KEB Hana Bank’s Collaboration with Bank of Korea on CBDC Project and Stablecoin Alternatives

South Korea’s prominent financial institution, the KEB Hana Bank, is forming a strategic collaboration with the renowned Bank of Korea in pioneering the Central Bank Digital Currency (CBDC) Proof of Concept venture. They will be exploring alternate stablecoins and tokenized deposit concepts.

Participation in CBDC Proof of Concept Venture

According to reports from Maeil Kyungjae, a top-grade local newspaper, KEB Hana Bank has demonstrated active involvement in the CBDC Proof of Concept project initiated by the Bank of Korea.

Work toward a Blockchain-based Currency System

Maeil Kyungjae further emphasized that both the Bank of Korea and KEB Hana Bank are committed to contributing their expertise and resources towards planning and preparing for a “currency system based on blockchain technology.”

Research on Tokenized Deposits

The two banking giants are conducting rigorous “internal research” on the possibility and practicality of “tokenized deposits.” This innovative approach is highlighted by other central banks globally, inspiring their stablecoin design for respective CBDC projects.

Improving Conventional Stablecoins

Central banks hold the belief that they can augment and enhance the structure of the existing stablecoins, which they recognized as “private tokenized monies that circulate as bearer instruments.”

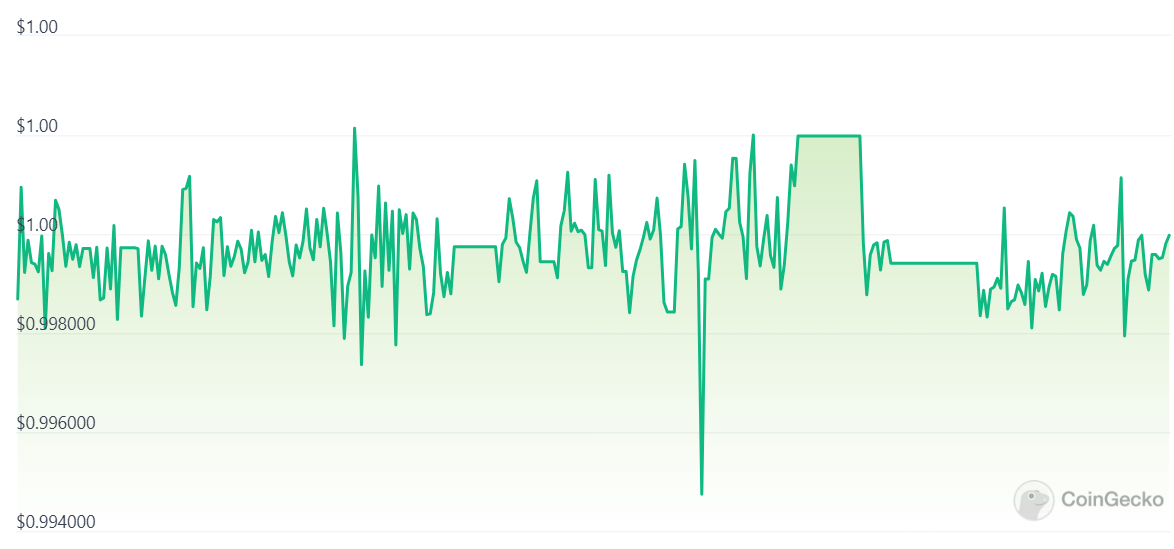

Evidence supporting the theory of stablecoin volatility was presented by De Blasis and his colleagues earlier this year, indicating popular stablecoins, such as the USD-pegged USDT, undergo fluctuations in valuations.

USDT prices over the past 14 days. (Source: CoinGecko)

This volatility is a critical factor central banks seek to eliminate in their CBDC projects.

