Bitcoin’s Future, according to Fidelity Investments’ Global Macro Director

Director of Global Macro at Fidelity Investments, Jurrien Timmer, issued a warning in a recent analysis on Bitcoin’s (BTC) future. Citing two primary factors, Timmer indicated that the king of cryptocurrencies might face some constraints in its upward price movement. The reasons behind this prediction are the current rate of Bitcoin adoption and fluctuations in high interest rates.

| Key Factors | Description |

|---|---|

| Bitcoin’s Adoption Rate | Continuity and speed of mass adoption |

| Interest Rates | Current high and variable interest rates |

Analysis Excerpts

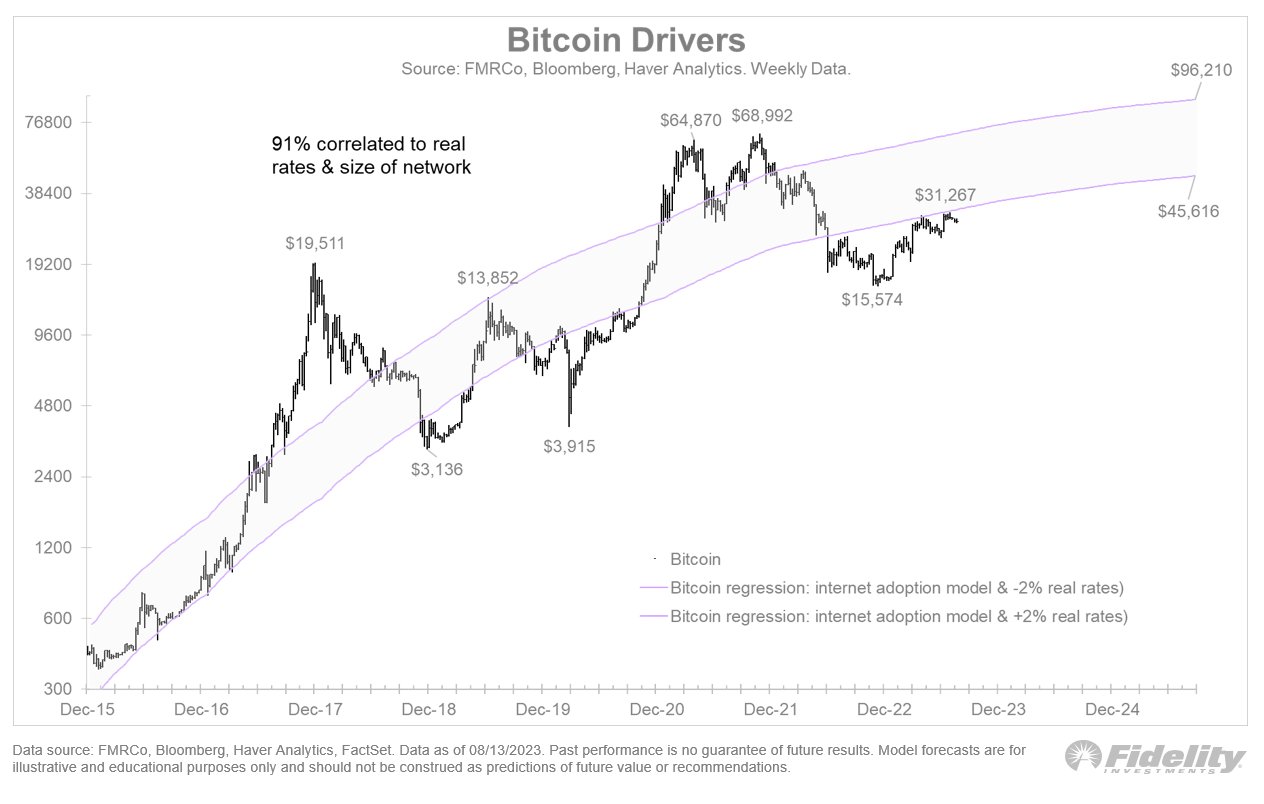

Using his Twitter account followed by over 167,000 users, Timmer laid out the prospects for Bitcoin. He shared a hypothesis that these factors could sustain Bitcoin within the values around $45,000 in 2023 and most of 2024.

