Analysis of Venture Capital Investment Trends in June

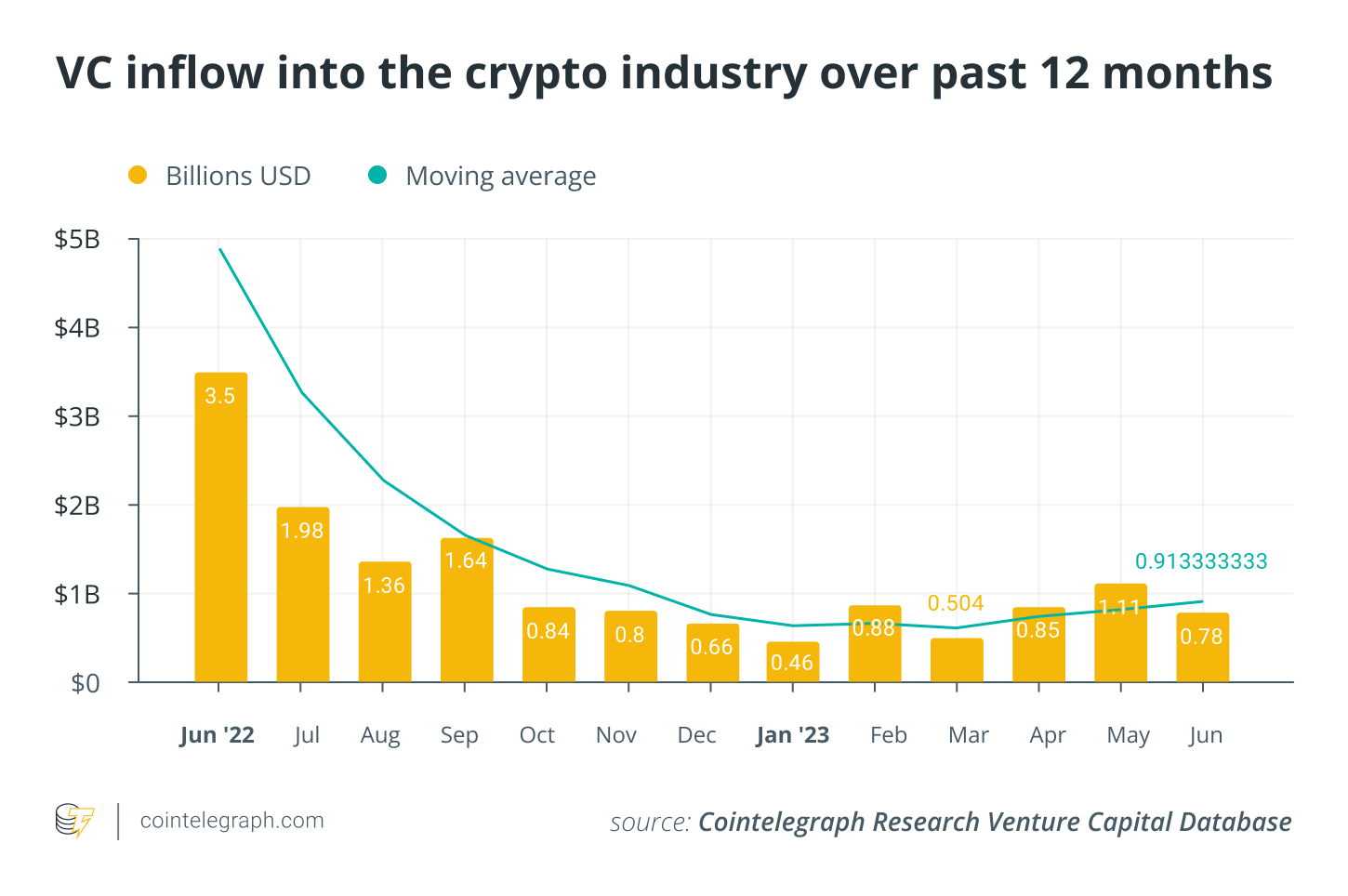

In the last month of the first half of 2023, Venture Capital (VC) investments experienced a significant drop-off; sinking by 29.73% to $779.32 million across a total of 62 separate deals, according to the data provided by the Cointelegraph Research Venture Capital Database. This decrease occurred despite the United States Federal Reserve ceasing any further increases to interest rates in June. The global macroeconomic environment remains stable for now, albeit characterized by political uncertainty and ongoing steps being taken to control inflation at the international level.

Investor Trends and Reactions

Given these circumstances, investors adopted a risk-off attitude in June, resulting in the growth trend from the previous three months being abruptly stopped in its tracks.

- However, this does not imply that the market sentiment is moving towards a pessimistic or bearish outlook. The trajectory for VC investments in 2023 continues to point upwards.

- Recent positive events related to Bitcoin exchange-traded fund (ETF) applications from major players like BlackRock, VanEck, WisdomTree and Fidelity as well Ripple’s legal victory versus the Securities and Exchange Commission (SEC) have contributed to a more upbeat atmosphere.

- Even though these developments were immediately reflected in the crypto market, VC investments tend to be a lagging indicator since established institutions typically act with more caution and inertia.

- Notably, VC activities might be affected by the ambiguous nature of the broader global economic conditions.

