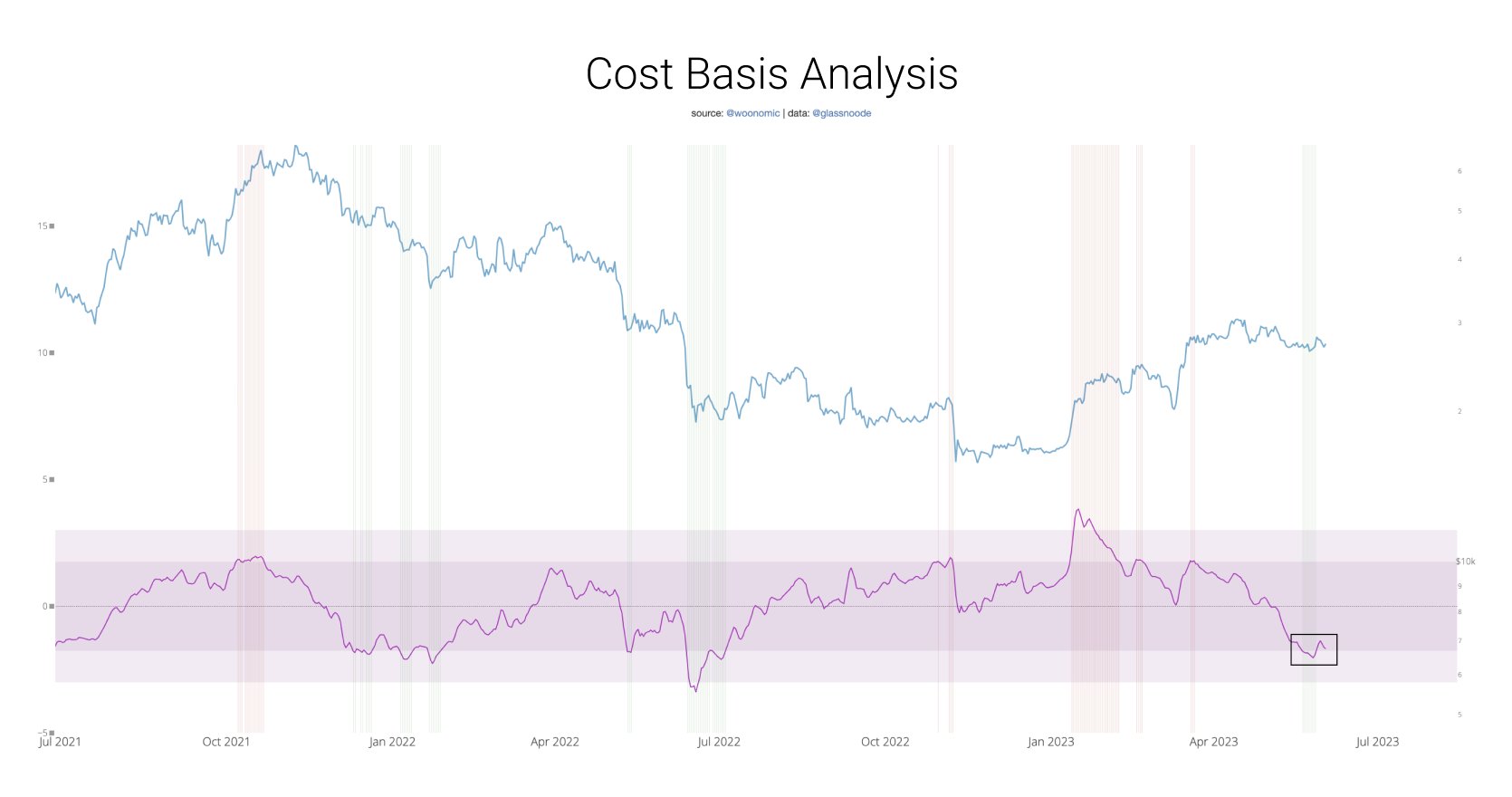

Widely followed on-chain analyst Willy Woo recently stated that one signal is pointing toward a possible burst to the upside for Bitcoin (BTC) this month. In a tweet to his one million followers, Woo explained that the cost-basis analysis of Bitcoin is hinting at an upcoming rally for the top crypto asset by market cap in the month of June.

The cost-basis is the price paid by investors to purchase an asset, which in this case is Bitcoin. According to Woo, the cost basis analysis shows an upside that looks better than the downside. He noted that summer months are typically flat or bearish for the cryptocurrency, but every June inside the re-accumulation phase has been bullish. He believes that there is a window for BTC to rip in June, with his educated guess being a week away for the opportunity to open.

Source: Willy Woo/Twitter

Meanwhile, Glassnode founders Jan Happel and Yann Allemann assert that those currently attempting to short BTC are “desperate” and that their time would better be spent focusing on artificial intelligence (AI) and liquid staking derivative (LSD) altcoins. They argue that looking for more reasons to short BTC is a sign of desperation and that focusing on AI and LSD alts would be a better use of time.

In a Swissblock post, Happel and Allemann shared their anticipation of BTC shooting up to a $30,000 price tag after it stayed within the previously predicted range of between $26,000 and $27,500. They noted that amidst numerous potential catalysts, such as the resolution of the U.S. debt ceiling and significant data releases, Bitcoin successfully held within the anticipated range. Presently, the market sentiment is favoring optimism, and risk perception has lessened. However, they are still awaiting an increase in market participation and momentum to propel the cryptocurrency toward the $30,000 target.

At the time of writing, Bitcoin is trading for $27,093, exhibiting a fractional decrease over the last 24 hours.

As the largest and most valuable cryptocurrency, it is not surprising that Bitcoin continues to draw attention from investors and analysts alike. The month of June is considered to be particularly important in the cryptocurrency’s history, as it signals the beginning of a new cycle. In recent years, this cycle has coincided with significant price gains for the digital asset.

There is no denying that the overall market sentiment for Bitcoin remains positive, with many bullish investors and analysts continuing to express their confidence in the cryptocurrency. As we move into the second half of 2021, it remains to be seen whether this optimism will translate into a continuation of the upward price trend we have witnessed thus far.

In conclusion, the crypto market and its investors are eagerly awaiting the next phase of Bitcoin’s growth. With analysts like Willy Woo and Glassnode founders Jan Happel and Yann Allemann providing positive outlooks for the cryptocurrency, it appears that the stage is set for continued success. However, in the ever-changing world of cryptocurrency, it is essential to remain cautious and closely monitor developments, as the market can change direction in an instant.

To capitalize on these potential gains, investors must stay informed and be prepared to react quickly when new information becomes available. While there is no guarantee that Bitcoin will indeed experience an uptrend this month, it is essential to be prepared for any eventuality. By staying informed and keeping a close eye on the market, investors can optimize their chances of success and protect their assets in the volatile world of cryptocurrency.