There has been a growing concern regarding the potential of a recession in the United States. Not only financial experts, but average citizens as well, are increasingly fearing the potential adverse consequences of a market crash.

1. Identifying the Symptoms of a Looming Recession

The fears regarding a recession have been fueled by a series of red flags that have been noticeable in the economy. With each passing day, the murmurs about the impending financial storm are getting louder, and several people have already begun experiencing the financial struggles generally associated with a recession.

Here are few indicators that typically signal an adverse economic state:

- Corporate layoffs have been more frequent. For example, Binance.US and Coinbase have reduced their staff by an unspecified number or by 2,050 employees respectively over the past year.

- Consumer spending has seen a consistent dip.

- Corporations appear to be taking significant cost-cutting measures.

These realities paint a picture of a deteriorating economy, re-affirming the fears of the American public. “As we progress through 2023 and into the following year, there will be a continuous effort to reduce costs eventually leading to more unemployment,” says Thomas Simons, a Senior Economist at Jefferies.

The potential domino effect here is that layoffs could force a pullback in consumer spending, which could further push the US economy towards a recession. Simons further adds that “due to a lack of new demand, businesses are working through backorders. The decline in demand for goods should lead to further disinflation but also more widespread job cuts in the manufacturing sector than witnessed to date.”

2. Trends Suggesting a Robust Economy

Despite the growing signs of a recession, several data points indicate a strong economy. The US has managed to maintain a reasonably low unemployment rate of 3.7%, and the performance of stock and cryptocurrency markets have been impressive.

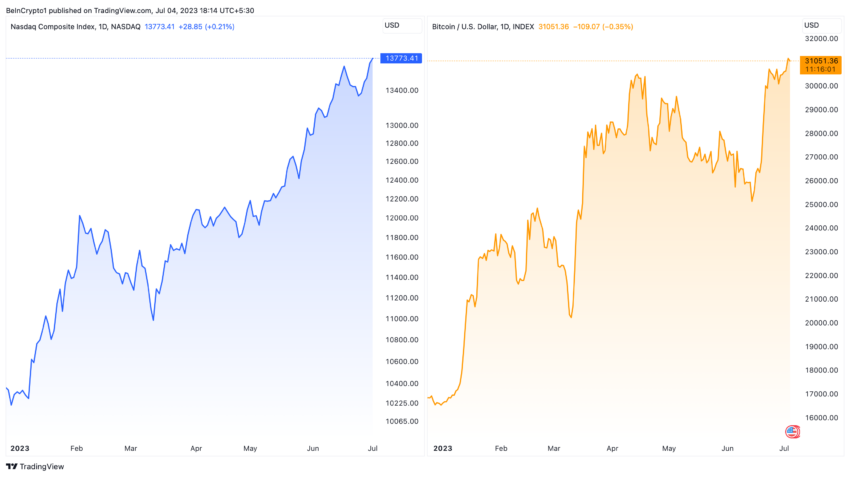

The Nasdaq Composite Index marked its best first-half performance since 1983. Simultaneously, Bitcoin ended its second consecutive month on a high, showcasing a year-to-date (YTD) positive performance of 90%.

These positive indicators have left many analysts frustrated as they believe these indexes fail to reflect the deterioration of the US economy accurately. Alex Krüger, an Economist at Asgard Markets, opines that “despite leading economics indicators moving sharply lower and consumer expectations being pessimistic, the recession has been front-run. We see no reason to change our bullish stance.”

On the other hand, despite popular unease, several other factors hint at the market’s resilience and capacity for recovery.

Nasdaq and Bitcoin YTD Performance. Source: TradingView

Conventional wisdom suggests a recession is imminent, considering the pervasiveness of key indicators such as the inverted yield curve, business surveys reflecting a negative outlook, and increasing inflation. Yet, Seth Carpenter, Chief Global Economist at Morgan Stanley, points out that such fears might be premature or overstated. He states, “The labor market is one of the key stories so far this year. There has been a clear slowing, however, the rate of job gains has been pretty strong and we think that has been contributing to resilience spending. That also means as things do cool down with the Federal Reserve rate hikes, we are just not likely to tip over into a recession.”

A YouTube video also provides some insights into this scenario.

3. Assessing the Possibility of a Market Crash

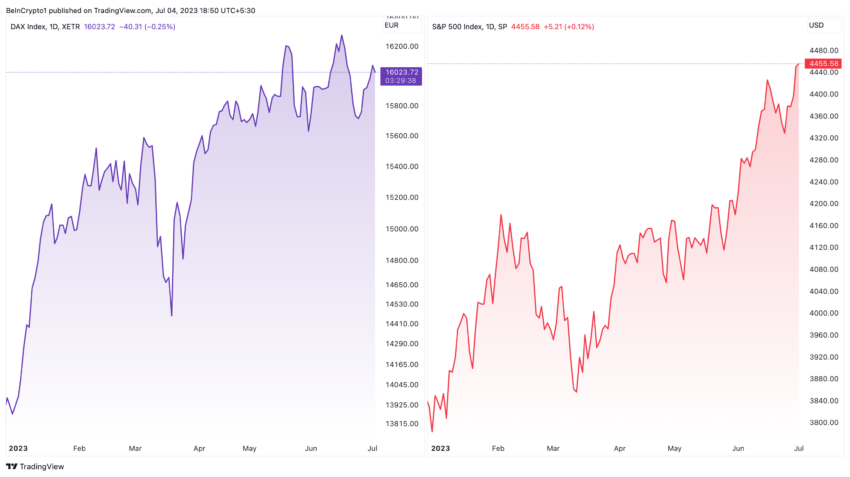

There is a common belief that stock and crypto prices must plummet during a recession. This belief is based on limited data and overlooks exceptions. For instance, the DAX Index in Germany hit record highs, defying expectations, despite the country going through a recession.

Moreover, the argument that current market valuations are highly inflated may not necessarily be accurate. It’s essential to recognize that perceptions of value can often be influenced by biases in data selection. For example, the Forward Price-to-Earnings (P/E) for the S&P 500, excluding FAANG (Facebook, Amazon, Apple, Netflix, Google), presents a different image of market pricing and calls for a more in-depth examination.

DAX and S&P 500 YTD Performance. Source: TradingView

Significantly, the market is forward-looking. It is swiftly embracing the artificial intelligence revolution reminiscent of the internet or the industrial revolution, which has the potential to enhance productivity substantially and boost global GDP, providing a counterbalance to recessionary pressures. Kassi Fetters, Financial Planner at Artica Financial Services, affirms that “the name of the game now is being okay in a constant state of adaptation, learning, and change. Investors should view AI as another tool, instead of an enemy.”

In conclusion, the market is currently cash-heavy, providing a cushion against potential market fluctuation. The record levels of cash in money market funds suggest that the financial system has ample liquidity to absorb any shocks.