An Analysis of Uniswap’s Performance in the Crypto Market

In this analysis, we explore the recent performance trends of Uniswap, a popular cryptocurrency in the Decentralised Finance (DeFi) market. This comprehensive evaluation covers its price, the behavior of large holders, also known as ‘whales’, and the overall demand for Uniswap within the DeFi market. The key takeaways from our evaluation can be summarised as follows:

- Uniswap’s price, currently trading at $4.60, experienced a bounce from the $4.47 support point after a 27% price dip in August.

- Accounts holding anywhere between 100,000 to 1 million UNI tokens added over 7 million new UNI tokens to their collection, equivalent to approximately $32 million over the course of the month.

- Demand for Uniswap seems to be declining within the DeFi market. This trend is evident from a $400 million decrease in the total value locked (TVL) on the chain.

Breaking Down Uniswap’s Price Dynamics

Uniswap had been struggling to recover from its losses in recent weeks, sparking concerns among some investors. While some retail investors are selling their Uniswap tokens to prevent further losses, whale addresses are continuing to buy and hold tokens, which could help to steady the asset’s price.

Uniswap’s Struggle for Recovery

Uniswap, trading at $4.60, is currently slightly above the support level of $4.47. Although there was an initial recovery after hitting this support level, Uniswap failed to maintain a consistent upward trajectory. The crypto asset has been unable to recover from its 27.5% drawdown observed in mid-August.

The State of Bearish Momentum

As observed through the Relative Strength Index (RSI), the bearish momentum is yet to dissipate completely, which means there is a possibility of further declines. Should the RSI value fall below the oversold zone’s threshold of 30.0, this could signal a turnaround, shifting momentum from bearish to bullish.

Figure 1: The UNI/USD 1-Day Chart.

Factors Influence Price Recovery

However, for a genuine bullish momentum to be recognized, the RSI would need to exceed the neutral zone line at 50.0. Given some investors’ propensity to sell off their tokens before a potential further price drop, it is possible that a significant price recovery may take some time.

How Whale Addresses are Influencing Uniswap’s Market

Even with the current bearish climate, large holders of Uniswap, also known as ‘whales’, have continued their accumulation of UNI tokens.