Tokenized Deposits’ Potential to Overthrow Stablecoins

In April, the Bank for International Settlements (BIS) released a paper highlighting tokenized deposits and their likelihood to displace stablecoins in the financial and banking sectors. The BIS claimed stablecoins “may entail departures in their relative exchange values away from par in violation of the ‘singleness of money.’”

The research suggested the use of tokenized deposits, empowered with block-chain technology, as a feasible alternative since they “do not circulate as bearer instruments but rather settle in central bank money” and ‘’are more conducive to singleness.’’

The BIS further asserted that the utilization of tokenized deposits could potentially allow enhanced functionality, capitalizing on the programmable ledgers’ capacities to drive contingent execution and composability of transactions.

Implications for South Korea’s Banking Sector

South Korean commercial banks, worried about being sidelined from the CBDC landscape, are eager to secure a foothold in this field. It is reported that KEB Hana Bank seems to be taking these recommendations seriously and has been exploring the blockchain space for approximately five years.

The bank has been charting progress into the housing sector powered by blockchain and funding research projects related to the cryptocurrency field.

Hana’s closest competitor, Woori Bank’s Woori Financial Management Research Institute, also published a report about tokenized deposits recently and is garnering attention towards this innovative concept since the BOK Governor Lee Chang-yong professed that ‘tokenized deposits are needed’ in the banking industry at a BIS event in March.

Last month, Hana’s Management Research Institute projected the domestic security token market would expand to approximately $27 billion next year, signifying rising interest in the potential of tokenized deposits in the banking and finance sectors.

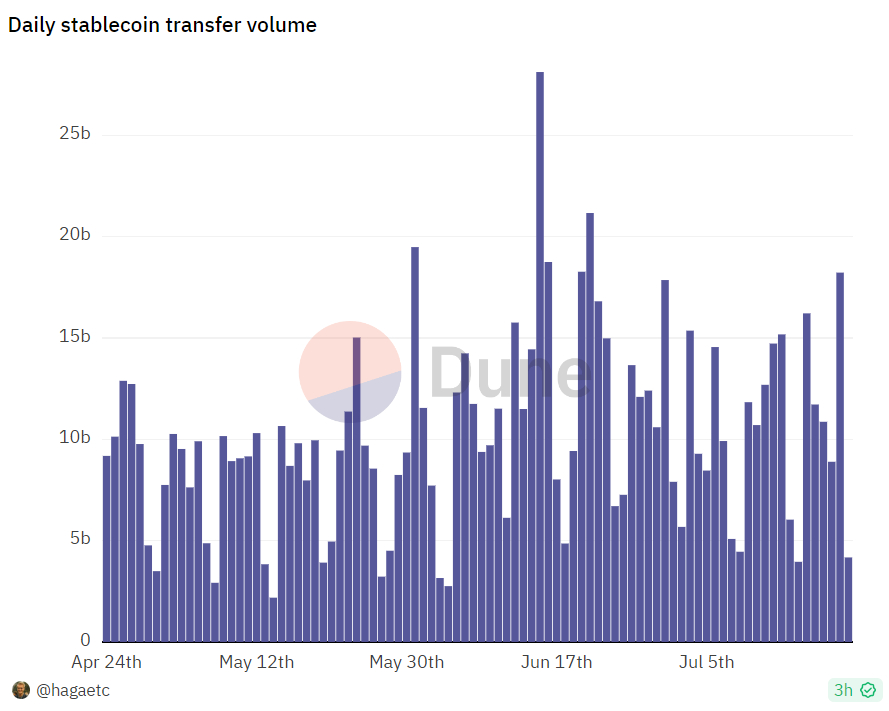

Source: Dune

Conclusion

Overall, South Korea’s banking sector, led by KEB Hana Bank and the Bank of Korea, is making significant strides towards exploring and adopting innovative financial blockchain technology such as CBDCs and tokenized deposits. The advancement of these technologies could potentially reshape the traditional banking infrastructure, adding a fresh impetus to the rapidly evolving financial landscape in South Korea.