An Overview of XRP’s Recent Market Activity and Predictions

Following the summary judgment in the Ripple vs SEC case, XRP, the fourth-largest cryptocurrency by market capitalization, has emerged in the limelight of the crypto market. While the asset is currently exhibiting a consolidation trend, projections suggest that this phase might merely be “the calm before the storm”. A significant influencing factor is the activity of large investors, often called whales, along with a developing bull flag pattern.

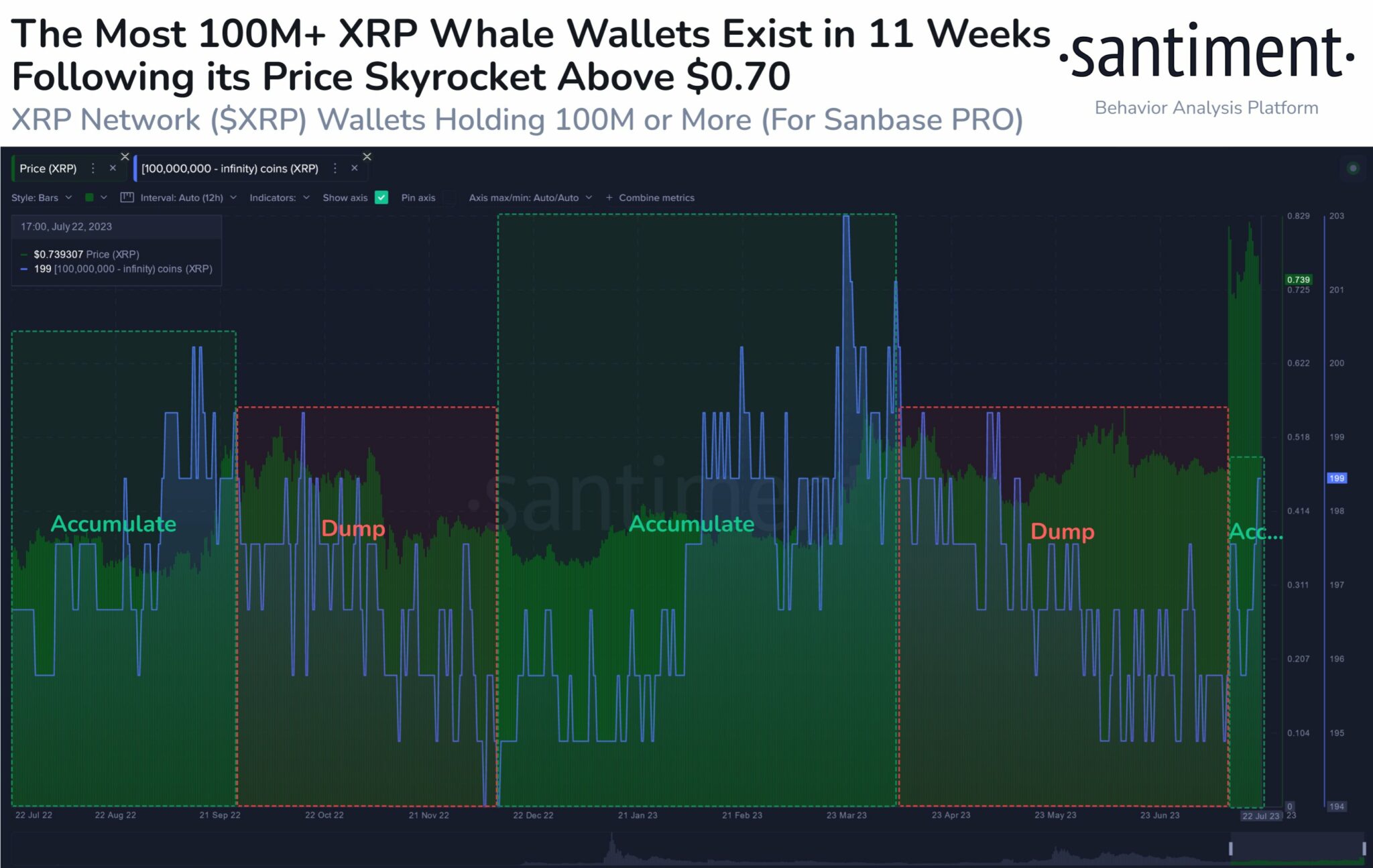

An Increase in XRP Whale Wallets: What You Need to Know

Santiment, an established market intelligence platform, recently reported an outstanding increase in the number of XRP whale wallets – those holding 100 million or more XRP. The whale count now stands at a remarkable 199. Each of these whale wallets commands a minimum value of $74 million and their strategic buying and selling activities have been under close watch due to their significant influence on XRP’s price movements.

Key details to note about the XRP whale wallets include:

- The number of whale wallets recently surged, matching the highest recorded figure since May 13.

- In July 2022, when XRP’s trading value stood below $0.40, the whale wallets were in accumulation mode with 200 recorded whales.

- Three months later, the number of whales declined as they sold when XRP values exceeded $0.50.

- From December to March 2023, when XRP was trading at $0.41, the accumulation phase resumed among the whales.

- In April, a larger number of whales again disposed of their XRP storage, causing a drop in their count to below 200.

- Current data indicates the possible onset of a new accumulation phase among whale wallets, according to Santiment.

The Influence of the Bull Flag on XRP’s Price: What to Expect

Following the summary judgment in the Ripple vs. SEC case, XRP’s price rose rapidly forming a bullish chart pattern termed as the bull flag. This pattern comprises of two rallies separated by a brief consolidative retracement period. After the initial rally, a pause occurs due to profit-taking, which then leads to a tight trading range as buyers and sellers reach equilibrium.

Here are some factors that XRP investors should consider:

- To the downside, the $0.685 mark is crucial, representing the 23.6% Fibonacci retracement level. Holding above this level is of significant importance in maintaining the consolidation trend.

- If the lower end of the range is broken, a deeper correction could be on the horizon, with potential targets at $0.64 and $0.59.

- To the upside, XRP encounters resistance at $0.845. If the currency breaks above this point, another sharp rally could be triggered.

- For such a breakout to occur, a catalyst is required which could either originate from the ongoing Ripple case or the broader crypto market.

- If a break above occurs, the closest target would then be the 38.2% Fibonacci retracement level, where the impulsive rally ended after the Ripple ruling.

- Beyond the psychologically significant $1 level, forthcoming bullish price targets could be $1.13, 1.33 and $1.61.

Featured image from Binance Academy, chart from TradingView.com

With a steadfast watch on large investors’ activities and the developing bull flag pattern, the future of XRP’s performance in the crypto market seems promising. Whether this is indeed the calm before an impending storm is a narrative that will unveil itself with time.