SwirlLend: A Deep Dive into the Recent Decline in Total Value Locked (TVL)

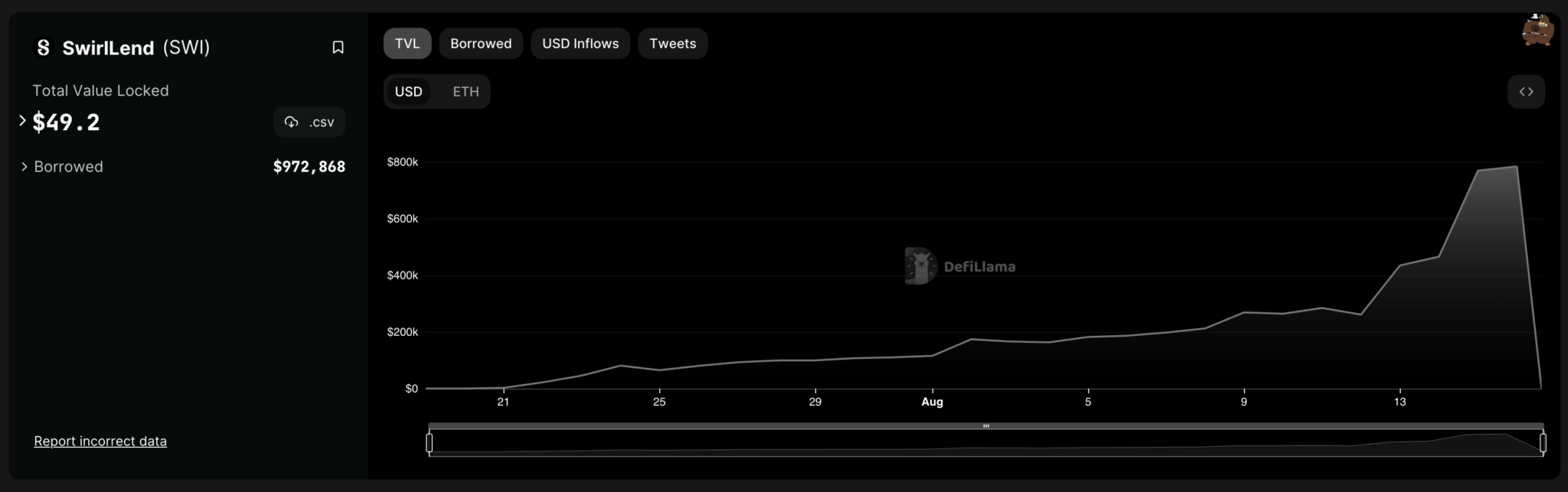

Recent data released by DeFiLlama unveiled a significant decline in the Total Value Locked (TVL) of SwirlLend. The protocol has seen its TVL drop from an impressive $784,000 to a meagre $49.2. This sharp drop coincided with the suspension of the protocol’s official Twitter account, further adding to the uncertainties.

In addition to the drastic drop in TVL, the native token of the SwirlLend protocol, SWI, has also taken a hit, with its value approaching zero.

Social Media Absence of SwirlLend

The concerns do not end with the reduction of TVL and the value of the native token. SwirlLend has also wiped its presence from various social media platforms. This unexpected move raised several questions about the intentions of the protocol.

Reported Transfer of Cryptocurrencies

Further compounding the unsettling circumstances, reports have emerged indicating that the deployer of the protocol has made substantial asset transfers. Below is a detailed breakdown of the transferred assets:

- Approximately $289.5K worth of cryptocurrencies transferred from Base to Ethereum.

- This included 140.68 ETH and 32.6K USDC.

- An additional stash of approximately 92 ETH remains on Base in their possession.

Exploitation of SwirlLend on Base and Linea

Complications have further escalated as it was discovered that SwirlLend has been exploited on both the Base and Linea platforms. Reports indicate that the attacker transferred approximately 94 ETH from Linea to Ethereum via the Orbiter Finance bridge.

Presently, the attacker’s Ethereum address is holding 165.6 ETH and 32,641 USDC. This indicates a well-executed manoeuvre by the attacker to transfer these digital assets.

This unfortunate incident marks the third attack on a Base project, further fuelling concerns about the platform’s security measures and susceptibility to phishing attempts.

Previous Related Incidents

Besides SwirlLend’s recent debacle, the Base platform has witnessed other incidents that have compromised its reputation and questioned its security infrastructure.

- Rocketswap, a decentralized exchange (DEX) on Base, recently had a breach that led to a loss of control over the platform. The breach was due to a proxy contract exploitation within the farm contract, which led to unauthorized assets transfer.

- LeetSwap, another decentralized exchange, had to cease trading operations due to a mining incident which resulted in a loss of 340 ETH for liquidity providers.

Sadly, these successive security breaches are tainting the Base ecosystem’s reputation and necessitate an in-depth review of its underlying security measures.