Strong Inflows into Crypto Asset Management Products for Second Consecutive Week

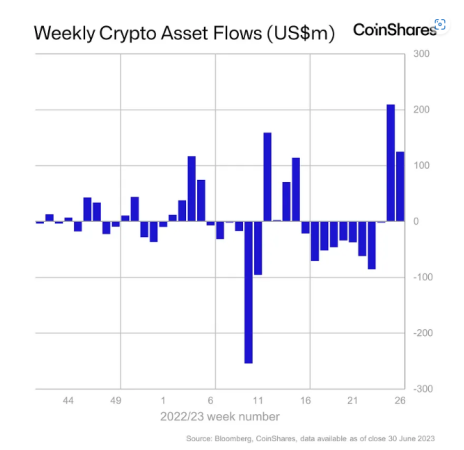

The crypto asset management industry is witnessing a strong inflow for two consecutive weeks, as reported by CoinShares, a European based asset manager. According to the report, $125 million flowed into the industry last week, signaling strong investor interest in these financial products.

Total Inflows Over the Past Two Weeks

The inflow reported in the last week is not an isolated event. The total inflow into crypto asset management products over the past two weeks amounted to $334 million, reflecting a strong bullish sentiment in the sector.

| Week | Inflows into Crypto Asset Management Products |

|---|---|

| 1 | $125 million |

| 2 | $209 million |

| Total | $334 million |

Source: CoinShares

Dominance of Bitcoin Investment Products

According to the CoinShares report, Bitcoin investment products accounted for the vast majority of inflows, securing more than 98% of the total funds. This highlights the dominance of Bitcoin, the largest cryptocurrency by market capitalization, in the world of asset management products.

Breakup of Inflows:

- Bitcoin: More than 98% of total funds

- Others: Less than 2% of total funds

Short-bitcoin Investment Products Witness Outflows

On the flip side, short-bitcoin investment products, which are designed to profit from a decline in the value of Bitcoin, witnessed outflows of $0.9 million. This shows a contrast in investor sentiment towards investing in Bitcoin and betting against it.

- Inflows: Bitcoin investment products

- Outflows: Short-bitcoin investment products

Swift Turnaround for the Sector

The past two weeks of strong inflows mark a swift turnaround for the sector, which saw several weeks of outflows until the middle of June. This turnaround can be tied to a wider rally in the market. This rally began after a flurry of filings for new spot exchange-traded funds, which are currently under review by the U.S. Securities and Exchange Commission.

- Sector witnessing outflows until mid-June.

- Swift turnaround observed with strong inflows in the last two weeks.

- Turnaround linked to the wider market rally and filings for new spot exchange-traded funds.