“What’s next for Bitcoin? If real rates remain at +2%, and the adoption curve continues to grow in line with internet adoption a few decades ago, then the upside seems somewhat limited for now.”

Source: Jurrien Timmer/X

Potential Upside And Downside For Bitcoin

Timmer’s chart predicts that Bitcoin could move up to $45,616 towards the end of 2023. Alternatively, the chart also indicated the possibility of Bitcoin hitting a high of $96,210 before the end of 2024, if there is a decrease in interest rates. The figures are speculative and dependent on market conditions.

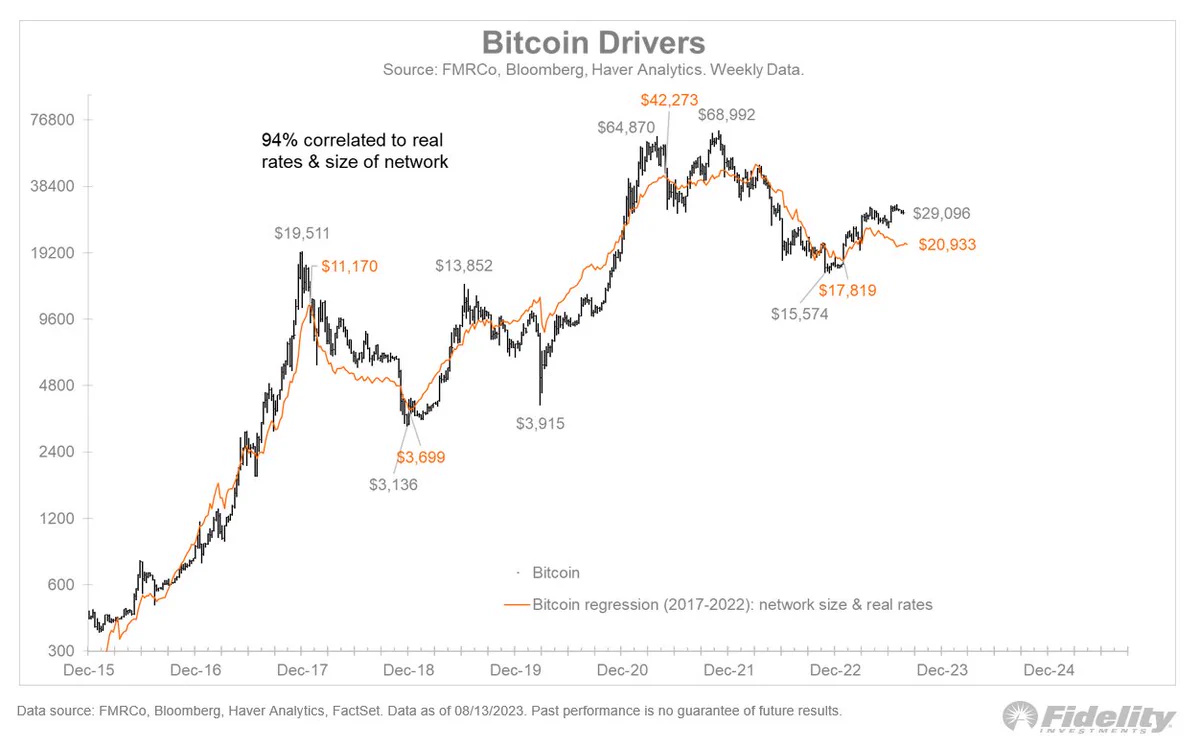

Bringing the two factors into play – Bitcoin’s current adoption rate and interest rates, Timmer suggested that as of now, Bitcoin’s valuation outpaces its true value. His analysis implies a potential market correction that could witness Bitcoin values dropping to $20,933.

“Bitcoin has been in a holding pattern near $30,000, and continues to trade somewhat ahead of itself, at least based on real rates (the still-negative term premium for bonds is relevant) and network growth.”

