Bitcoin Bull Predicts Continuous Upward Trend

A popular cryptocurrency analyst has recently voiced his optimism for Bitcoin’s (BTC) prospects despite last week’s major price nosedive. The analyst continues to claim that the Bitcoin market is on course for a significant bull cycle.

Who is the Analyst?

The individual in question goes by the pseudonym Dave the Wave and operates on a social media platform referred to here as ‘Platform X’. The analyst boasts a significant online presence with a following of over 139,700 loyal followers who trust his predictions and keen discernment of the crypto market.

Dave’s Analysis of Price Indicators

Dave the Wave explained that short-term indicators are not the most dependable for predicting Bitcoin’s price trajectory, more so bearing in mind the current state of the crypto market.

- His take is that broader indicators of Bitcoin’s price patterns show the bull market cycle is holding shape even though it recently crashed through crucial support levels, descending to the $25,000 bracket.

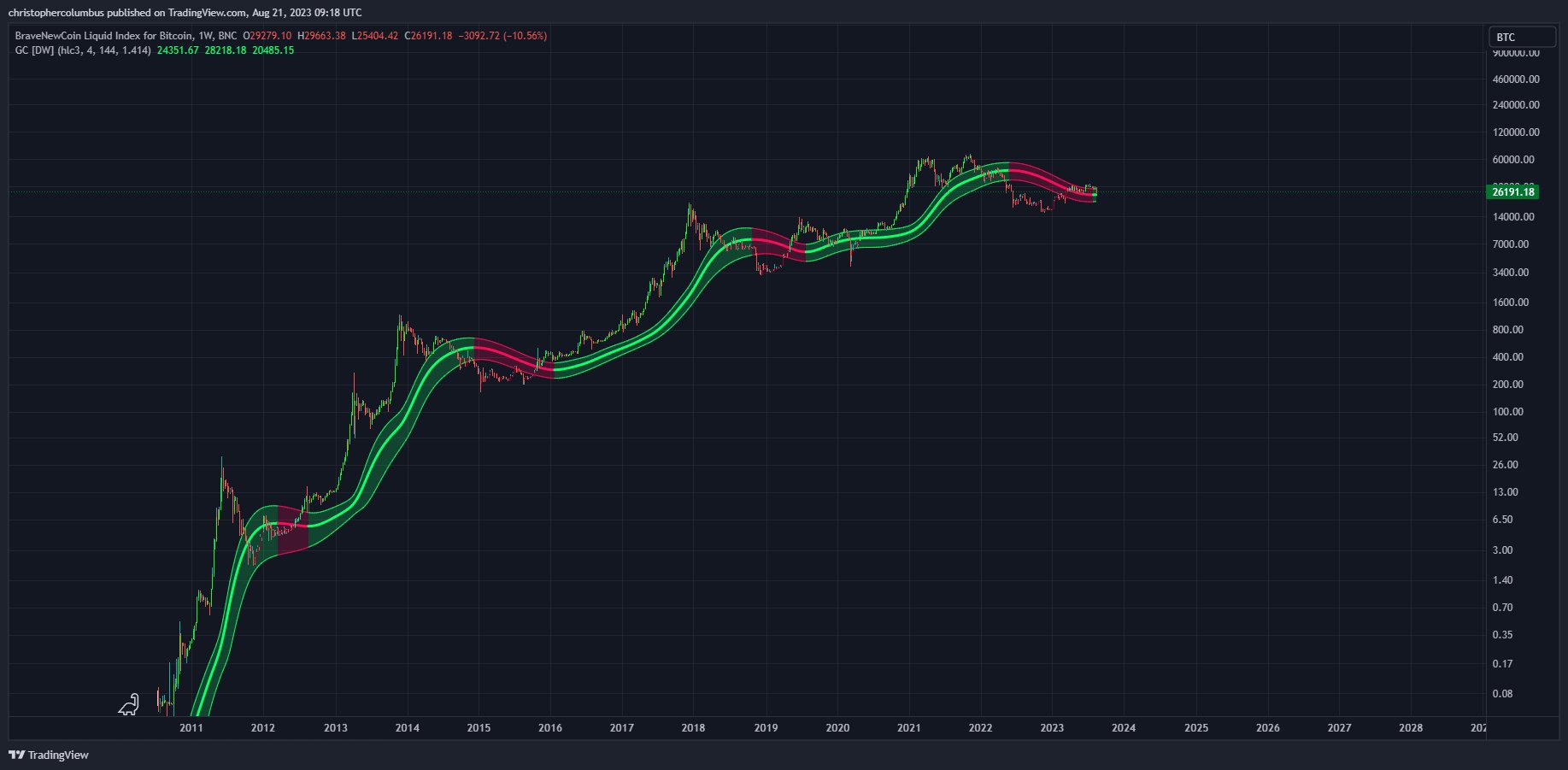

- He has developed his unique version of logarithmic growth curves (LGC), that aims to predict Bitcoin’s macro peaks and troughs while filtering out mid-term volatility and noise.

- Additionally, he uses the Gaussian channels, which are momentum indicators used to identify price tops and bottoms.

“Beware the shorter-term indicators that might suggest that support for a BTC ‘bull market’ has been lost. Price is right where it should be in terms of the LGC, the Gaussian channel, and in terms of a normal consolidation after a solid run up.”

Images Sourced from Dave the Wave/X

BTC Prices and the 200-Week Moving Average

Despite the general belief in the 200-week moving average (MA) as a major price support level indicator for Bitcoin, the analyst thinks otherwise. He thinks this metric will lose significance as the market matures.

“As outlined at an earlier date, a BTC metric such as the [200-week MA] becomes less significant as technical support as the market matures.”

The analyst had previously stated,

“Why would the Bitcoin [200-week MA] remain a support of price? If the macro trend is one of reducing volatility and diminishing returns, then it would eventually become a *mean* of price… with price oscillating around it.”

Evaluated Entry Point for Ethereum (ETH)

Furthermore, Dave the Wave also revealed his plans to find an entry point to the smart contract platform – Ethereum (ETH).

- He predicts ETH is following an upward trend based on the weekly Gaussian analysis.

- His last position in trading turned out pretty decent, and he is hopeful for another one, this time with lesser volatility.

“Waiting and watching. Weekly Gaussian about to turn up on ETH/ USD. My last position trade turned out not too shabby. Looking for another. Less volatile this time around.”

Ethereum Market Status

At the moment when the report was being written, Ethereum was trading at $1,654, showing a minor decrease of 0.1% in the last 24 hours.

Generated Image: Midjourney