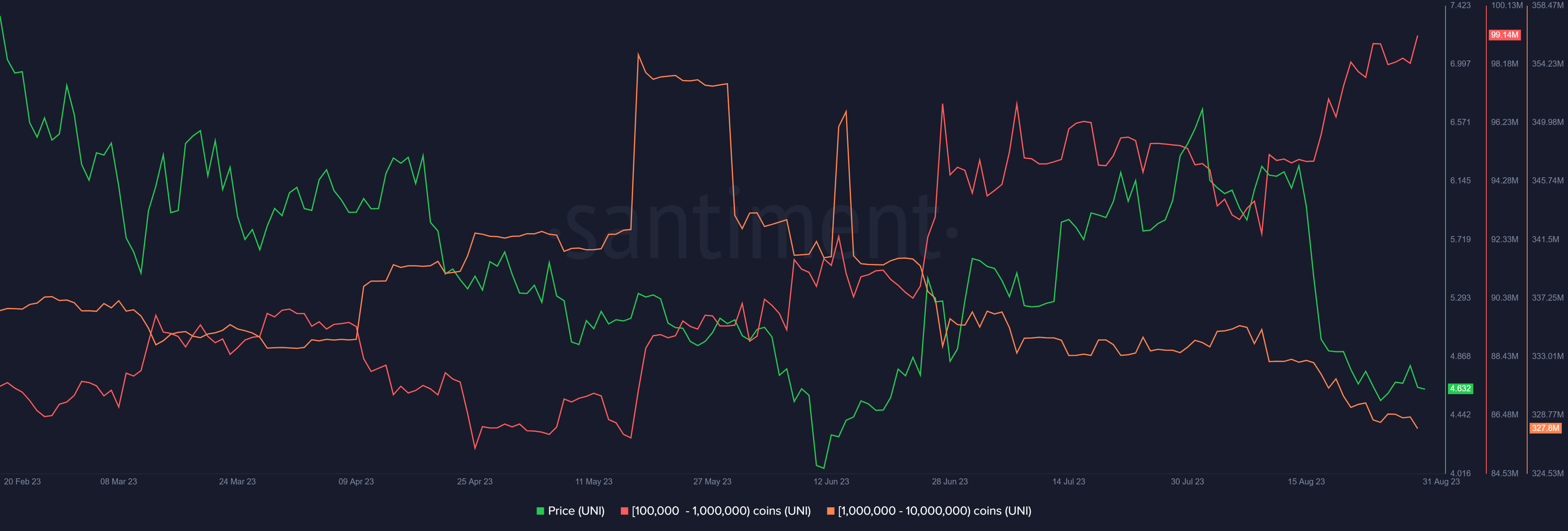

Whale Addresses and UNI Distribution

Addresses holding between 1 million to 10 million UNI tokens have reportedly sold nearly 7 million UNI since the start of September. Contrarily, addresses holding between 100,000 UNI to 1 million UNI have increased their holdings by approximately the same amount, bringing their total UNI holdings up to 99 million from 92 million earlier.

Figure 2: Distribution of Uniswap Supply

Possible Market Impact

Due to the significant influence large holders have on the market sentiment and price action, their continuous accumulation could prevent Uniswap’s price from falling below the $4.47 support line. If these ‘whale’ addresses continue to accumulate UNI tokens, this could turn the tide in favor of Uniswap, potentially triggering a rise in price.

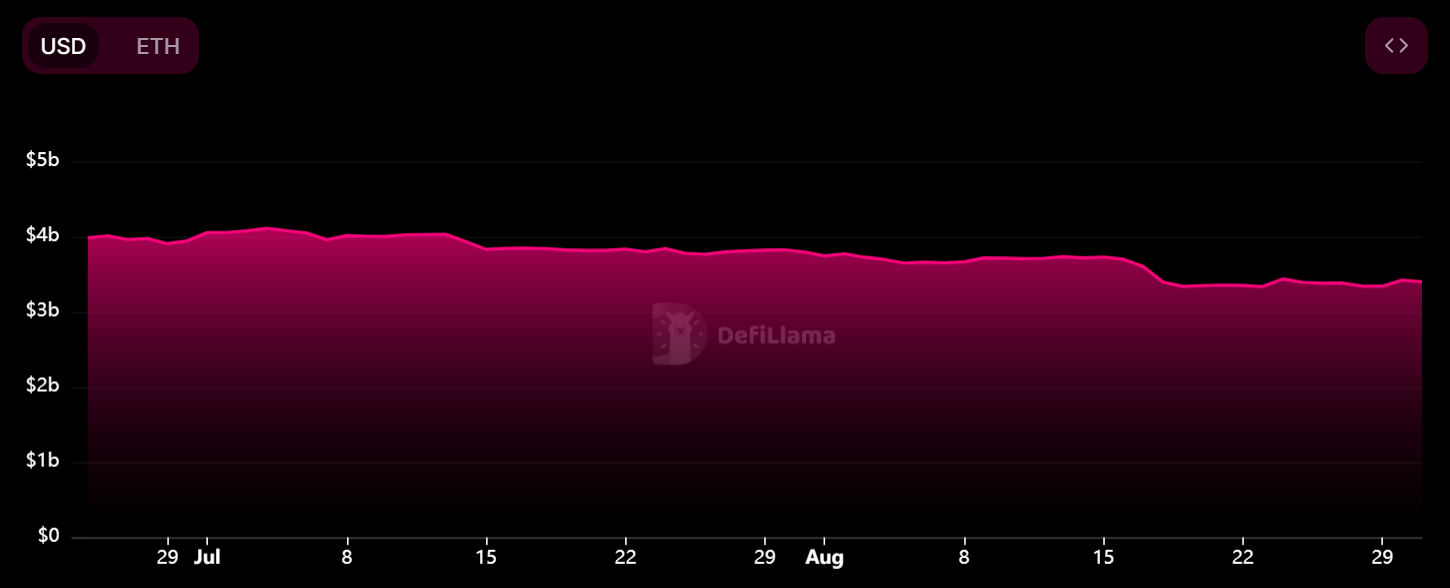

Overall Performance in the DeFi Market

Despite the resilience displayed by some whale addresses, the protocol is facing challenges within the broader Decentralized Finance (DeFi) market. The Total Value Locked (TVL) on the chain has been consistently decreasing for some months now, with a significant $400 million decline recorded in August.

Figure 3: Uniswap’s Total Value Locked.

The possibility of further drawdown for Uniswap cannot be ruled out completely due to these factors, despite the efforts of ‘whale’ addresses accumulating tokens.