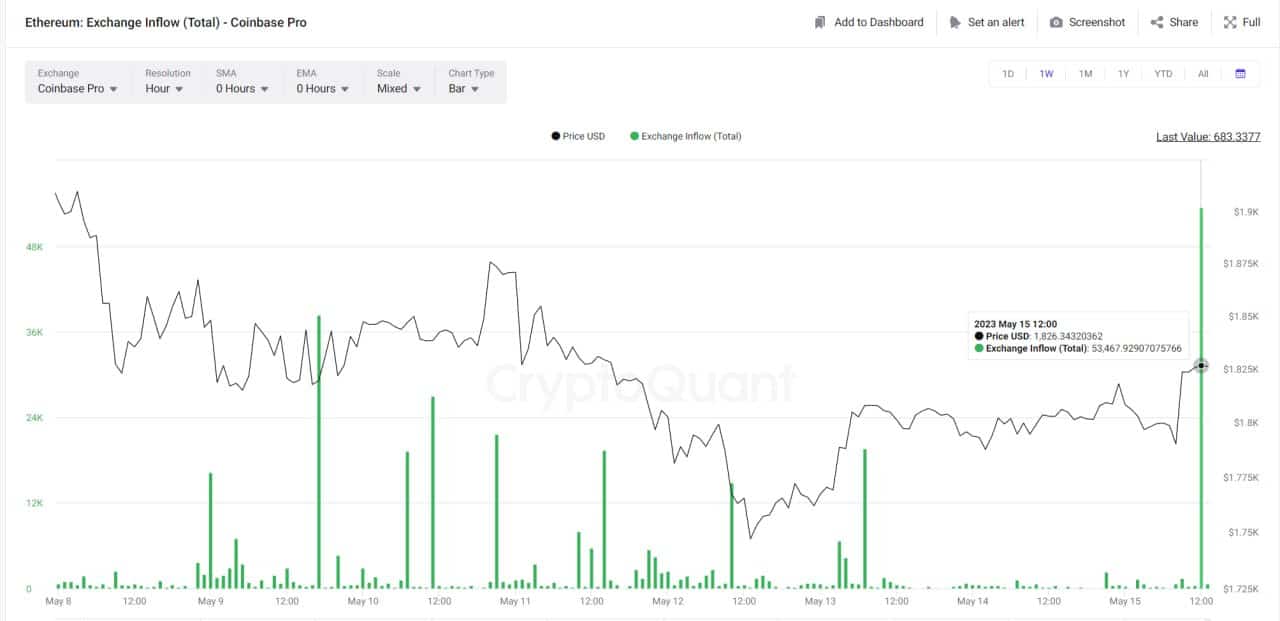

Crypto News: Coinbase’s Wrapped Staked ETH, or more commonly known as cbETH, has gained significant momentum since its launch. However, Coinbase recently received more than 53,400 ETH, out of which the majority were moved from the Coinbase’s cbETH deposit address — that may be related to the fact that ETH staking was terminated.

Coinbase Witnesses Massive ETH Inflow

On Monday, the cbETH deposit address 0xc7…a019 saw a massive withdrawal of 44,000 ETH to the Coinbase 10 wallet address, as per the data obtained from CryptoQuant. This suggests that people have been terminating their ETH staking contract, which further indicates a building sell pressure for Ethereum.

A wrapped cryptocurrency, such as cbETH, is a crypto token that symbolizes another cryptocurrency that has been “wrapped” or “locked up” in a digital smart contract. Coinbase developed the ERC-20 utility token to serve as a representation of Ethereum 2.0 (ETH2) which could be obtained by staking ETH tokens on the platform.

Read More: Over 1 Billion Hedera Tokens Set To Unlock On June 1, Major HBAR Price Drop Ahead?

Moreover, because cbETH is a liquid token, there is no lock-up time and the token may be used for additional DeFi operations such as lending, swapping, and providing liquidity — all of which can be done directly from the Coinbase Wallet.

Stakers Withdraw Rewards, Not Principal

The Shanghai upgrade made it possible for Ethereum speculators to finally withdraw their funds from the mainnet. Some individuals have been holding off on doing so ever since the staking option was initially made available in December 2020.

Since Ethereum’s long-awaited “Shapella” upgrade, most stakers and entities who have staked Ether have withdrawn incentives rather than their principal. According to TokenUnlocks, staking incentives accounted for more than 172,000 Ether, or more than 95% of withdrawals. Users who had completely stopped staking and would no longer take part in Ethereum’s consensus mechanism — which is used to arrange and confirm transactions — made up the remaining 5%, which was their initial stake.

In the wake of this crypto news, the price of ETH is currently exchanging hands at $1,826.91, which represents a gain of 1.31% over the past 24 hours, compared to a drop of 1.92% recorded over the preceding seven days.

Also Read: Bitcoin-Ether Correlation Dips Below 80% For First Time In 2 Years, What It Means?