Introduction

Bitcoin (BTC) has remained below the $28,000 mark for ten consecutive trading days, following the losses incurred from the August 17 flash crash. In this article, we will analyze various factors, including on-chain data, to forecast potential reactions in Bitcoin’s price against bearish tailwinds in the days ahead.

August 28: BTC Price Drop and Slowing On-Chain Activity

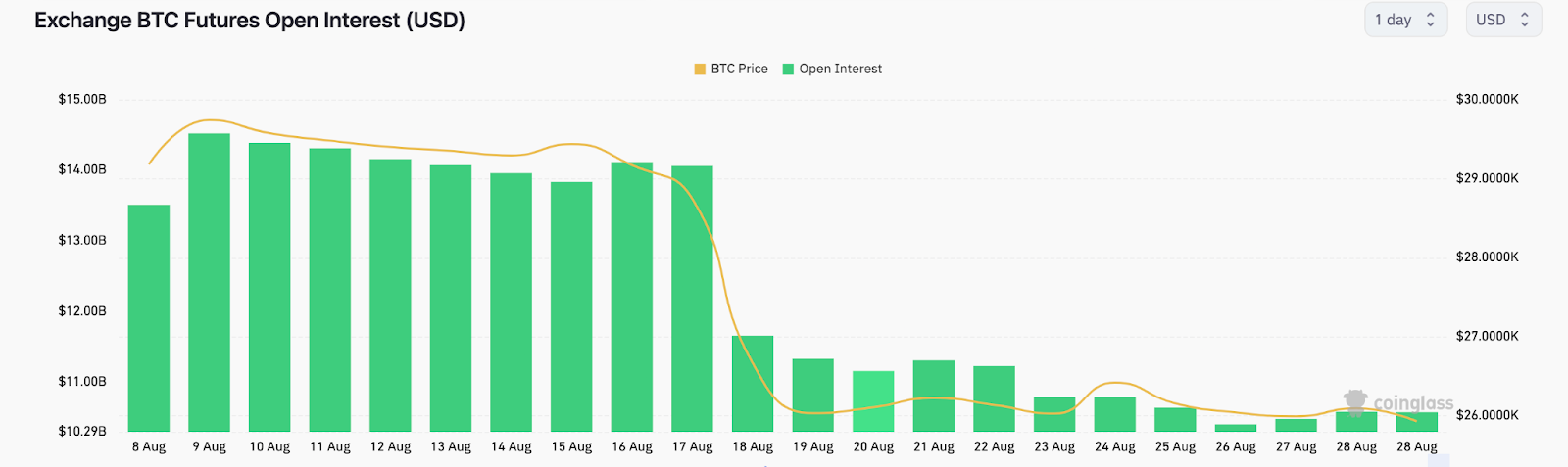

On Monday, August 28, Bitcoin’s price fell below the critical $26,000 support level. This decline coincided with slowed on-chain activity, which is a key indicator of the network’s health. Derivatives market data also suggests that trading activities in the futures market might further contribute to bearish sentiment within the BTC spot markets.

Bitcoin Retail Investors: Heading for the Exit?

-

The non-stop sideways movement of Bitcoin’s price since the sharp drop on August 17 has left many network participants disillusioned. As a result, many have decided not to engage in transactional activities.

