Understanding the Bearish Trend in Bitcoin’s (BTC) Price Performance

Bitcoin (BTC), the globally acclaimed cryptocurrency, has been experiencing a considerable price adjustment. The cryptocurrency has been hovering around $26,000, following a significant drop from $29,000 around August 18. This price fluctuation is considered an instance of market consolidation. This stagnation came to light as a result of consistent scrutiny from regulators which suggested that Bitcoin might be entering a bearish phase.

Decreased Social Volume of BTC

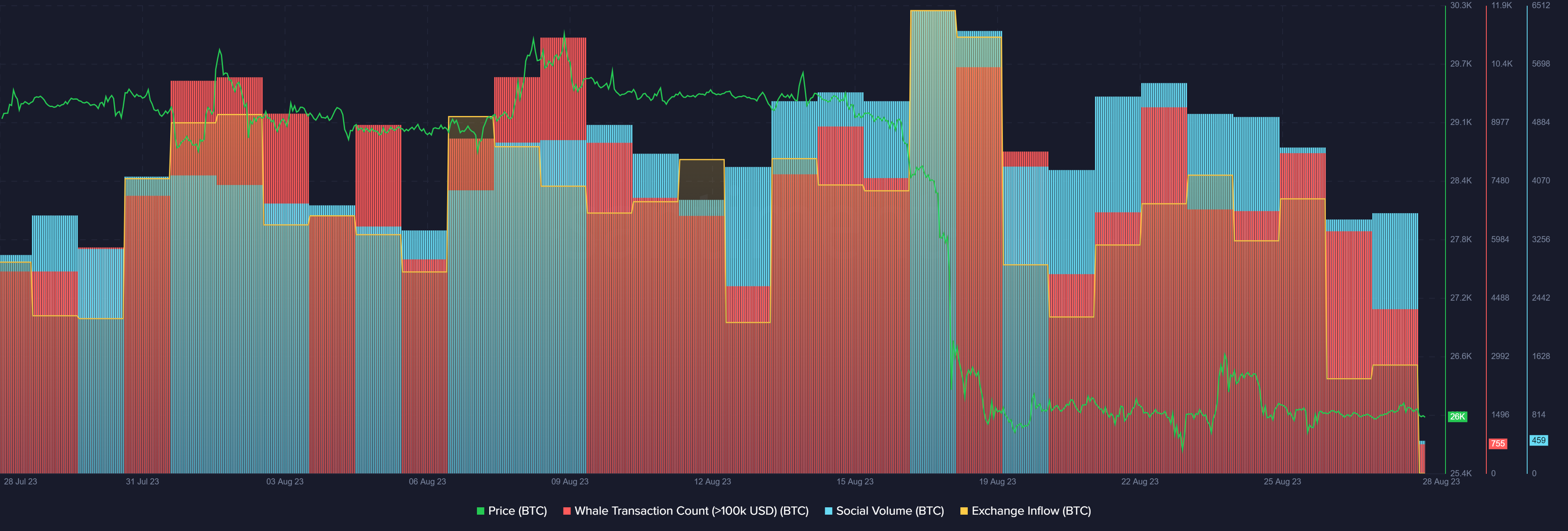

A pointed out by the renowned market intelligence platform, Santiment, Bitcoin’s social volume decreased by approximately 88% within the span of 24 hours. This significant fall took place amidst failing attempts by the digital asset to maintain a price above the crucial mark of $26,000.

Snapshot of Bitcoin’s Performance

Image: BTC price, whale activity, social volume, and exchange inflow update as of Aug. 28 | Source: Santiment

Drop in BTC Whale Transactions

In a similar manner, BTC whale transactions, which consist of transactions involving a minimum of $100,000 worth of Bitcoin, plunged from 4,210 to just 755 within a day. This denotes an 81.5% decrease according to the records maintained by the data analytics firm, Santiment.

Noteworthy Insights about Bitcoin Whales

Bitcoin whales have a profound impact on the cryptocurrency market. Discover more about who they are and the influence they exert on the market trends and conditions by exploring the following article: Meet the Whales: Bitcoin’s Biggest Holders and Their Market Influence.

Continued HODLing Among Bitcoin Investors

Even amidst the price dip, Bitcoin investors seem to be holding on to their BTC assets, with many likely aiming for a higher price in the future. This is reflected in the significant drop in BTC’s exchange inflow as per Santiment’s data.

Detailed Analysis of BTC’s Exchange Inflow

- 6,941.33 BTC entered exchanges in the past 24 hours.

- This is a 77.5% decline from the 31,075 coins that flowed in on Aug. 27.

Current Market Performance of BTC

By the end of the 24-hour evaluation period, Bitcoin had dipped by 0.5%, standing at $25,910 at the time of writing. While its market cap hovered around $504 billion, the cryptocurrency witnessed a substantial surge in 24-hour trading volume by 35%, surpassing the $8 billion mark.

Future Outlook for Bitcoin

Looking forward, the last quarter of 2023 appears to hold significance for Bitcoin as the much-anticipated halving event draws closer. An analyst with the Twitter handle Filbfilb expects Bitcoin to rise once again and enter a bull trend before the end of this year.

Extras

For more insights on Bitcoin, check out the following analysis piece: Pantera Capital: Bitcoin Could Hit $148,000 After Halving.