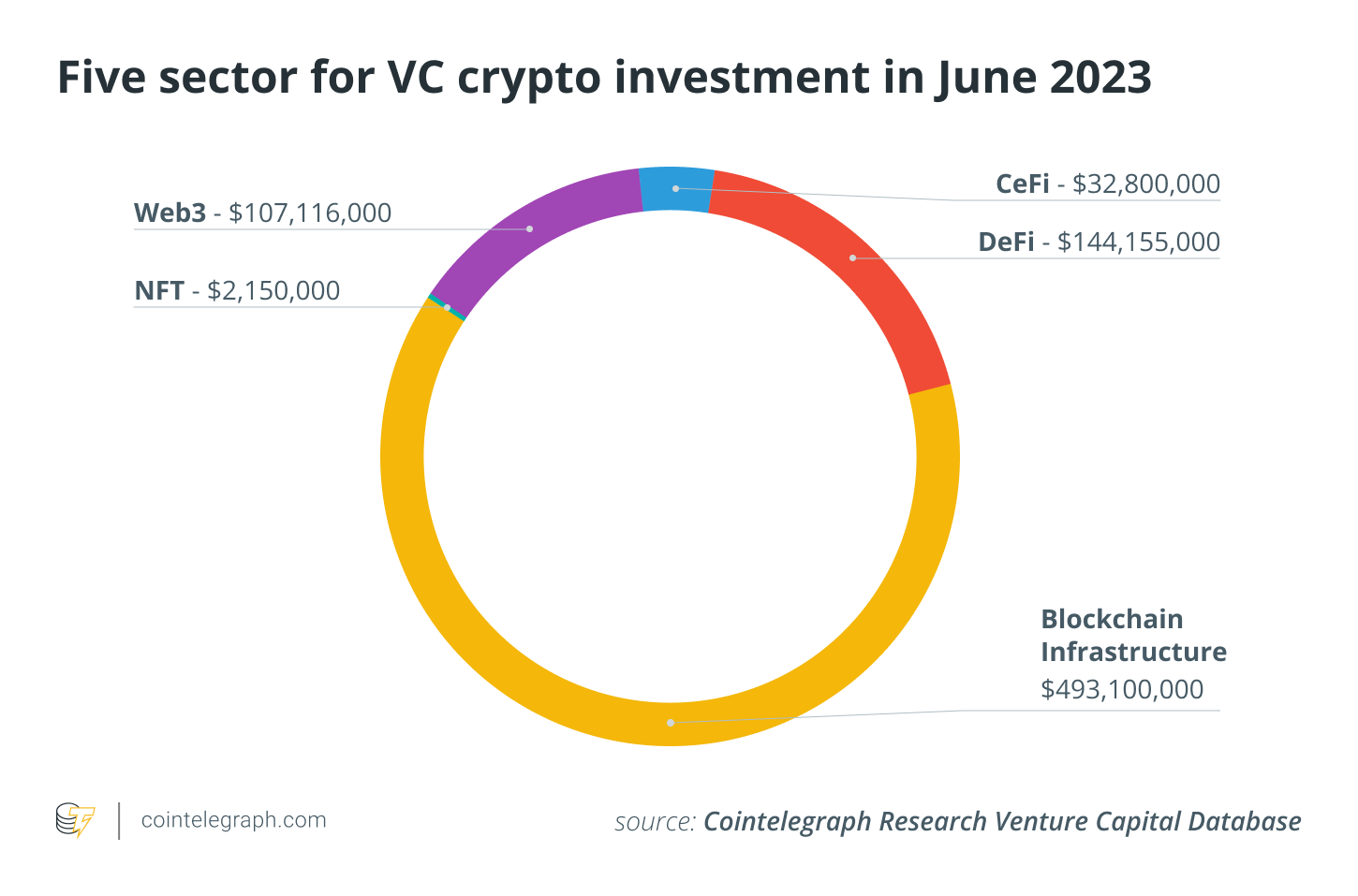

Persistent Focus on Blockchain Infrastructure

Examination of VC deals in June from the Cointelegraph Research Venture Capital Database reveals a sustained interest in blockchain infrastructure. The sector remained at the forefront of the market, securing 20 separate deals and amassing over $493 million in funding.

- Decentralized finance (DeFi) regained some traction, acquiring 20 deals and over $144 million in investments.

- Unlike speculation, Web3 did not fare as well as expected, receiving around $107 million across 18 deals.

- Centralized finance (CeFi) and nonfungible tokens (NFTs) came last on the list, obtaining approximately $32 million and $2 million respectively from one and three individual rounds.

Noteworthy Deals In June

- Islamic Coin (ISLM) raised the most capital, securing $200 million from Alpha Blue Ocean’s ABO Digital. This project aims to establish a digital financial tool for the global Muslim population, and its total funding has now exceeded $400 million.

- Trailing behind was the Gensyn deal worth $43 million, led by a16z Crypto and featuring contributions from CoinFund and Canonical Crypto amongst others.

- Mythical Games landed $37 million in a Series C deal led by Scytale Digital, with backing from ARK Invest and Animoca Brands among others. With this funding, it aims to roll out a new marketplace and explore other modes of revenue generation.

- Bitpanda Pro garnered $33 million in a Series A round led by Peter Thiel’s Valar Ventures and subsequently rebranded to One Trading. They plan to use this capital to expand their reach to professional traders and institutions across Europe.

Looking Ahead: July and August

The consistent increase in VC capital inflows into the blockchain space observed in March, April, and May was reversed in June, suggesting an uncertain future. Still, minor fluctuations month by month are less significant than the overall trend which continues to ascend. With the Ripple-SEC lawsuit and spot ETF fillings yet to impact the crypto venture capital market, July and August will likely point towards whether general macroeconomic conditions or crypto market hype events will hold more sway.

Stay up-to-date with VC activities by following the Cointelegraph Research VC Database. It is updated weekly and monitors over 6,000 deals occurring from 2012 to the current day.