-

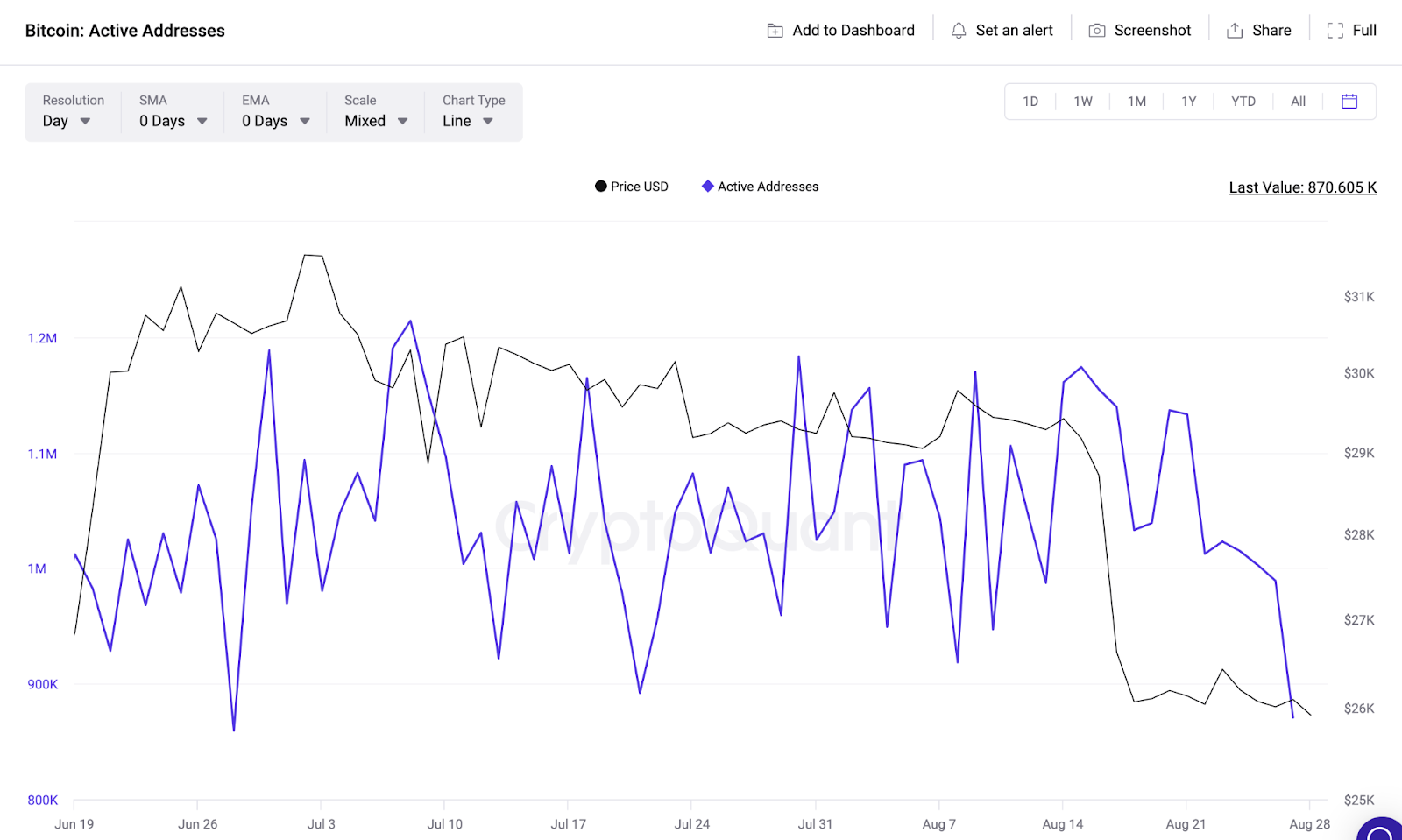

Active Addresses on the Bitcoin network have steadily declined since August 15, reaching a 36% reduction in active addresses by August 28. This decline took the number of active addresses from 1.18 million to 870,605, marking a new record low.

Active addresses are a measure of unique wallet addresses that conduct economic transactions on a blockchain network every day. A decrease in active addresses suggests underlying bearish sentiment due to falling demand for the concerned cryptocurrency. The trend in the chart shows that the number of investors utilizing BTC for transactions has continued to slide since the August 17 price drop. Notably, Bitcoin recorded fewer active users on June 28, when it fell to 859,363. If this trend persists, Bitcoin’s price may face further decreases in the upcoming days.

