Glassnode Co-founders Predict Possible Bitcoin Bottom Scenarios Following Market Downturn

The co-founders of the crypto analytics firm Glassnode, Jan Happel and Yann Allemann, often known together as the Negentropic handle, have shared their insights on possible scenarios for bottom formation of Bitcoin (BTC) following the recent market downturn. They recently communicated their predictions to their 56,000 followers on X platform.

Bitcoin’s possible local bottom scenarios

| Scenario | Description |

|---|---|

| 1. Gradual drop to $25,000 range | Bitcoin price could experience a slow and steady decline until it reaches the range of $24,800 and $25,000. |

| 2. Severe liquidation event followed by bottoming out | Alternatively, Bitcoin may witness a fast, aggressive wick that quickly leads to a rapid buy up resulting in a bottom formation. |

These predictions have taken into account past instances where similar scenarios played out each time the Bitcoin Risk Signal hit a value of 100.

Source: Negentropic/X

Analysing the above chart, it appears that Bitcoin typically experiences a corrective movement whenever the Risk Signal hits the value of 100.

Insights from Pseudonymous Crypto Strategist, Rekt Capital

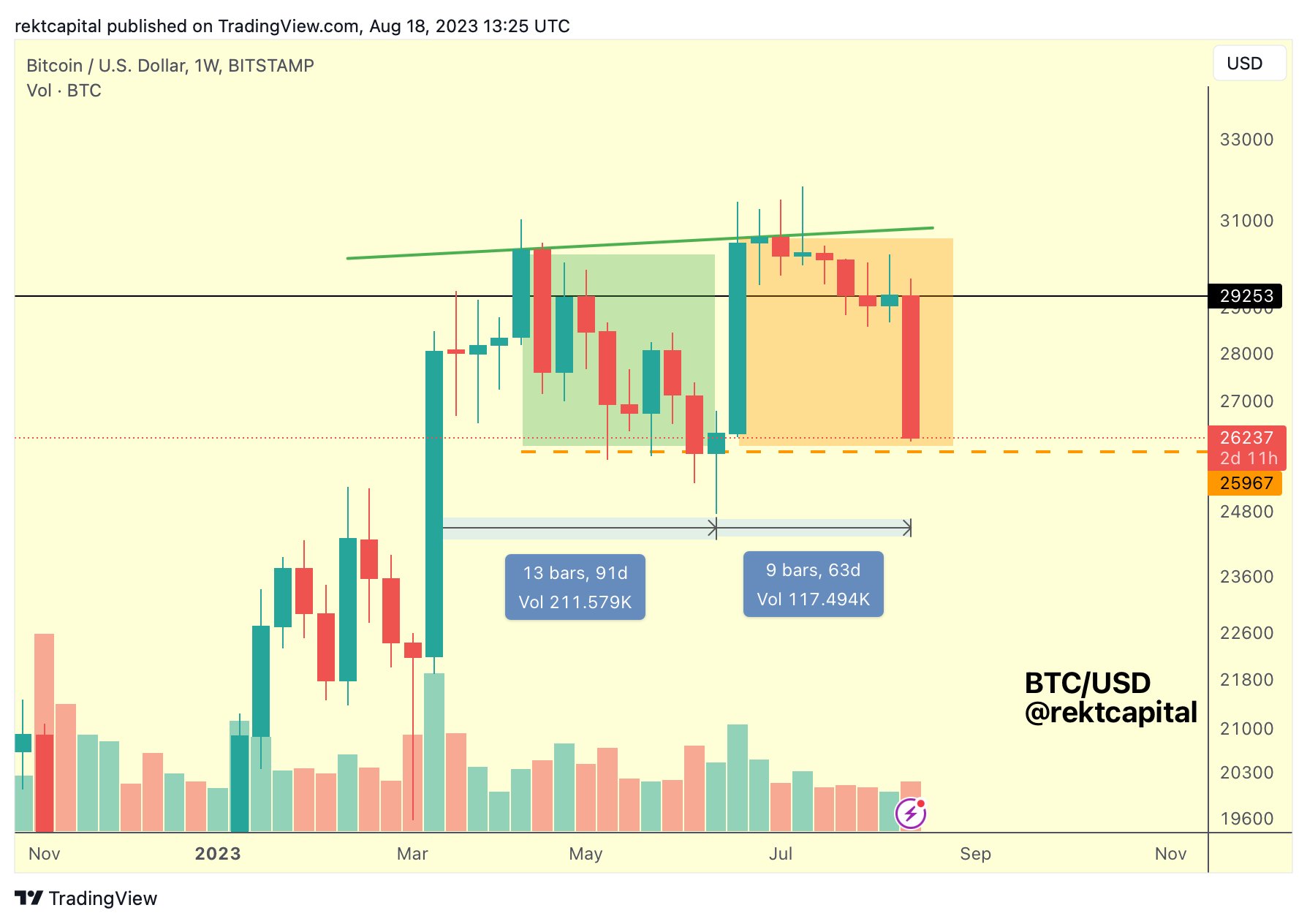

In addition to the projections from Glassnode’s co-founders, Pseudonymous crypto strategist Rekt Capital has also shared his observations. According to Rekt Capital, after printing a bearish double-top pattern, Bitcoin appears weak.

- The first half of the double top took 91 days to form.

- The second half of the double top took only 63 days to form.

Key observations from Rekt Capital’s analysis include:

- The first half dropped in price in a step-by-step manner, gradually breaking potential supports (example provided in the green box).

- The recent crash did not show any respect for any possible supports on its way down, as showcased in the orange box.

- There was no evident reaction, demonstrating the weakness of buy-side pressure in the orange-boxed region.

- Current volume levels suggest that the seller pressure peak hasn’t been reached yet.

Source: Rekt Capital/X

At the time of writing this article, Bitcoin is being traded at $26,028, experiencing a decrease of 2.3% in the last 24 hours.

Generated Image: Midjourney