Understanding American Consumers: A Look at Savings and Expenditure

In the wake of the global economic turmoil brought about by the Covid-19 pandemic, economic insights and consumer data have become highly useful. Central to understanding economic trajectories has been looking at consumer behavior, savings, and spending patterns. Let us unpack some key revelations from recent consumer data relating to Americans.

Declining Personal Savings

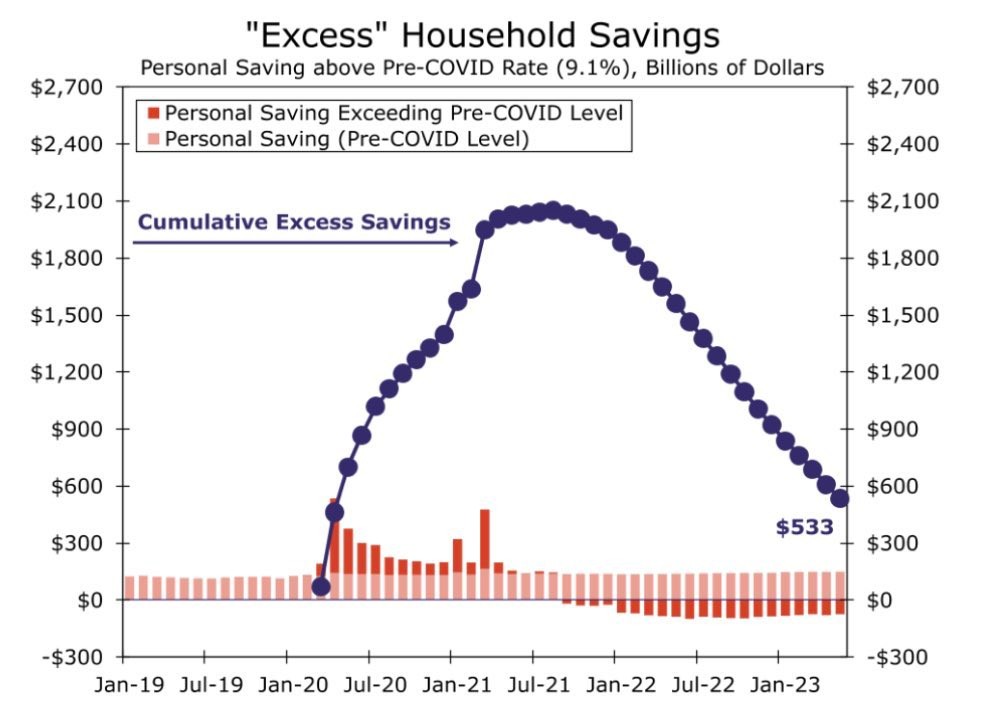

One of the jaw-dropping statistics is the vast amount of savings Amerticans have spent during the past couple of years. Recent consumer data indicates that Americans have spent an astonishing $1.76 trillion of their savings since 2020. This is a significant figure especially considering the enormous economic uncertainties the world has seen.

Peak Savings in 2020-2021

| Year | American Savings |

|---|---|

| 2020-2021 | $2.3 trillion |

Stats from the Federal Reserve show that Americans had amassed a peak savings level of $2.3 trillion between 2020 and 2021. Astoundingly, a significant portion of this has now been spent.

Current Savings Status

According to updated figures from the U.S. Department of Commerce and Wells Fargo, reported by MacroEdge chief economist Don Johnson, that number has dramatically come down to $533 billion. The fall in savings is indicative of the high levels of expenditure individuals and families had to endure during the pandemic.

Source: Don Johnson/U.S. Department of Commerce/Wells Fargo

Personal Savings Vs. Disposable Income

Further highlighting this trend, stats from the Federal Reserve Economic Data (FRED) system show that the amount of personal savings as a percentage of disposable personal income also dropped. In May of this year, this number stood at a mere 4.6%, well below the historical average of 8.9%. This represents a significant shift in consumer behavior and their ability to save money.

Increase in Credit Card Usage

- Record Credit Card Debt: American consumers collectively owe a record-breaking $986 billion on their charge cards, data from the Federal Reserve Bank of New York revealed last month.

- Increased Dependence: The rise in the use of credit cards among US citizens coincides with the decrease in personal savings, suggesting an increased dependence on credit for everyday expenditures.

- Economic Vulnerabilities: This increasing reliance on credit, coupled with lower savings, potentially positions American households at greater risk in the face of future economic downturns. Wells Fargo economist Shannon Seery points out that this makes Americans more vulnerable to future economic shockwaves.

Looking Forward

Seery further warns, “Households have been able to continue to spend at elevated rates and that sustained level of demand is helping stave off a US recession. [But] acquiring less in savings will ultimately leave US households more vulnerable to economic shock and could potentially position them worse off during an eventual economic contraction”

Wells Fargo economists anticipate that the labor market will soften in the months ahead, leading to reduced spending that may trigger a mild recession at the start of the coming year.

Conclusion

Understanding consumer behavior, savings, and debt is of vital importance to devise economic and financial strategies both on an individual and a policy level. These recently revealed statistics offer valuable insight into changing consumer patterns in the wake of a global pandemic, a phenomenon that will continue to shape economic forecasts and realities in the future.