Increased Investor Caution as Funds into Bitcoin Markets Reach 5-Month Lows

| Market Impact Following August 17 Crash |

|---|

|

Open Interest refers to the total value of active derivative contracts for an asset. A decrease in Open Interest usually indicates a bullish sentiment due to a lack of significant capital inflows. The timing of the 33% decline in Bitcoin’s Open Interest suggests that most investors are reacting cautiously to the recent price crash and uncertainties such as the impending Fed rate announcement and lack of progress on Bitcoin ETF applications. The lack of capital flows in futures markets, combined with slowing network activity, could push Bitcoin prices below $25,000 in the upcoming days.

BTC Price Prediction: Market Liquidations May Drive BTC Below $25,000

- Evidence from the crucial indicators mentioned implies that the BTC price might fall below $25,000.

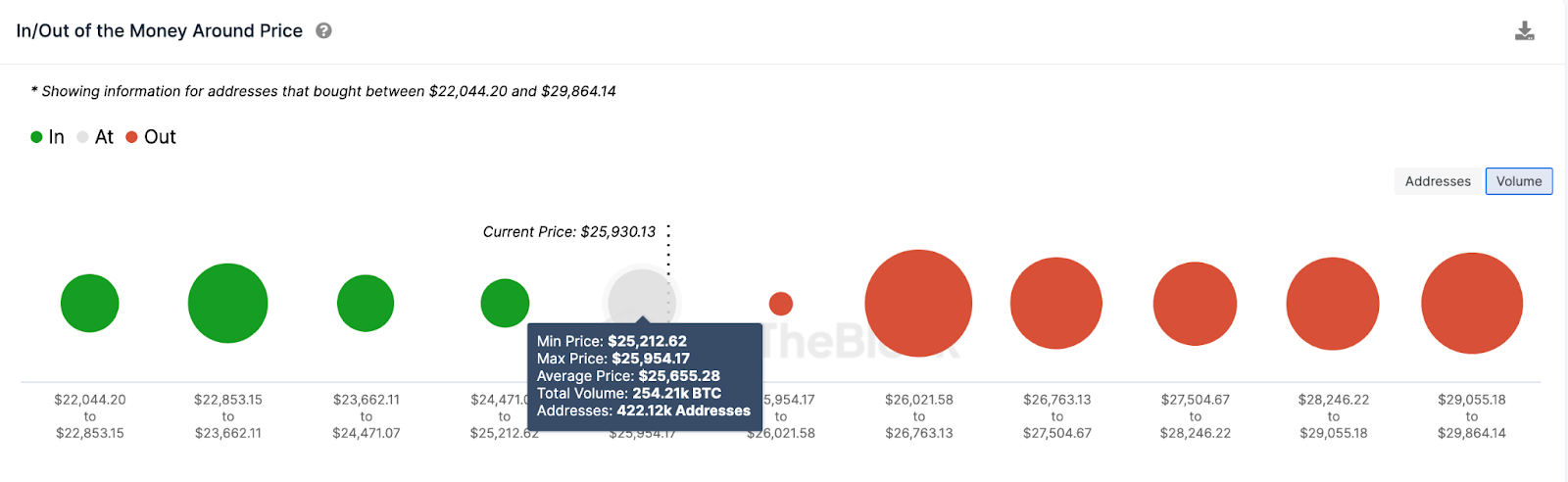

- IOMAP data, which shows the current distribution of Bitcoin holders’ entry prices, supports this prediction. The chart illustrates that 422,120 addresses purchased 254,210 BTC for a minimum price of $25,200. To avoid the risk of another wave of liquidations, the bulls might buy more BTC to cover their positions. However, if the support level breaks, it could trigger another panic sell-off trend, pushing the Bitcoin price below $25,000.

- On the other hand, if smart investors decide to buy the dip and take advantage of the bearish tailwinds, Bitcoin could breach the $29,000 mark. However, if the 3.2 million addresses that purchased 1.14 million BTC for a maximum price of $27,500 decide to close their positions early, they could initiate a pullback. If that resistance level does not hold, Bitcoin prices could reach $29,000 for the first time since early August.

In conclusion, the combination of factors such as decreasing active addresses, reduced open interest in futures markets, and potential liquidations may drive Bitcoin’s price below $25,000 in the upcoming days. However, smart investor actions and market sentiment can also affect Bitcoin’s price trajectory.