Federal Policymakers and Economists Weigh in on Inflation Worries

Several Federal policymakers and economists across the US are expressing concerns about the recent decline in inflation. They fear that this drop will be a short-lived phenomenon, with concerns centering on robust wage growth. The absence of a recession stirs the assumption that there will be an inevitable rebound, particularly under the circumstances of a tightening labor market on the horizon. This prospective tightening is anticipated to result in a surge of core inflation within the coming year.

The US Federal Reserve Is Expected to Hike Up Key Interest Rates Yet Again

Standing as the regulatory power presiding over monetary policy, The US Federal Reserve (FED) has a key interest rate adjustment projected for its next two-day meeting scheduled for July 25-26. The expectation is that the FED could raise the prevalent interest rates to a range of 5.25 – 5.5%. Such an increase will represent their highest level since the year 2001, (almost two decades), aligning with the overarching goal of returning inflation back to a more acceptable rate of 2%.

Inflation Trends: Overflow versus Minimal Dillution

Relative to the four-decade high inflation peak witnessed in the previous year, price growth seems to be gravitating towards normalcy. This economic atmosphere creates perceivable functional and fiscal advantages for families and businesses alike. Primarily, wages are setting the pace, growing at a faster rate than prices. This dynamic triggers intensive discussions and debates among policymakers, critically analysing the potential benefits or setbacks of further slowing down the economy.

Significant Fall in Inflation as Derived from Government Data

Government data released on 12th July highlight a significant deceleration in inflation rates. According to this data, prices underwent a mere 3% increase year-on-year in June, coupled with an only 0.2% rise from the previous year. Interestingly, this recorded increase was the smallest registered within a 12-month period since March of the previous year (2021). This data evidences substantial progress from the most recent inflation reports, where a 4% year-on-year increment was observed.

| Key categories | Month-on-month price variation |

|---|---|

| Rent | Drop |

| Used cars | Drop |

| Pork | Drop |

| Airline tickets | Stagnation (after previous surge) |

| Hotels | Stagnation (after previous surge) |

Items such as used cars, rent, and pork all experienced month-on-month price drops. Other items that witnessed drastic previous increases such as airline tickets and hotel prices are beginning to level off as demand starts returning to more regular patterns.

Wage Growth: Outpacing Inflation

For the fourth consecutive month, wages have managed to outperform inflation. BLS reports released on the same day reveal that average hourly earnings have risen 0.4% from May to June, exceeding inflation by a marginal 0.2%.

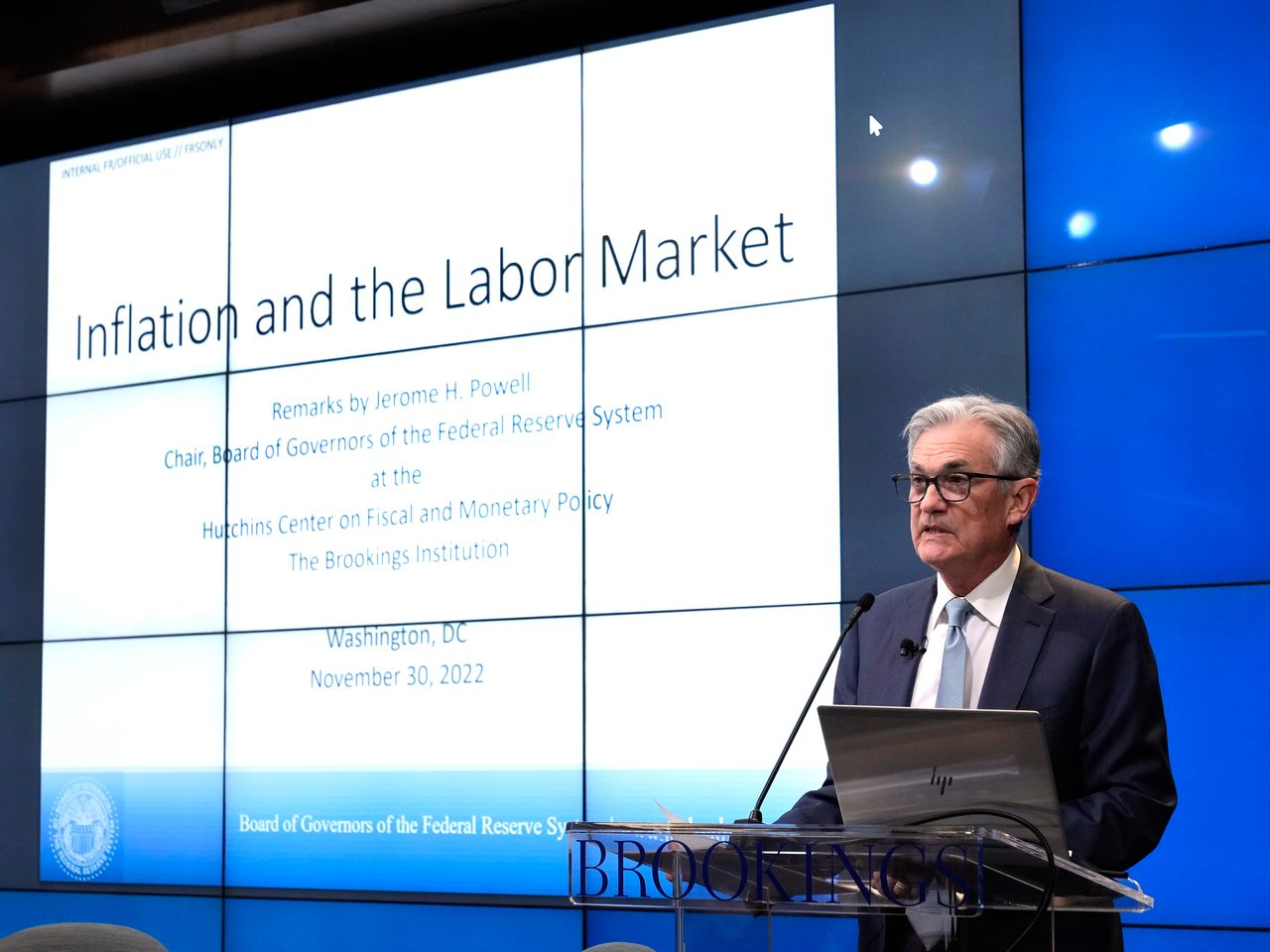

The primary rationale behind Federal Reserve Chairman Jerome Powell’s proposition for a slowdown in the labor market pivots on his increasing apprehensions about the sustainability of tight employment. His fear is that continuous wage increases could potentially trigger surging inflation rates once again. As unemployment ascends amidst this financial climate, employees lose their negotiation power for securing higher wages, leading to dampened household expenditure.

DISCLAIMER: The information contained herein is offered as general market commentary and does not include any form of investment advice. Readers are strongly urged to conduct their own due diligence and research prior to making any investment decisions.