The supply of Bitcoin held for a long time is on the rise, as holders are increasingly reluctant to sell. Market action over the last few years has also been marked by some of the most tight trading ranges. On May 22, Glassnode, an on-chain analytics provider, reported that vast portions of Bitcoin supply remain dormant in investor wallets, with several key age bands hitting all-time highs. The Bitcoin supply held for more than a year continues to reach new highs as the “hodl” narrative becomes more popular.

Bitcoin holders resolute

“The remarkable level of HODLing across the supply continues, with such high coin inactivity supporting the extreme lows of on-chain volume throughput.”

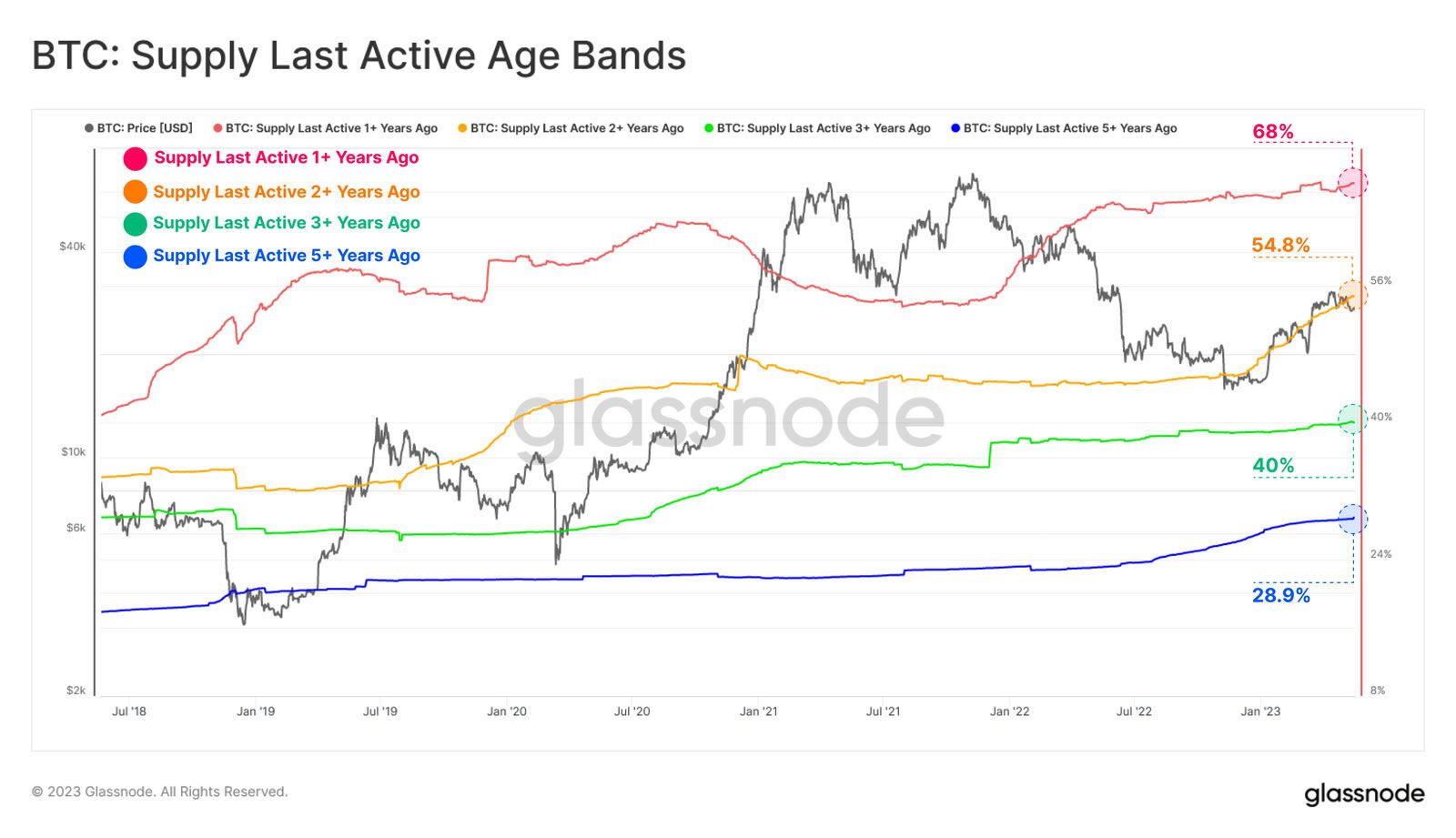

The chart below shows an increase in hodling across all bands, with the steepest in the two years last active band. These were coins accumulated in early 2021 at the beginning of the bull market.

Bitcoin Supply Last Active | Glassnode

Furthermore, the supply of long-term holders, or BTC held for more than 155 days, has reached a new all-time high of 14.46 million BTC. “This reflects coins acquired immediately after the FTX failure maturing into LTH (long-term holder) status,” Glassnode noted.

Additionally, the Bitcoin liveliness metric, which compares hodling and spending behavior, has fallen to its lowest level since December 2020. This confirms that hodling is the dominant market activity at the moment.

“Persistent downtrends in Liveliness reaffirm that HODLing is certainly the current primary market dynamic across the majority of supply.”