Source: Jurrien Timmer/X

Bitcoin’s Price Action Following a Typical Power Curve

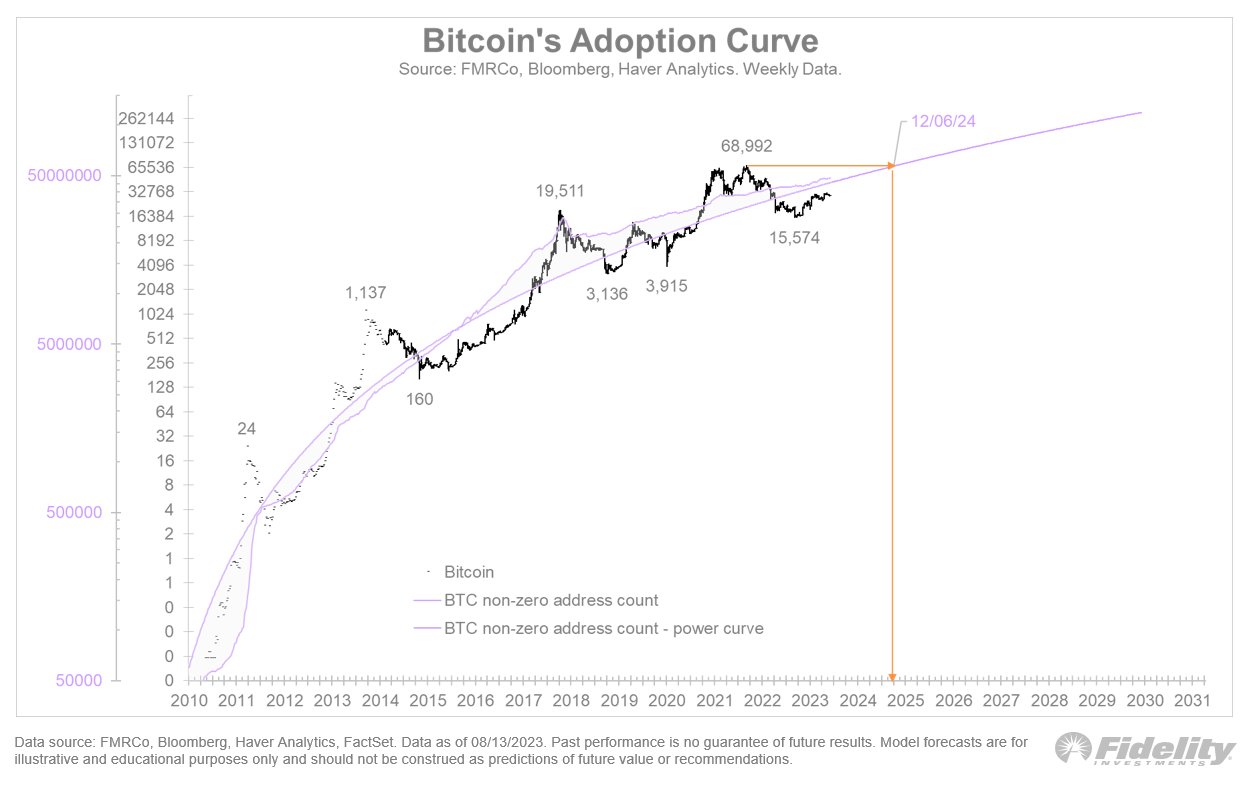

In another model, Timmer portrayed the price action of Bitcoin following the pattern of a usual power curve. This equation suggested that Bitcoin could reattain its all-time high of $68,992 only by December 2024.

“If Bitcoin’s adoption curve continues to grow along the slope of a typical power curve, it could take more than a year to revert to the old highs.”

Source: Jurrien Timmer/X

Bitcoin’s Current Market Status

Bitcoin is trading for $26,013 at the time of writing, which represents a decline of 7% in the last 24 hours. The constant changes in the crypto market underscore the importance of understanding the potential factors that might influence Bitcoin’s value in the near future.