Unpacking Bitcoin’s Status Following Grayscale’s Legal Victory

On August 30, the Wall Street saw Bitcoin (BTC) on a profit-taking trail towards a value of $27,000 after Grayscale, a renowned digital asset manager, comes out on top of a recent legal issue.

Figure 1: BTC/USD 1-hour chart (Source: TradingView)

General State: Low Attraction in BTC Purchasing

Data, referred from Cointelegraph Markets Pro and TradingView, testifies the Bitcoin price volatility cooling from the day before, sparked by a favorable verdict for Grayscale against the US regulators, causing BTC value to upsurge by 7.5%.

- Bitcoin reached its two weeks high by achieving $28,143 on Bitstamp before stabilizing at a lower rate.

- Despite the daily candle closing over two key moving averages, intraday support was still unsettled, leaving analysts cautious.

Funding Rate and Trading Volume Ratio

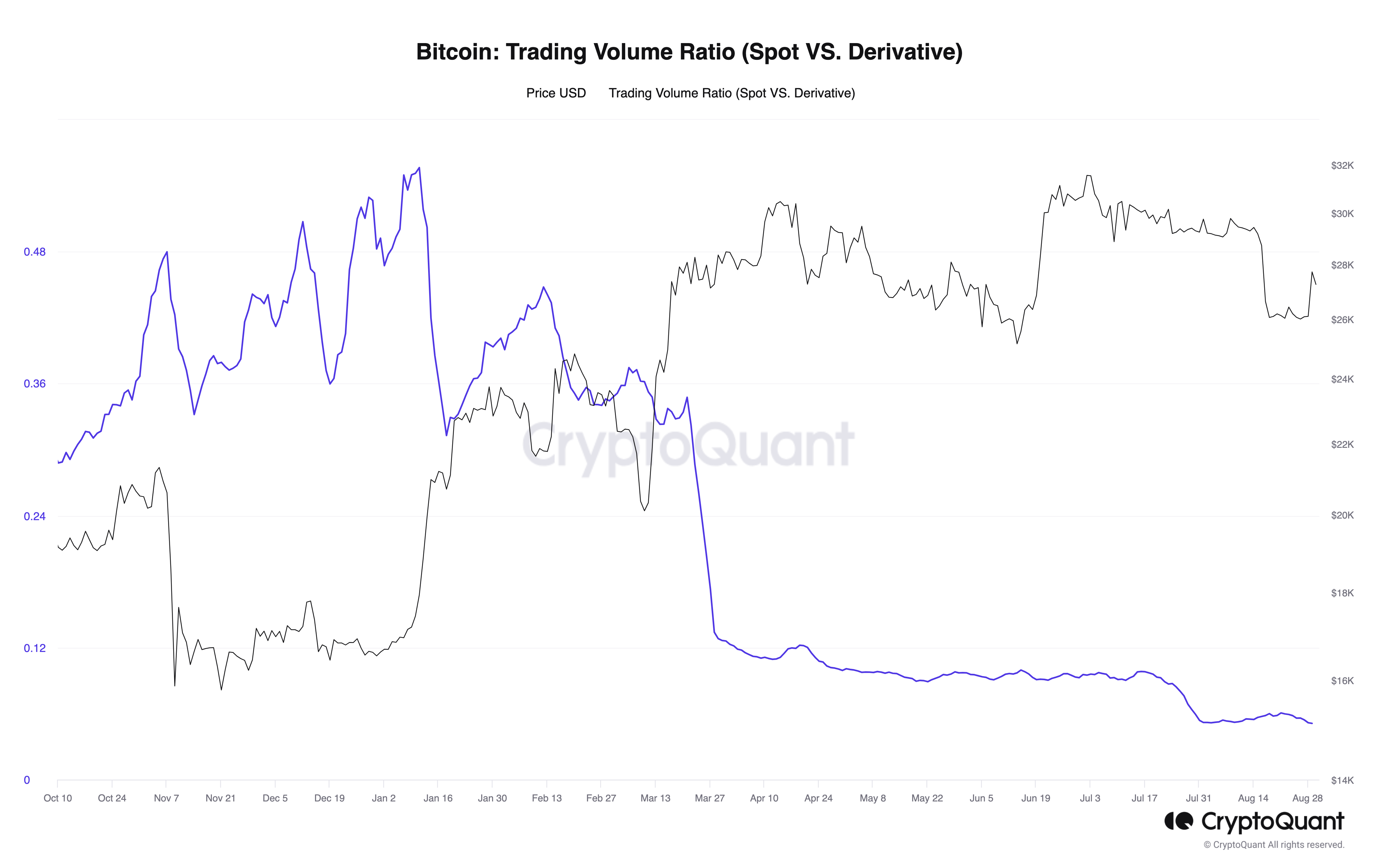

In an insightful post on the CryptoQuant platform, contributor MAC_D communicated that the jump by Grayscale originated at the derivatives exchanges. He also observed that the funding rates held fairly neutral but a noticeable lack of authentic buyer interest on spot markets.

Figure 2: Bitcoin: Trading Volume Ratio (Spot VS. Derivative) chart (Source: CryptoQuant)

The ‘Funding Rate’ analysis from MAC_D suggested:

- The funding rate is not at an extreme value, hence a sharp price correction is unexpected.

- With BTC price surge, it is tough to conclude that the spot exchange led the price hike as the ‘Trading Volume Ratio (Spot VS. Derivative)’ indicates a decrease rather than increment.

Further data reveals that trading volumes are still below those seen during the upticks earlier in 2023.

“Although there’s a tendency for prices to change significantly even with small trading volumes due to the decreased overall liquidity in the cryptocurrency market, a little caution is needed about this rally leading to a dramatic rally.”

Bitcoin Price Moves: Copying History?

Rekt Capital, a popular trader and analyst, suggests that BTC might be reproducing a move seen around its all-time high in 2021.

It is noted that no price peak for Bitcoin is assumed currently, yet the recent tops near $31,000 on the weekly chart and the subsequent breakdown resemble Bitcoin’s performance entering the 2022 bear market. This invokes caution as many similarities are seen between the 2021 double top pattern and the present situation.

If the similarities unravel themselves, BTC’s value could shift from support to resistance, triggering further downside.

Bitcoin Bottoming Perspective

A previous report from Cointelegraph outlines hypothetical benchmarks for Bitcoin’s price bottom, pointing to $23,000 as increasingly crucial. Rekt Capital also highlighted this number as critical in comparison to the 2022 bear market bottoming structure – an inverse head and shoulders pattern.

“That’s the level that we could see price rebound from.”

This comprehensive analysis doesn’t contain investment advice or recommendations. Every investment and trading move entails risk, and readers are encouraged to conduct their own research before making a decision.