Over the past weekend, Bitcoin (BTC) has hinted at potential downside risks as market participants geared up for the July 23 candle close. This sparked anticipation across the trading community, as evidenced in data from Cointelegraph Markets Pro and TradingView.

Bitcoin’s Status: A Snapshot

BTC/USD 1-hour chart. Source: TradingView

Bitcoin was found trading below $30,000, which now has become a point of intraday resistance. A sharp dip was seen on July 22 where Bitcoin’s value sank to $29,640, however, a recover and a bolster was seen in time for the daily close. Despite this recovery, traders remained on edge, fearing that Bitcoin could take another plunge.

Possible Future Scenarios for Bitcoin

According to popular trader Crypto Tony, Bitcoin is currently dealing with a double top rejection. He believes that it’s essential to pay careful attention to price levels in case the market takes a downturn. In his analysis of the 3-day chart, he mentioned:

“Those two levels are $25,000 & $20,000, and these are both key psychological levels. Make a note.”

BTC/USD annotated chart. Source: Crypto Tony/Twitter

A similar sentiment was echoed by fellow trader and analyst Nebraskan Gooner. He also admits that downward BTC price action “seems likely” as BTC/USD has sunk below the narrow range that’s been in play for over a month. He noted on Twitter:

#Bitcoin

Below range for a couple days now…

Downside seems likely. pic.twitter.com/c59Z01kJpK

Others’ Perspective

Others, however, are sitting on the fence, waiting for volatility to reenter the market but refraining from taking a stand on Bitcoin’s direction. They decline to predict whether Bitcoin would break upwards or downwards to test levels from earlier in the year.

Prominent trader and analyst Toni Ghinea also commented on Bitcoin’s future. He is expecting a significant price movement in the coming week. His vision is of a make-or-break decision for the recent narrow price range. Toni Ghinea summarizes his strategic approach in the following way:

“I’m expecting a big move with $BTC next week. 31-32k is resistance. 29k is support. If there’s a break above do NOT get euphoric. If there’s a nuke next key area is 27-28k. That’s it.”

Significant Events to Look Out For

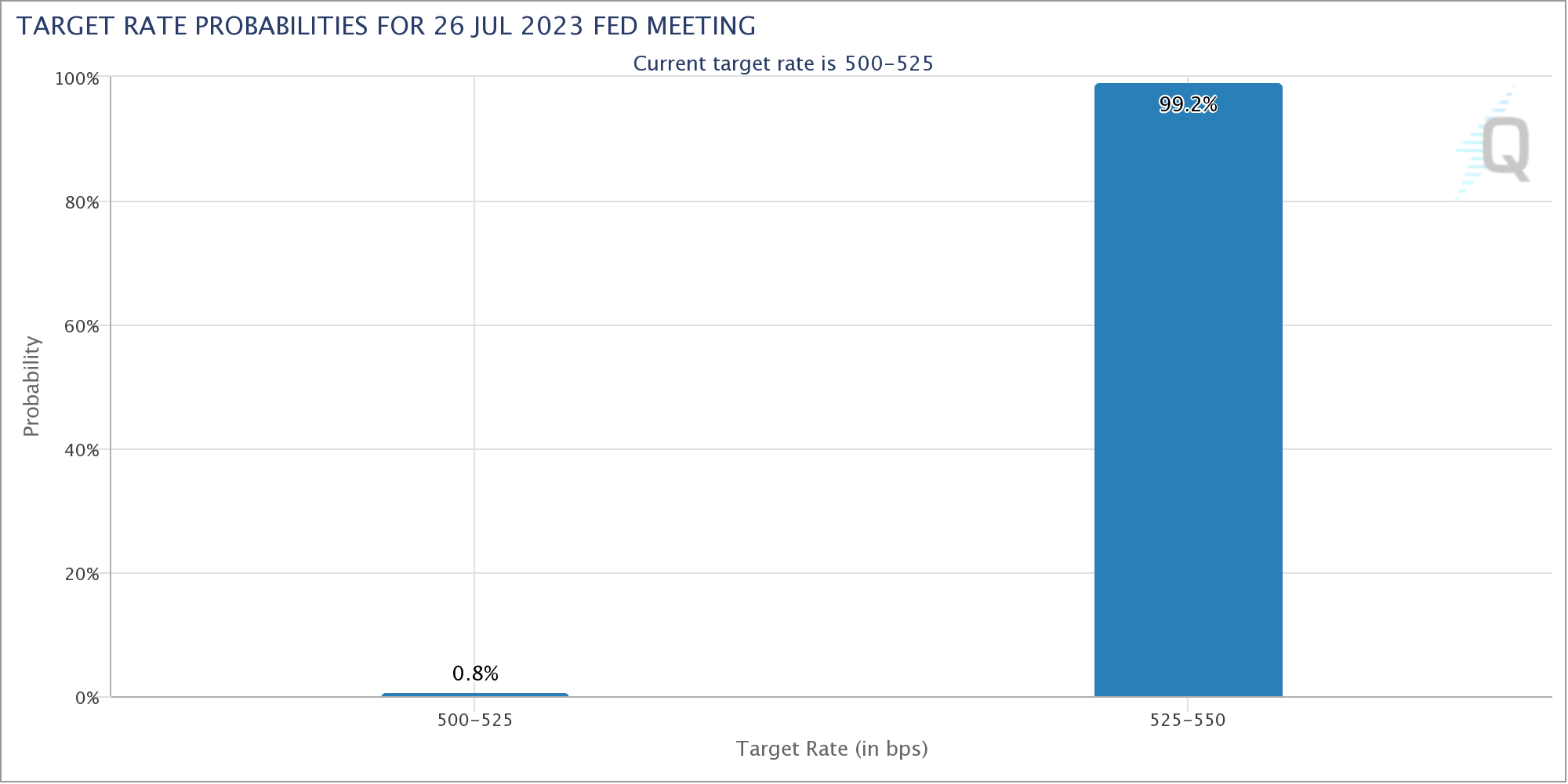

The upcoming week is expected to bring a wave of potential volatility indicators as markets absorb macroeconomic policy cues. The focus will be on the United States Federal Reserve’s Federal Open Market Committee (FOMC). They’ll be meeting to decide on interest rates ahead of the Bitcoin monthly close. Nearly everyone is expecting a return to rate hikes this month, following a previous pause, as per data provided by CME Group’s FedWatch Tool.

Fed target rate probabilities chart. Source: CME Group

As of July 23, the odds were striking – sitting at 99.2% for a return to rate hikes. If this pans out, volatility in Bitcoin markets is almost a guaranteed outcome.

This article provides ideas and not investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.