On May 23, Unchained confirmed the sentiment that Bitcoin is not being moved. It noted that a record-high 68.13% of Bitcoin hasn’t moved in over a year.

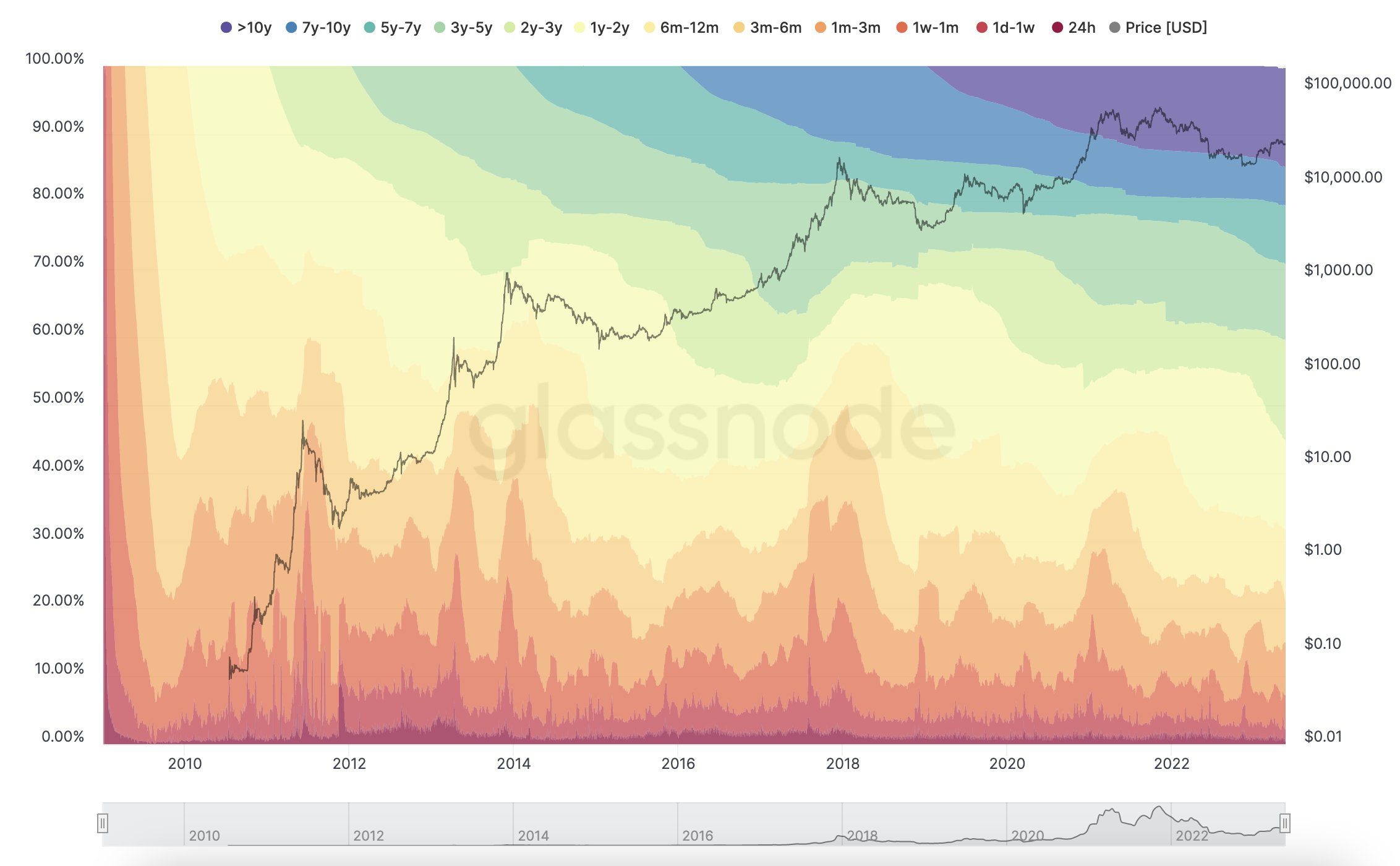

BTC Hodl Waves Indicator | Glassnode

Historically, Bitcoin finds a price bottom when sellers have been exhausted, forging the latest wave of long-term holders, it said.

Glassnode concluded that these metrics paint a relatively constructive view of Bitcoin holder conviction. “Most are simply not interested in spending their coins just yet.”

On May 22, BeInCrypto reported that market volatility was imminent following a prolonged period of tight price ranges.

BTC Price Outlook

However, that volatility hasn’t materialized just yet as BTC is still consolidating. The king of crypto has gained 2.3% on the day in a move to $27,283 at the time of writing.

BTC Price in USD 1W – BeInCrypto

The move keeps BTC within its tight weekly range and will continue to do so unless resistance at $27,600 is broken.

On the downside, support can be found at $26,600, where Bitcoin has rebounded twice in the past week.

In summary, the increasing supply of Bitcoin held for an extended period of time, along with a general reluctance to sell, suggests a strong level of conviction among holders. This is further evidenced by the fact that a record-high percentage of BTC hasn’t moved in over a year. While market volatility was expected, BTC’s price continues to consolidate and remains within a narrow trading range. For the time being, the “hodl” narrative appears to be dominant in the market, and it remains to be seen how this will impact Bitcoin’s price in the future.