Introduction

Investors in the cryptocurrency market are eagerly awaiting a potential breakout in the price of Cardano (ADA). While ADA has faced some challenges recently, fluctuating between the $0.25 and $0.45 range, many believe that this phase could be an opportunity for both retail and institutional investors to accumulate this highly competitive smart contracts token.

The Price Drain of ADA

Currently, ADA is experiencing a minor fall of 0.1% to $0.2895. It has an investment volume of $112 million and a market capitalization of $10 billion.

The downward trend in ADA’s price became more prevalent after reaching $0.37 in July. This drop occurred after a court ruling declared that programmatic sales of XRP were not securities.

In June, the Securities and Exchange Commission (SEC) alleged that ADA, along with 63 other cryptocurrencies such as Polygon (MATIC) and Solana (SOL), are securities. As a result, investors sought exposure to other tokens that the SEC had deemed to be operating illegally as securities. This led to a price increase for Cardano, pushing it from lows around $0.25 to a high of $0.37.

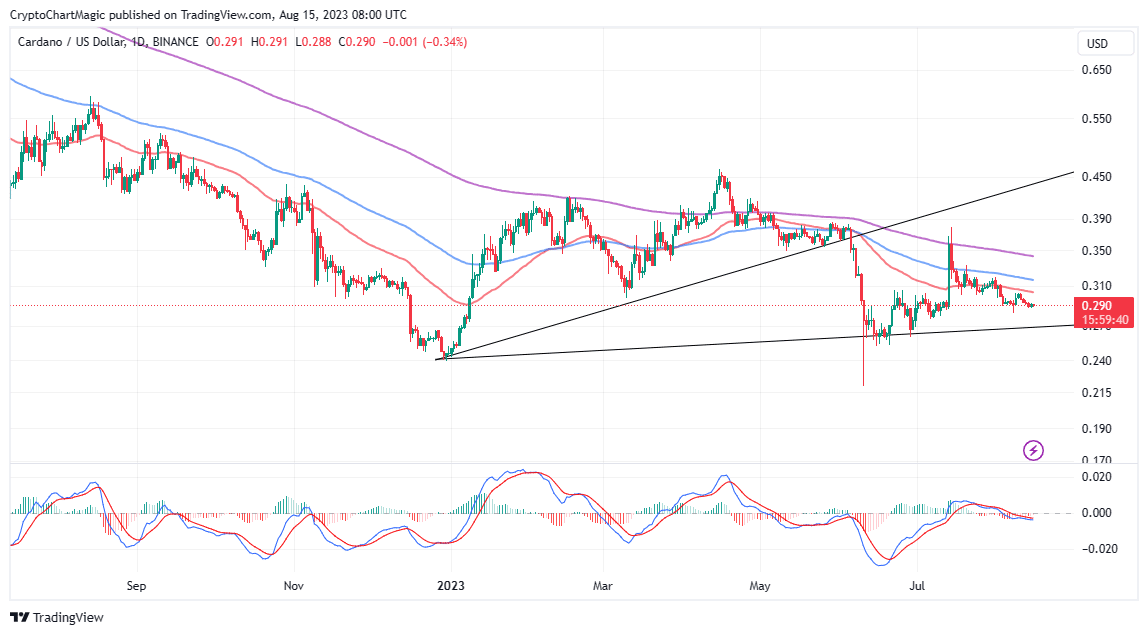

However, due to a weakened crypto market structure and a halted uptrend, Cardano has lost most of its gains and is currently trading around $0.2895. ADA is currently positioned below all three moving averages, including the 200-day Exponential Moving Average (EMA) at $0.343, the 100-day EMA at $0.316, and the 50-day EMA at $0.303. This indicates that the decline is likely to continue.

ADA/USD daily chart on Tradingview

MACD Indicator: Portending a Bearish Grip

The Moving Average Convergence Divergence (MACD) indicator is signaling a bearish trend for ADA, suggesting potential losses around $0.25.

MACD Trading

In order for the bearish trend to be confirmed, the blue MACD line must cross below the red signal line, indicating a weak market structure.

The collapse of the upper ascending trendline on the chart played a significant role in ADA’s price decline. The lower trendline, however, has provided some support. It is crucial for Cardano to stay above this trendline for a potential trend reversal.

If the price of ADA crosses below this trendline, it could further plummet to $0.25 or even $0.20.

A Bullish Phase on the Horizon for Cardano

Despite the current bearish sentiment, there is still hope for a bullish phase in the near future, particularly if ADA can rebound above the resistance level at $0.3.

If Cardano can consistently breach and stay above the 50-day EMA, it suggests that sellers are losing their grip, and buyers are preparing to push the price of ADA above $0.45, which was a significant hurdle in July.

A crypto analyst and trader named Ali has pointed out that Cardano’s price pattern seems to be following a similar oscillation between 2018 and 2020, during which ADA fluctuated between $0.10 and $0.028 for 665 days. This period of consolidation allowed investors to accumulate ADA, leading to a 2,985% bull run.

Future Predictions

Ali emphasizes the importance of patience in the crypto markets and suggests that those who are willing to wait will be rewarded. If history repeats itself, Cardano may experience a significant breakout in early 2024.

Related Topics

- Celsius Networks’ creditors decline their $2 Billion Repayment Proposal, Here’s Why.

- XRP Sideways Market Structure Prolongs – Can Short Trades Turn Profitable Again?

- Timing Bitcoin Leg Ups With Unpredicted Pumps.